Risk is an unavoidable component of modern life, and it is present at both the micro and macro levels. In a post-pandemic crisis environment, risk management and career in this domain has thus become a natural need, particularly for business continuity. Many businesses throughout the world are fighting for survival by establishing a risk-free ecosystem and exploring new business opportunities.

Let us know about Career in Risk Management!

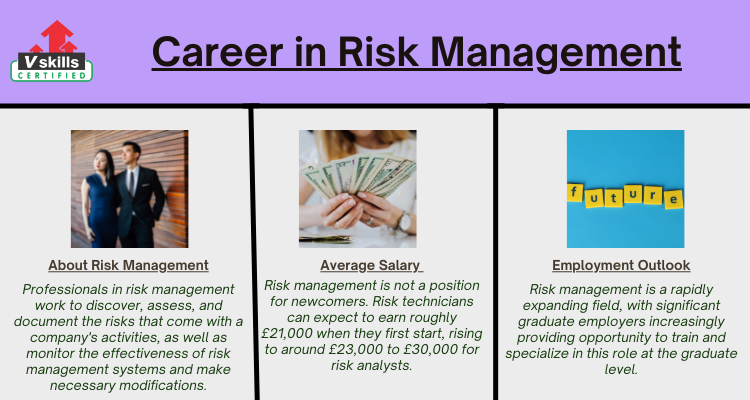

About Risk Management

Professionals in risk management work to discover, assess, and document the risks that come with a company’s activities, as well as monitor the effectiveness of risk management systems and make necessary modifications. Risk management focuses on risks that affect the entire firm, including operational, compliance, financial, technology, and asset-related issues.

Responsibilities

As a risk manager, you’ll most likely need to:

- plan, build, and implement a comprehensive risk management strategy for the company

- make risk assessments, which entails risk analysis as well as identifying, summarizing, and quantifying the business’s hazards

- analyze risk, which entails comparing predicted risks to organizational criteria such as expenses, legal requirements, and environmental variables, as well as evaluating previous risk management.

- determine and quantify the organization’s ‘risk appetite,’ or the amount of risk it is willing to take.

- Report risk in a style that is appropriate for varied audiences, such as the board of directors.

Eligibility

Although any graduate can work in this field, a degree in one of the following topics may improve your chances:

- accounting

- engineering

- finance or economics

- IT

- law

- management or business studies

- mathematics

- risk management

- science

- statistics.

Postgraduate qualifications are not required, but they can be beneficial, especially if your bachelor’s degree is in a field that is unrelated to your field of study. A number of universities offer master’s degrees in risk management. Risk management can be studied as a whole or in more detail, such as corporate and financial risk management or health and safety risk management.

Career Prospects

ERM is applicable to all industries, including automotive, pharmaceuticals, finance, telecom, retail, banking, e-commerce, IT; ITES, real estate, energy, FMCG, and manufacturing, therefore a qualification in enterprise risk management can help you become a risk-aware business leader in any company.

Risk Management Analysts, Associate Risk Managers, Risk Consultants, Credit; Risk Heads, and maybe Chief Risk Officers are all positions that professionals can hold. Because risk pervades all functions and departments of a company, understanding risk management is advantageous in any position. Enterprise Risk Management, Financial Risk Management (for those interested in a career in financial services), Digital Risk Management Qualification (for cyber security professionals), and Supply Chain Risk Management were chosen from a long list of options to give you an edge when starting your risk management career.

You’ll most likely begin your career in risk management as a risk technician or analyst after completing a graduate training program. With time and experience, you can advance to the position of risk manager, with ten or more years of experience leading to the position of chief risk officer (CRO). Opportunities for advancement are growing as more companies recognize the need of appointing CROs to their boards of directors. Departments are also reorganizing and emphasizing risk as a critical component of their overall strategy.

Average Salary

- Risk management is not a position for newcomers. Risk technicians can expect to earn roughly £21,000 when they first start, rising to around £23,000 to £30,000 for risk analysts.

- Risk managers earn between £30,000 and £45,000 a year, depending on experience.

- Senior risk managers can make between £45,000 and £70,000, with those with director-level expertise earning more than £70,000.

Employment Outlook

Risk management is a rapidly expanding field, with significant graduate employers increasingly providing opportunity to train and specialize in this role at the graduate level. This is especially true in the banking and capital markets sectors, where risk teams are growing in size.

Risk managers work in the public sector, charities, and for-profit businesses. Risk management is handled in the finance or operations divisions of certain small businesses.

Resources offered by Vskills for Risk Management

Vskills offer Risk Management certification for all those interested in working in this field or in advancing their career. This certification course covers various objectives –

- Firstly, Risk Basics – Nature & Source

- Secondly, Risk Classification

- Measuring Risk

- Also, Risk Management

- Then, Issues in Risk Management

- Basel

- Finally, Case Studies

Vskills also offers free practice tests and online tutorials to supplement the learning process. You can check them by clicking on the following links –

- Free practice tests

- Online tutorials for Risk Management

Other Resources for Risk Management

Before you can become an expert in desired areas, you must first build a solid base. Before you can move on to practical teaching, you’ll need to have the right applied skills. To gain better understanding of the domain, you can use the following tools:

- Firstly, Online Tutorials for Risk Management

- Also, Certification Courses from verified sources such as Vskills, Coursera, Udemy and so on.

- In addition, Online communities

- Moreover, Blogs and study material from experts in this field and many more.

Here are some examples of how you can improve your abilities:

- Freelancing

- Internships

- Apprenticeship programs

The above steps will help you to get this domain started. It’s a long way to go, however. You can take an advanced course to reach a new level of skills.

Discover the career opportunities and other prospects of Career in Risk Management. Hurry up and start preparing now with Vskills.in!