Liability abounds in the insurance industry. Damages must be compensated for, and the means to do so must come from someplace. When you study how to become an insurance underwriter, you may assist protect policyholders from financial loss while also preventing insurance companies from taking on the risk of a bad credit application. To safeguard an insurance company’s financial line, it’s up to the underwriter to exercise sound judgement.

Let us know about Career as an Underwriter!

About Underwriter

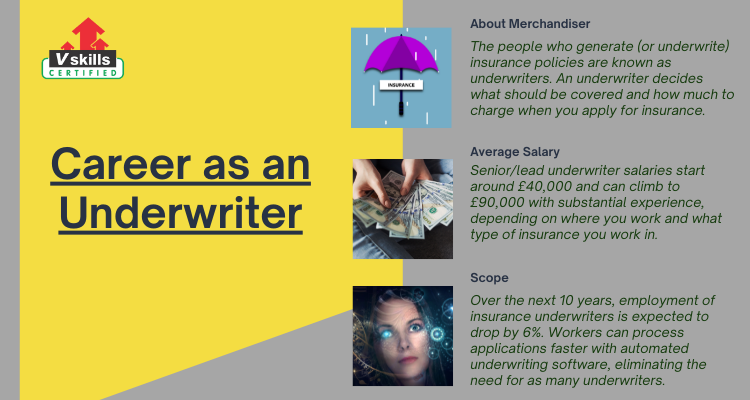

The people who generate (or underwrite) insurance policies are known as underwriters. An underwriter decides what should be covered and how much to charge when you apply for insurance. Essentially, their job entails making a large number of judgement calls. A good underwriter has the financial and risk expertise, as well as a keen eye for detail, to design coverage that meets the needs of both the firm and the customer.

Underwriters operate behind the scenes after assessing the risk and writing the policy, while agents or brokers deal with customer correspondence. To underwrite the most effective coverage, underwriters employ complicated algorithms and risk management approaches.

Roles and Responsibilities of Underwriter

The following are the responsibilities of a Certified Underwriter –

- Undertake data assessment on information recovered from hard money loan applications.

- Consult with loan officers following a meeting with clients

- Scrutinize real estate properties in question and make a judgment about investment

- Undertake risk evaluation on client based on past borrowing history, credit rating, and industry experience

- Undertake additional information from loan officers when appropriate

- Provide application decisions based on consultation with supervising underwriter

- Prepare reports about risk in detail and assess other data.

Eligibility

Bachelor’s degrees in business, finance, economics, or mathematics are common among insurance underwriters. Any authorised college that provides relevant undergraduate degrees can provide you with insurance underwriting courses and classes.

Master’s degrees in insurance risk management are available at several schools. When looking for an underwriter position or a promotion, having a master’s degree provides you a substantial edge. You may begin your career by purchasing your own education insurance coverage. To help with the fees, check into these scholarships for finance and financial management students.

Certifications can help you grow in your profession and earn more money. Chartered Property Casualty Underwriter (CPCU®), Associate in Commercial Underwriting , Associate in Personal Insurance, Life Underwriter Training Council Fellow (LUTCF), and Chartered Life Underwriter are the most prevalent credentials (CLU).

Career prospects

After gaining experience, you can advance to the role of senior underwriter or team leader/manager. As you acquire expertise, you’ll generally be assigned to supervise junior employees who will delegate their underwriting choices to you. You may also be able to provide training to new or less experienced personnel, as well as coach and mentor them.

Accepting additional responsibility and dealing with more difficult or bigger dangers as your career progresses will improve your possibilities to advance and move to new positions and organizations. Experienced underwriters can move into other key areas of insurance, such as risk management, loss adjustment, claims, or brokerage, since their wide expertise allows them to take on general management responsibilities.

Alternatively, you may pursue a career in reinsurance to deal with complicated cases with high levels of risk, or specialize in an area such as marine or aviation insurance. You may also pursue a career in sales, honing your relationship-building abilities in order to reach sales objectives for certain types of insurance. Some of the roles you can expect in this field are –

- Automobile and property underwriters

- Bond underwriters

- Insurance analysts

- Insurance writers

- Underwriting account representatives

- Underwriting service representatives

Average Salary and Scope

- Trainee underwriters on graduate programs might earn between £24,000 and £30,000 per year. For example, the two-year Lloyd’s Insurance Graduate Scheme pays £30,000 per year.

- Underwriters who are qualified generally earn between £25,000 and £40,000 per year.

- Senior/lead underwriter salaries start around £40,000 and can climb to £90,000 with substantial experience, depending on where you work and what type of insurance you work in. You may make far over £100,000 with the appropriate mix of degrees, talents, and experience.

As a result, the majority of underwriters work 40-hour weeks, primarily during normal business hours. Underwriters operate in all areas of the insurance business, including life, health, mortgage, and property-casualty insurance, because their job is so fundamental to how the industry functions.

Over the next 10 years, employment of insurance underwriters is expected to drop by 6%. Workers can process applications faster with automated underwriting software, eliminating the need for as many underwriters. More underwriting judgments will likely be done automatically as this technology develops and gets more extensively utilized in the insurance business.

However, underwriters will still be required to evaluate and update the criteria used by the automation. Furthermore, their analytical skills will be required in complicated or specialized insurance sectors including workers’ compensation, marine insurance, and health insurance.

Resources offered by Vskills for Underwriter

Vskills offer Underwriter certification for all those interested in working in this field or in advancing their career. This certification course covers various objectives –

- Meaning and Fundamental of Underwriting

- Underwriting & Pricing of Product

- Underwriting in India

- Trends in Claim

Vskills also offers free practice tests and online tutorials to supplement the learning process. You can check them by clicking on the following links –

Other Resources for Underwriter

Before you can become an expert in desired areas, you must first build a solid base. Before you can move on to practical teaching, you’ll need to have the right applied skills. To gain better understanding of the domain, you can use the following tools:

- Firstly, Online Tutorials for being Underwriter

- Also, Certification Courses from verified sources such as Vskills, Coursera, Udemy and so on.

- In addition, Online communities

- Moreover, Blogs and study material from experts in this field and many more.

Here are some examples of how you can improve your abilities:

- Freelancing

- Internships

- Apprenticeship programs

The above steps will help you to get this domain started. It’s a long way to go, however. You can take an advanced course to reach a new level of skills.

Discover the career opportunities and other prospects of Career as Underwriter. Hurry up and start preparing now with Vskills.in!