The business world is ever changing and super dynamic in nature. At certain times these changes may have a negative effect on an organisation. It is crucial for companies to respond and adapt to changes quickly. This may lead to the need for restructuring the organisation. A Certified Restructuring Manager is responsible for reorganizing the legal, ownership, operational, or other structures of a company for the purpose of making it more profitable, or better organized for its present needs.

Roles and Responsibilities of a Certified Restructuring Manager

Restructuring Managers work on various projects ranging from insolvency to advising on the restructuring and financial turnarounds. They are critical for companies’ success in the long run. They must investigate the causes of underperformance of business, design the restricting solutions and act as insolvency partners. Moreover, their responsibilities include:

- Firstly, they must identify key issues facing underperforming businesses by undertaking detailed financial and commercial analysis

- Then, they have to identify the different recovery and restructuring options available to clients

- Further, review and analyse the of historical trading, projections, and underlying assumptions along with critical appraisal of key risks and potential sensitivities

- Also, assist management in situation of insolvency and evaluate other financial data and key business functions

- Finally, review the adequacy of existing funding facilities, including consideration of financing limits, term and covenants

Vskills Certified Certified Restructuring Manager Overview

Vskills Certification for Certified Restructuring Manager asses the candidates as per the company’s need for corporate restructuring. This exam focuses on basic principles of corporate restructuring, takeovers, and mergers. Also, it covers various areas which include corporate restructuring, takeovers, mergers, corporate failures, corporate strategy, strategic planning, Indian laws enabling restructuring, divestitures, de-mergers, merger and amalgamation, merger management, funding, valuation, DCF method, post-merger reorganization and efficiency.

Why become a Vskills Certified Certified Restructuring Manager?

A Certified Restructuring Manager works in high profile assignments in a client focused environment. They are critical to the survival o an organisation in such trying times. This certification will advance your career progression and help you broaden your employment opportunities. Moreover a Certified may find job in top MNC’s and organisations like Deloitte, KPMG, PwC, Tata Capital. Also, becoming a Vskills Certified Restructuring Manager will help you gain the following benefits:

- Firstly, a Government verification tag

- Also, the Certification will have lifetime validity.

- Further, you will get Lifelong e-learning access.

- Moreover, you get access to Free Practice Tests.

- Additionally, You will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine.com.

Exam Details

- Exam Code: VS-1178

- Duration: 60 minutes

- No. of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%).

- There is NO negative marking

- This is an Online exam

Corporate Restructuring Manager

The financial or operational restructuring of portion or all of an organization is referred to as Corporate Restructuring. Restructuring can be done for a variety of reasons, such as gaining access to post-acquisition synergies, improving efficiency and financial performance, or increasing working capital levels. Let us discover Career as a Corporate Restructuring Manager!

Exam Process

Course Outline: Certified Restructuring Manager

This exam covers the following topics:

