Claims managers are in charge of the claims department, ensuring that the firm conducts an effective review in line with the law and regulations. They must be extremely meticulous and capable of detecting little inconsistencies that might indicate purposeful deceit or even incorrect facts.

Let us know about Career as a Claims Manager!

About Claims Manager

A Claims Manager is someone who is in charge of making sure that insurance claims are handled properly. He also double-checks that the payment was made correctly and in compliance with business rules. At regular intervals, a Claims Manager evaluates the work of adjusters and makes final changes before finalising the claim amount. The major responsibility of the Claims Manager is to oversee and manage the daily activities of claim adjustment. Candidates interested in working as a Claims Manager should have strong analytical abilities in order to go through all of the key data during the claim payment procedure.

Roles and Responsibilities of a Claims Manager

Given below are the Responsibilities of a Certified Claims Manager

- Firstly, to maintain a relationship with a customer through claims processing, claims services, and compensation services.

- Secondly, to control the damage of the firm, as it is considered as the largest cost issue in a composite insurance company.

- Then, to take care of further development and pricing

- Subsequently, to deal with different tasks and jobs related to a claim manager’s position.

- Also, to deal with customers to follow up any issue related to insurance claims

- Moreover, to report the messages to the appropriate departments

- Last but not the least, to record the report of the claim

- Finally, to determine the amount of damage and if necessary involve an expert

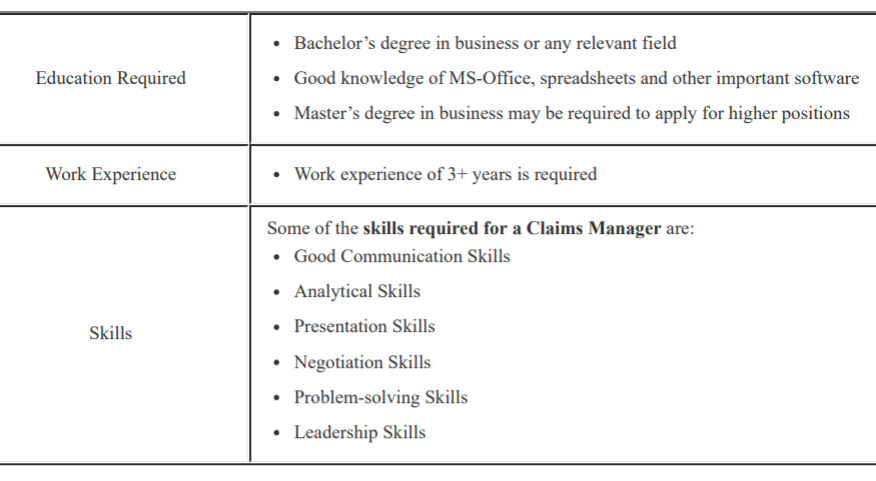

Eligibility

Refer to the table below –

Career prospects

Vice President – A company’s vice president is in charge of all internal operations. They attempt to develop strong client connections while being focused on the company’s financial objectives. The average vice president works a lot of hours, averaging 65-80 hours each week. Because you’re in charge of the bulk of the firm, you’ll probably spend a lot of that time ensuring sure everything is operating as smoothly as possible.

Office Manager – As an office manager, you want to make sure everything is going well, from everyone’s day-to-day tasks to managing a small administrative staff. Office managers generally work 40 hours each week on average. This is a benefit because the schedule isn’t as hectic as other managerial roles.

Branch Manager – A Branch Manager is an executive who manages and coordinates a financial institution’s or company’s branch operations. What’s at risk is ensuring that the branch meets its financial targets, and the branch manager will do all in his or her ability to ensure that this happens. They hire, train, and manage employees, and they use all of their ingenuity to devise foolproof ways to boost production and performance. It is their job to bring in new consumers or partners while maintaining the loyalty of existing customers or partners.

Operations Manager – You have a lot of duties as an operations manager. You may be in charge of several departments or operations in public or private organizations, but the most important thing to remember is that you are in charge. You’ll be developing regulations, staying on top of everyday operations, and finding out how to use particular materials and resources in addition to being in control. Before you get too worked up, remember that each area will most likely be overseen by supervisors.

Average Salary

Several factors impact your beginning pay, including the industry you work in, your company, and your degree of responsibility. Your education and degree have a major influence on the amount of money you earn.

A Claims Manager’s starting compensation is about $70,000 per year. The average annual income is around $105,000, with the highest compensation reaching $130,000.

Scope

Claims Manager jobs will differ depending on the industry. He can work in a variety of fields, including healthcare, insurance, finance, business services, and hospitality. When it came to the most critical talents needed to be a claims manager, we discovered that processes were included on 17.3 percent of applications, customer service was featured on 10.9 percent of resumes, and oversight was listed on 7.9 percent of resumes. Hard talents like these come in handy when it comes to carrying out important employment tasks.

Resources offered by Vskills for Claims Manager

Vskills offer Claims Manager certification for all those interested in working in this field or in advancing their career. This certification course covers various objectives –

- Insurance

- Underwriting

- Underwriting & Claims Settlement

- Role of Insurance Intermediaries

- Claim Settlement

- Legal Aspects

- Ethics & Corporate Governance

- Trends in Claims settlement

Vskills also offers free practice tests and online tutorials to supplement the learning process. You can check them by clicking on the following links –

Other Resources for Claims Manager

Before you can become an expert in desired areas, you must first build a solid base. Before you can move on to practical teaching, you’ll need to have the right applied skills. To gain better understanding of the domain, you can use the following tools:

- Firstly, Online Tutorials for being Claims Manager

- Also, Certification Courses from verified sources such as Vskills, Coursera, Udemy and so on.

- In addition, Online communities

- Moreover, Blogs and study material from experts in this field and many more.

Here are some examples of how you can improve your abilities:

- Freelancing

- Internships

- Apprenticeship programs

The above steps will help you to get this domain started. It’s a long way to go, however. You can take an advanced course to reach a new level of skills.

Discover the career opportunities and other prospects of Career as Claims Manager. Hurry up and start preparing now with Vskills.in!