Foreign Exchange options are financial instruments that give buyers the right, but not the obligation, to exchange one currency for another at a pre-agreed price (called the strike price) on or before a specific date. Forex option pricing refers to the methods used to calculate the fair value of these options.

Key Responsibilities

Foreign Exchange (Forex) Option Pricing professionals play a vital role in the financial markets by focusing on forex options’ valuation, analysis, and management. Their work involves a mix of technical, analytical, and strategic tasks.

- Valuation of Forex Options

- Use mathematical models to calculate the fair price of forex options based on factors like exchange rates, strike prices, time to maturity, volatility, and interest rates.

- Ensure accurate pricing to help clients or traders make informed decisions.

- Risk Management

- Analyze the risks of forex options, such as currency fluctuations and market volatility.

- Develop strategies to minimize risks for clients, such as using hedging techniques.

- Market Analysis

- Monitor global financial markets and economic events that could impact currency values (e.g., interest rate changes and geopolitical events).

- Use this information to predict trends and recommend trading strategies.

- Developing Pricing Models

- Create and refine mathematical models (like Black-Scholes or binomial models) to improve pricing accuracy.

- Customize models based on specific market conditions or client needs.

- Advising Clients

- Provide guidance to businesses, financial institutions, or investors on how to use forex options for risk management or speculative purposes.

- Help clients understand the pricing and implications of trading forex options.

- Trade Execution

- Work with traders and brokers to execute forex option trades efficiently and at the best prices.

- Ensure compliance with regulatory standards during trading activities.

- Portfolio Management

- Manage portfolios containing forex options by balancing risks and returns.

- Adjust positions based on market conditions and client objectives.

Who They Work With

- Banks and Financial Institutions: To support forex trading desks and manage currency risks.

- Multinational Corporations: To hedge foreign currency risks in international operations.

- Hedge Funds and Investment Firms: To develop forex trading strategies.

- Government Agencies: For managing foreign exchange reserves or policy-related activities.

Skills Required

- Strong knowledge of financial markets and currency trading.

- Proficiency in mathematical and statistical tools.

- Familiarity with pricing models and financial software (e.g., Bloomberg, Excel VBA, Python).

- Analytical thinking and problem-solving abilities.

- Effective communication skills to explain complex concepts to clients.

Why Their Work Matters

Foreign Exchange option pricing professionals are essential in ensuring market stability, helping organizations protect their finances from currency risks, and enabling investors to capitalize on market opportunities. They act as a bridge between complex financial theories and real-world market applications.

Vskills Certificate in Foreign Exchange Option Pricing: Overview

Foreign Exchange (FX) Option Pricing involves calculating the fair value of options that provide the holder with the right, but not the obligation, to purchase (call option) or sell (put option) a specific amount of one currency in exchange for another at a fixed exchange rate (strike price) on or before a designated expiry date.

Key Elements of FX Option Pricing:

- Market Influences: Evaluating factors that affect currency exchange rates, such as interest rate differences, economic data, geopolitical events, and overall market sentiment.

- Option Types: Understanding various FX option structures, including standard (vanilla) options like European and American options, as well as more complex exotic options like barrier or Asian options.

- Pricing Models: Applying theoretical models like the Black-Scholes and Garman-Kohlhagen models to determine an option’s value. These models account for factors such as the current exchange rate, strike price, time to expiry, interest rates, and market volatility.

- Risk Analysis: Identifying and managing risks tied to FX options, such as market risk (price changes), volatility risk, and counterparty credit risk.

- Practical Uses: FX option pricing plays a critical role for financial institutions, businesses, and investors in managing currency risks, speculating on forex movements, or structuring complex financial transactions.

skills, India’s leading certification provider, offers candidates access to top-notch exams along with valuable post-exam benefits, including:

- Government-verified certifications.

- Lifetime validity of certifications.

- Unlimited access to e-learning resources.

- Free practice tests for exam preparation.

- Recognition as a ‘Vskills Certified’ professional on Monsterindia.com and Shine.com.

Achieve your career goals with Vskills and stand out in the job market!

Course Outline

The Certification covers the following topics –

Foreign Exchange Markets

- Overview of FX markets

- Market conventions (currency pairs, quote notation)

- Market participants (banks, corporates, hedge funds)

- FX spot market dynamics

- FX forward market dynamics

Option Basics

- Overview of options

- Call and put options

- Option payoffs and profits

- Option pricing models

FX Option Structures

- Vanilla options

- European options

- American options

- Exotic options

- Barrier options

- Asian options

- Digital options

- Compound options

FX Option Pricing Models

- Black-Scholes model

- Garman-Kohlhagen model (BS for FX)

- Market conventions adjustments

- Volatility surfaces and smile

- Stochastic volatility models

- Local volatility models

Greeks and Risk Management

- Delta, gamma, theta, vega

- Hedging strategies

- Sensitivity analysis

- Risk management techniques

Numerical Methods

- Finite difference methods

- Monte Carlo simulation

- Quasi-Monte Carlo methods

- Fourier transform techniques

Market Practices and Regulations

- FX market regulations

- Best execution practices

- Role of regulatory bodies (e.g., SEC, CFTC)