Introduction to Corporate Restructuring

- Pathways for Takeovers and Mergers

- Forms of Business Growth

- Sources of Finance for Business Growth

Corporate Failures

- Business Failure and Reorganization

- Symptoms of Bankruptcy or Failure

The Physiology of Business Failure

- Types of Business Failure

- To Reorganize or Liquidate

- Informal Alternatives for Failing Business

Dynamics of Restructuring

Historical Background from Indian perspective

- Present Scenario

- Global Scenario

- National Scenario

Corporate Strategy

- What we mean by strategies

- Levels of Strategies

- Strategic Planning

Competitive Advantage and Core Competencies

- Strategy Formulation and Execution

- Corporate Restructuring Strategies

- Motives for Restructuring

Provisions under various Indian laws enabling restructuring

- Provisions under Companies Act of

- Amalgamation under the Income-Tax Act,

- Demerger of Companies under Income-Tax Act,

- Accounting Standards

Divestitures

- Financial Evaluation of a Divestiture

De-Mergers

- Difference between Demerger and Reconstruction

- Tax Aspects of Demergers

Merger and Amalgamation

- Concept of Merger and Amalgamation

- Merger/Absorption

Reasons for Merger and Amalgamation

- Improving Economies of Scale

Categories of Merger

- Horizontal Merger

- Vertical Merger

- Conglomerate Merger

- Mergers and Acquisitions

- Types of Mergers

- Other Motives for Merger

The Merger Negotiation Process

- Tender Offers

- Valuing the target Company

- Terms of Mergers

- Illustration of the Problem of Merger Terms

- Factors Dominating Situations

Cost of Merger

- Estimating the Cost of a Merger

- The Consolidation

Methods of Merger/Amalgamation

- Preliminary Steps in Mergers

- Comparative Cost and Returns

- Filing of certified copy of Court’s order with RO

- Determination of Cut off Date

Procedural Aspects under Various Laws

- Procedural Aspects, Including Documentation for Merger/ Amalgamation

- Convening a Board Meeting

- Holding Meeting(s) as per Court’s Direction

Economic Aspects of Mergers etc

- Economic Considerations

Merger Management

- Strategic Management of Mergers

- Accounting Aspects of Merger and Amalgamation

- The Pooling of Interest Method

Financial Aspects of Merger/Amalgamation

- Financial Aspects of Merger/ Amalgamation including Valuation of Shares

- Methods of Valuation of Shares

Taxation Aspects

- Taxation Aspects of Mergers and Amalgamations

- Sale in the Course of Winding up

- The Human Aspects of Mergers and Amalgamations

Funding the Merger Process

- Funding of Mergers

Process of Funding

- Funding through Equity Share Capital

- Funding through Employees Stock Option Scheme

- Funding through Financial Institutions and Banks

- Funding through Rehabilitation Finance

- Funding through Public Deposits

Valuation of Shares and Business

- Need and Purpose

- Factors Influencing Valuation

- Merger Negotiations

DCF Method

- Discounted Cash Flows

- Discounted Cash flow Valuation Method

- Statutory Valuation

Other Models

Post Merger Re-Organization

Management of Financial Resources

- Post merger success and valuation

Measuring Post Merger Efficiency

- Criteria of a successful merger

- Measuring Key Indicators

- Merger & Acquisition Trend

- Funding

- Need for Financial Restructuring

The Agile Organisation

- Central Management

Takeover

- Meaning & Concept of Takeover

Bailout Takeovers

Economic Aspect of Takeover

- Financial & Economic Aspect of Takeover

Alliances

Implementing & Managing the Alliance

- Evaluating an Alliance

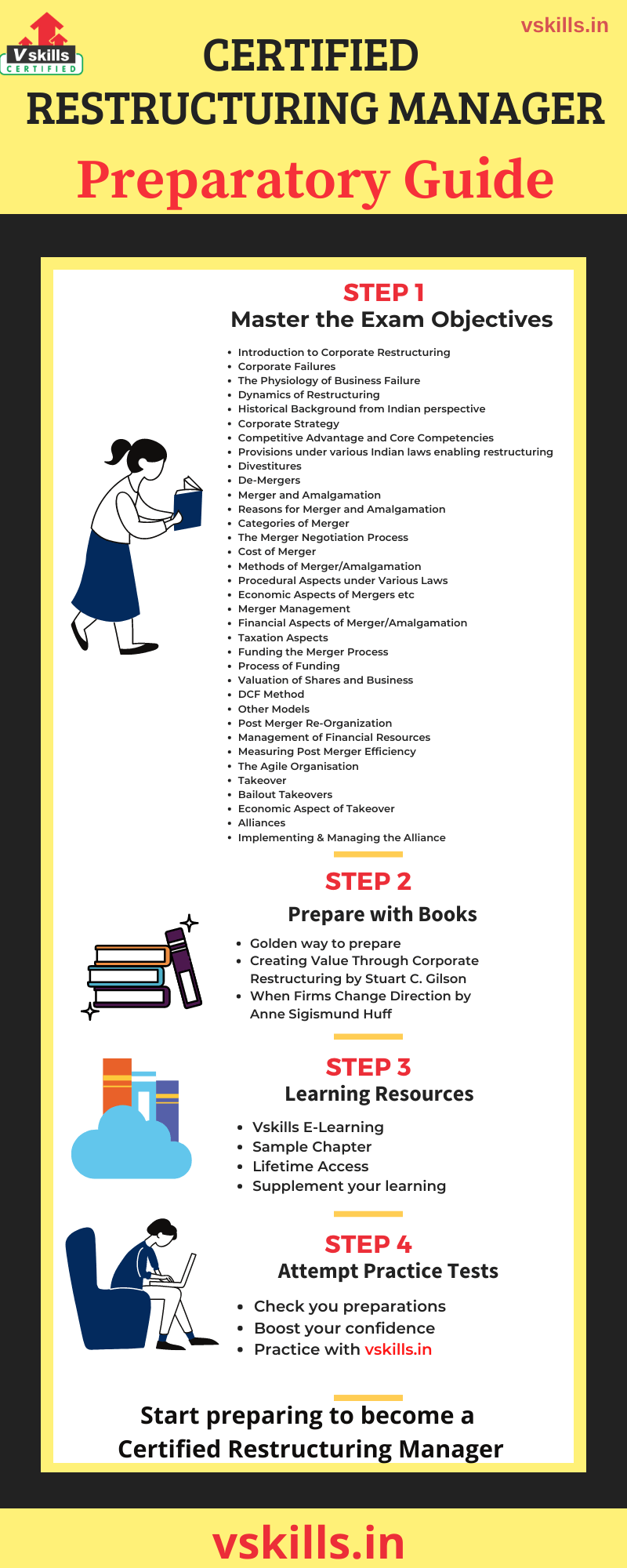

Preparatory Guide: Certified Restructuring Manager

Preparing for an exam is the real task. Consistency and determination are the two most essential keys to unlock your certification. But preparing from the genuine resources and being on the right track is also important. Look no further as we present you our step by step preparatory guide. It will set you on teh right track to pass this exam with flying colours.

