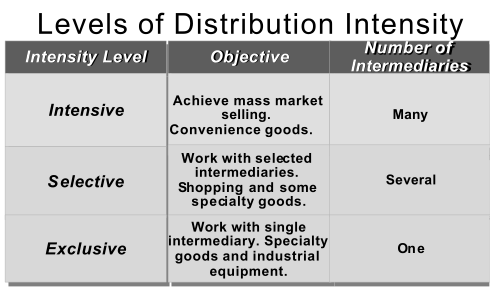

While two firms may go for the same channel design, they may need different intensities. It depends on the position of the firm its objectives and strategies, its sales, profits, and market coverage, present and projected, and its resources. For example, Maruti and Mitsubishi India, being passenger car firms operating in the same market, may opt for similar channel design. But they may settle for different channel intensity; Maruti has a massive network consisting of 144 sales outlets, 175 dealer workshops and 750 authorized service stations across India. Mitsubishi has not gone in for similar intensity.

In fact, a firm would be ill-advised to adopt without question the channel intensity of another firm, even if the latter were the industry leader. What suits one may not suit the other. Blindly following another firm’s channel pattern and intensity will land the firm in trouble. Recent experience of some well-known MNC FMCG firms in India will clearly amplify this point. Below table shows how choosing channel intensity wrongly landed P & G and Nestle in trouble.

| Wrong Choice of Channel Intensity : P & G and Nestle | |

| P & G, Nestle and HLL are FMCG companies Operating in India. P & G and Nestle thought that it would be appropriate for them to follow the HLL channel model. It was only after losing some Precious money and time that they realized that they neither needed no could afford channel intensity on the HLL pattern. HLL maintains a channel consisting of over a million retail points and 7,500 distributors, the largest in the country. The arrangement has suited HLL very well. HLL has a large basket of products and brands Covering every possible price/ demographic/geographic segment. At the last count, it had over 110 actively selling brands. HLL’s marketing channel has to naturally cover every income group and every geographical segment in the country. And HLL has an annual sales turnover of over Rs. 10,000 crore. P & G and Nestle were different from HLL in all these respects. Moreover, the HLL model comes with its associated costs. Setting up marketing networks in rural areas and small towns takes both time and money. HLL had incurred the associated investment and had absorbed a dent on its bottom-line on this account over the past several years, and it is not affected currently by this strategy. After learning the lessons the hard way, P & G Decided to forget the HLL model and drastically downsized its distribution. | It now confined itself to Class I and Class II towns, and exited practically all rural areas. Only for some select products like Vicks Action-500, it continued its distribution in rural areas. It also reduced the number of pack sizes in which it offered its products as another measure towards reducing distribution costs. Nestle too decided to move away from the HLL model. Earlier, embracing the HLL model, it had gone in for high channel-intensity. For example, between 1993and 1996, Nestle had added on 350,00 retail points to its distribution network in India, the bulk of them in smaller towns and rural areas. As its sales were nowhere near the HLL level, it could not sustain the channel intensity. It reduced it considerably. It also compressed its product mix and product line. It now concentrated on products in which it was traditionally strong—milk products and beverages—and weeded out the low-profit products from the portfolio. It also went in for tighter market targeting and limited its attention to urban population. In fact, it limited its focus to roughly half of the urban population. With these moves, it could reduce the cost of Servicing the channel. Its new policy was to be on perpetual guard in the matter of channel intensity, limiting it to the level warranted by its sales and Profits—present and planned. |