Industry Trends and Developments

- Recent advancements in FX option pricing

- Machine learning applications

- High-frequency trading and FX options

Risk Management

- Risk metrics in FX options

- Portfolio management techniques

- Risk limits and controls

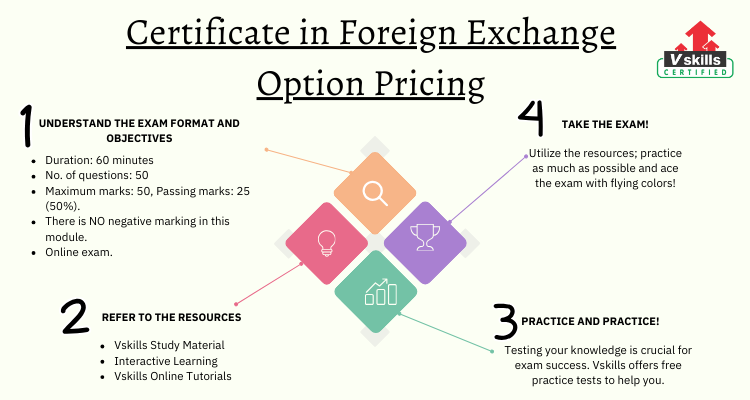

Preparation Guide for Certificate in Foreign Exchange Option Pricing

By following this guide and utilizing Vskills practice tests and tutorials, you can confidently clear the Certificate in Foreign Exchange Option Pricing and build a strong foundation in this specialized area.

1. Overview of the Certification

The Certificate in Foreign Exchange (Forex) Option Pricing equips professionals with the knowledge and skills to value, trade, and manage forex options effectively. It focuses on practical applications, theoretical pricing models, and strategies to handle currency risk and volatility.

2. Key Topics to Cover

To excel in this certification, it is essential to understand the following topics thoroughly:

- Basics of Forex Options

- What are forex options (call and put options)?

- Strike price, expiry date, and intrinsic vs. extrinsic value.

- Types of Forex Options

- Vanilla options (European and American).

- Exotic options (barrier, Asian, digital, etc.).

- Market Dynamics in Forex

- Factors affecting currency exchange rates (economic indicators, interest rate differentials, geopolitical events).

- Understanding market volatility and its impact on forex pricing.

- Forex Option Pricing Models

- Black-Scholes model and Garman-Kohlhagen model.

- Inputs for pricing models: spot rate, strike price, time to expiry, interest rates, and volatility.

- Risk Management in Forex

- Identifying and mitigating market risk, volatility risk, and credit risk.

- Role of forex options in hedging and speculation.

- Applications of Forex Options

- Hedging strategies for corporations and financial institutions.

- Speculation and arbitrage opportunities in forex markets.

3. Study Plan

Follow this step-by-step study approach to prepare effectively:

- Understand the Fundamentals

- Begin with the basics of forex trading and options.

- Familiarize yourself with key terms and concepts.

- Dive Into Pricing Models

- Study the Black-Scholes and Garman-Kohlhagen models in detail.

- Practice solving problems using real-world examples.

- Focus on Practical Applications

- Learn how to use forex options for hedging, speculation, and risk management.

- Explore case studies to understand market dynamics.

- Solve Practice Tests Regularly

- Take mock tests to evaluate your understanding.

- Focus on time management and accuracy.

- Revise Key Concepts

- Create quick notes for formulas and important points.

- Revise regularly to retain concepts.

4. Resources Needed to Clear the Exam

Here’s a list of resources to help you prepare:

- Study Materials

- Standard forex and option pricing textbooks (e.g., “Options, Futures, and Other Derivatives” by John Hull).

- Online tutorials explaining pricing models and forex strategies.

- Online Courses

- Enrol in forex option pricing courses on platforms like Vskills.

- Vskills certification includes comprehensive study material designed for the exam.

- Practice Tests by Vskills

- Use Vskills practice tests to assess your readiness. These tests simulate the actual exam environment and help you identify weak areas.

- Tutorials by Vskills

- Access Vskills tutorials that provide step-by-step guidance on pricing models, forex strategies, and exam preparation.

- Tools for Practical Learning

- Financial calculators or Excel templates for option pricing.

- Software platforms like Bloomberg, Reuters, or free simulators for hands-on practice.

5. Exam-Day Tips

- Read questions carefully and focus on understanding the requirements.

- Manage your time effectively to attempt all questions.

- Revise key formulas and practice numerical problems before the exam.

The Certificate in Foreign Exchange Option Pricing is a valuable credential for anyone looking to build expertise in forex options and their pricing. You can confidently tackle the exam and enhance your professional skills by mastering key concepts, practising with Vskills tests, and applying theoretical models to real-world scenarios.