In an era where financial crime is becoming increasingly sophisticated, the role of a Financial Crime Analyst has never been more critical. These professionals are at the forefront of the fight against fraud, money laundering, terrorist financing, and other illicit financial activities that threaten the stability of economies and institutions.

What Does a Certified Financial Crime Analyst Do?

A Certified Financial Crime Analyst is an expert trained to identify, investigate, and mitigate financial crimes. Their responsibilities include:

- Detecting Financial Crimes: Using advanced tools, analytics, and strategies to spot unusual patterns or red flags in financial transactions.

- Conducting Investigations: Delving into suspicious activities to uncover potential fraud, money laundering schemes, or other criminal behaviour.

- Implementing Compliance Measures: Ensuring organizations comply with anti-money laundering (AML) laws, sanctions, and regulatory requirements to prevent penalties or reputational damage.

- Risk Assessment: Evaluating financial crime risks within an organization and developing robust frameworks to mitigate these risks.

- Collaboration with Authorities: Working closely with law enforcement, regulatory agencies, and legal teams to build strong cases against perpetrators of financial crimes.

Vskills Certified Financial Crime Analyst: Exam Overview

A Financial Crime Analyst specializes in identifying, investigating, and preventing financial crimes within organizations or regulatory entities. Their core responsibilities include examining financial transactions, data, and trends to detect activities such as fraud, money laundering, cybercrime, and terrorist financing. These professionals collaborate with compliance departments, law enforcement, and other key stakeholders to ensure adherence to regulations and reduce risks linked to financial misconduct. By leveraging investigative skills, analytical tools, and an in-depth understanding of regulatory frameworks, Financial Crime Analysts play a crucial role in uncovering unlawful activities and supporting initiatives to combat financial crime.

Vskills, India’s leading certification provider, offers candidates access to top-notch exams along with valuable post-exam benefits, including:

- Government-verified certifications.

- Lifetime validity of certifications.

- Unlimited access to e-learning resources.

- Free practice tests for exam preparation.

- Recognition as a ‘Vskills Certified’ professional on Monsterindia.com and Shine.com.

Achieve your career goals with Vskills and stand out in the job market!

Course Outline

The Certification covers the following topics –

Introduction to Financial Crime

- Overview of financial crime

- Types of financial crime (e.g., money laundering, fraud, terrorist financing)

- Regulatory framework

Anti-Money Laundering (AML)

- AML regulations and compliance

- Know Your Customer (KYC) procedures

- Transaction monitoring

- Suspicious Activity Reporting (SAR)

- Customer Due Diligence (CDD)

Fraud Detection and Prevention

- Types of fraud (e.g., identity theft, credit card fraud, cyber fraud)

- Fraud detection techniques

- Fraud prevention strategies

- Investigative techniques

Terrorist Financing

- Understanding terrorist financing

- Recognizing red flags

- Compliance with laws and regulations

- Reporting suspicious activities related to terrorist financing

Cybercrime

- Cybercrime trends and threats

- Cyber fraud detection

- Cybersecurity best practices

- Investigating cyber-related financial crimes

Data Analysis and Forensics

- Data analysis techniques

- Forensic accounting principles

- Using technology for fraud detection

- Evidence gathering and preservation

Regulatory Compliance

- Compliance with international regulations (e.g., FATF recommendations)

- Compliance with local laws and regulations

- Regulatory reporting requirements

- Regulatory developments and updates

Ethical Considerations

- Professional ethics in financial crime analysis

- Confidentiality and privacy issues

- Ethical dilemmas in reporting financial crimes

Emerging Trends and Technologies

- Blockchain and cryptocurrency-related crimes

- Artificial intelligence and machine learning in financial crime detection

- Fintech and its implications for financial crime prevention

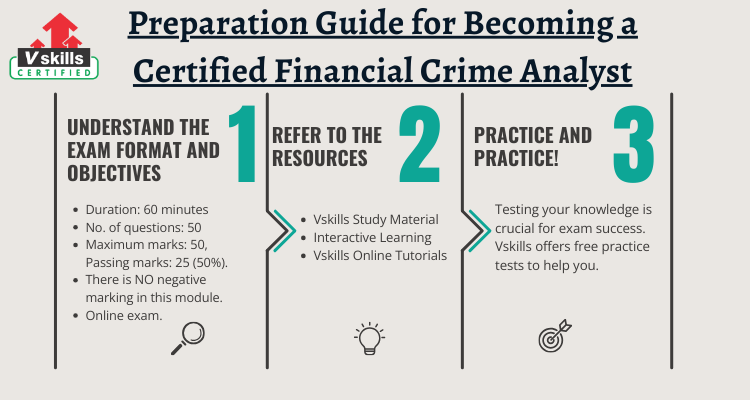

Preparation Guide for Becoming a Certified Financial Crime Analyst

Preparing for your Certified Financial Crime Analyst (CFCA) certification requires a focused and structured approach. Vskills offers a range of resources to help you excel in your certification exam and gain practical skills to advance your career. Here’s a step-by-step guide to get you started:

1. Leverage Vskills Online Resources

Vskills provides comprehensive e-learning material tailored to the certification exam. These resources include:

- Study Materials: Detailed study guides covering all essential topics like fraud detection, money laundering, regulatory frameworks, and risk assessment.

- Interactive Learning: Engaging videos, case studies, and real-world examples to help you understand the practical aspects of financial crime analysis.

- Self-Paced Learning: Study at your convenience with lifetime access to the e-learning portal, allowing you to revisit topics anytime.

2. Practice with Vskills Free Practice Tests

Testing your knowledge is crucial for exam success. Vskills offers free practice tests to help you:

- Familiarize yourself with the exam format and question types.

- Assess your readiness and identify areas for improvement.

- Build confidence through repeated testing and refinement of your skills.

Make it a habit to take these practice tests regularly as part of your preparation routine.

3. Prepare for Interviews

Certification is just the beginning; acing interviews is the next step. You can support your interview preparation with:

- Interview Questions Repository: Access a collection of commonly asked questions related to financial crime analysis.

- Mock Interview Sessions: Practice answering technical and behavioral questions confidently.

- Career Guidance: Learn how to showcase your certification and skills effectively on your resume and during interviews.

Other Tips for Success

- Plan Your Study Schedule: Dedicate daily time to systematically cover the syllabus.

- Engage in Discussions: Join forums and communities of CFCA aspirants to exchange ideas and clarify doubts.

- Stay Updated: Keep track of recent developments in financial regulations and crime prevention strategies.

With Vskills’ resources and your commitment, you’re well on your way to becoming a Certified Financial Crime Analyst. Take advantage of these tools and start preparing today to unlock new career opportunities!