The Built-up method is used for estimating the cost of equity capital or equity rate of return.

The method starts with the rate of return required by investors for risk free assets and adds one or more premiums for different risk factors. The sequence of steps is elucidated as follows:

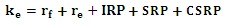

Where:

Ke = Required rate of return on equity

rf = Risk-free rate of return

re = Equity risk premium

IRP= Industry risk premium

SRP= Company size risk premium

CSRP= Company specific risk premium

- Risk premium to account for equity investment: This risk reflects the uncertainty in the context of the amount and timing of dividend distributions and gains realized from public company stock appreciation.

- Risk premium specific to the industry in which the business operates: High risk industries would result in higher industry risk premia.

- Risk premium which accounts for the company size: Generally, smaller company size is associated with higher investment risk. Hence small company investors demand higher returns.

- Company specific risk premium: This accounts for the unique attributes of the business itself. Business risk factors that lead to higher premium values include unstable earnings, high leverage, customer or product concentration.

Apply for Equity Research Certification Now!!

http://www.vskills.in/certification/Certified-Equity-Research-Analyst