Step 1- Review the Exam Objectives

First step is to deeply understand and analyse all the exam objectives. The Course Outline is the most crucial part of the examination. Since this forms the syllabus of the examination. And, obviously, all the questions originate from this particular domain list. Therefore it’s your responsibility to have complete clarity about the exam objectives. They are:

- Introduction to Corporate Restructuring

- Corporate Failures

- The Physiology of Business Failure

- Dynamics of Restructuring

- Historical Background from Indian perspective

- Corporate Strategy

- Competitive Advantage and Core Competencies

- Provisions under various Indian laws enabling restructuring

- Divestitures

- De-Mergers

- Merger and Amalgamation

- Reasons for Merger and Amalgamation

- Categories of Merger

- The Merger Negotiation Process

- Cost of Merger

- Methods of Merger/Amalgamation

- Procedural Aspects under Various Laws

- Economic Aspects of Mergers etc

- Merger Management

- Financial Aspects of Merger/Amalgamation

- Taxation Aspects

- Funding the Merger Process

- Process of Funding

- Valuation of Shares and Business

- DCF Method

- Other Models

- Post Merger Re-Organization

- Management of Financial Resources

- Measuring Post Merger Efficiency

- The Agile Organisation

- Takeover

- Bailout Takeovers

- Economic Aspect of Takeover

- Alliances

- Implementing & Managing the Alliance

Step 2- Explore your Learning Resources

Learning resources are meant to supplement your learning experience and exam preparation. Therefore you must make a wise choice and choose your authentic sources. Vskills offers you its own Official Learning Resources to enrich your preparations. These resources include E-Learning Study Material and Online Tutorials. Vskills also offers candidates the hard copy material that will help them in improving skills and staying up to date with the learning curve for getting better opportunities. Moreover, you get lifetime accessibility to all these resources. Also, they are constantly updated to provide you latest insights about the exam.

Step 3- Books to you rescue

Books are the go-to resource for any exam. These Books help you gain in-depth clarity about the exam domains. Most important of all, you can find real-time examples of the different concepts you learn for this certification exam. As a result, you can strengthen your knowledge about the application of the exam concepts. We suggest your to include the following books in your preparations to ace the exam:

- Creating Value Through Corporate Restructuring by Stuart C. Gilson

- Corporate Restructuring: Lessons from Experience by Michael Pomerleano; William Shaw

- Corporate Restructuring: A Boon for Competitive Advantage by Nag, G. C. Pathak, R. D

- When Firms Change Direction by Anne Sigismund Huff; James Oran Huff

Step 4- Check your progress with Practice Tests

Mistakes are inevitable, but surely, they can be limited. When it comes to exams, practice papers help a lot in limiting the mistakes. Moreover, training the brain is very essential. Practice papers give that simulation in which the brain needs to get used to the actual exam. Other than knowledge, there are many factors that can affect your performance in the exam. Going through practice tests helps you find your strengths and iron out your weaknesses. They make you understand the areas you’re lacking behind and work upon them. Most importantly, make sure that you are going through practice tests once you have gone through the whole syllabus. Lets Start Practising Now!

Job Interview Questions

If you are looking to crack your job interview in first attempt, then you must check out these interview questions. The sole purpose of these questions is to assist you in your job preparation.