Employees, based on nature and type of business, are offered a Bonus at the end of every year. This is a reward or amount that is over and above the salary that is paid to the employees. This is typically paid during festival time or end of financial year.

The basic objective to give bonus is to share the profit earned by the organisation amongst the employees and staff members. In India there is a principle law relating to this procedure of payment of bonus to the employees and that principle law is named as Payment of Bonus Act, 1965.

The Payment of Bonus Act applies to every factory and establishment employing not less than 20 persons on any day during the accounting year. The establishments covered under the Act shall continue to pay bonus even if the number of employees fall below 20 subsequently.

The Payment of Bonus Act, 1965 provides a statutory right to employees of an establishment to share the profits of his/her employer. As per this Central Act, any employee who was drawing a salary or wage not exceeding ten thousand rupees per month was eligible to be paid a bonus.

Section 2 (13) of the Act states that, “employee” means any person (other than an apprentice) employed on a salary or wage not exceeding ten thousand rupees per mensem in any industry to do any skilled or unskilled manual, supervisory, managerial, administrative, technical or clerical work for hire or reward, whether the terms of employment be express or implied.

As per Section 12 of the Principal Act which lays down the ‘Calculation of bonus with respect to certain employees’– Where the salary or wage of an employee exceeds three thousand and five hundred rupees per mensem, the bonus payable to such employee under section 10 or, as the case may be, under section 11, shall be calculated as if his salary or wage were three thousand and five hundred rupees per mensem.

For the purposes of calculation of the bonus to be paid to an employee under the Principal Act, INR 3,500 (Indian Rupees Three Thousand Five Hundred) per month was the maximum amount taken even if an employee was drawing up to INR 10,000 (Indian Rupees Ten Thousand Only) per month.

Eligibility for Bonus

Every employee drawing not less than Rs. 21,000/- per month and who has worked for not less than 30 days in an accounting year shall be eligible for the Bonus. Every employee will be entitled to be paid by his employer in an accounting year, bonus, in accordance with the provisions of this Act, provided he has worked in the establishment for not less than 30 working days in that year.

The Bonus Act 1965, is only applicable when all of the following conditions are met:

- The company is at least 5 years old

- The company has at least 20 employees

- The company has made a profit in that year

- The employee’s wages are not more than 21,000 every month

Employees that have left the organization are still eligible for their arrears. Employers will have to pay the outstanding bonus of past employees as well.

Wage

For the purpose of this Act, wages are defined as the total of the Basic salary + DA (Dearness Allowance).

Disqualification for Bonus

Notwithstanding anything contained in the act, an employee shall be disqualified from receiving bonus, if he is dismissed from service for fraud or riotous or violent behaviour while in the premises of the establishment or theft, misappropriation or sabotage of any property of the establishment.

Minimum/Maximum Bonus Payable

Minimum bonus

- The minimum bonus which an employer is required to pay even if he suffers losses during the accounting year or there is no allocable surplus is 8.33 % of the salary or wages during the accounting year, or

- 100 in case of employees above 15 years and Rs 60 in case of employees below 15 years, at the beginning of the accounting year, whichever is higher

Maximum bonus

If in an accounting year, the allocable surplus, calculated after taking into account the amount ‘set on’ or the amount ‘set of’ exceeds the minimum bonus, the employer should pay bonus in proportion to the salary or wages earned by the employee in that accounting year subject to a maximum of 20% of such salary or wages.

Previously, the maximum bonus payable was 20% of Rs 3500 per month. The minimum bonus payment was capped at 8.33% of Rs 3500 per month or Rs 100, whichever is higher. The calculation ceiling of Rs 3500 is currently doubled to Rs 7000 per month “or the minimum wage for the scheduled employment, as fixed by the appropriate Government” (whichever is higher). Therefore, the cost associated with bonus payments could be double, based on the organization’s performance.

Calculation of Bonus

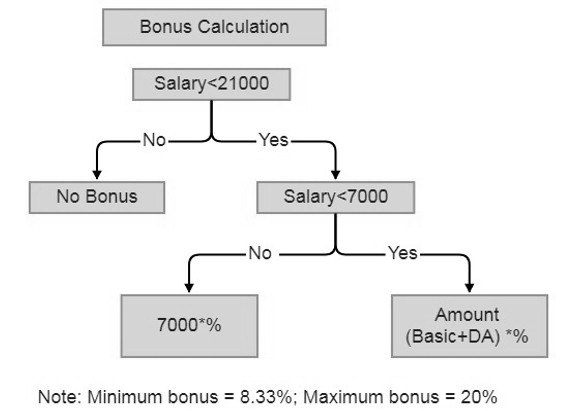

If the gross earning of your employees is below Rs.21000 you are eligible to pay bonus. Calculation of bonus will be as follows:

- If Basic+DA is below Rs.7000 then bonus will be calculated on the actual amount.

- If Basic+DA is above Rs.7000 then the bonus will be calculated on Rs.7000.

Examples of calculation of bonus

If the Basic salary of the employee is less than or equal to Rs 7,000 – Rahul is working as an engineer in a Company in Bangalore. His basic salary is Rs. 6,500 per month.

Formula: Basic Salary*8.33% = Bonus per month

6500*8.33% = 541.45 (6497.4 per annum)

If the Basic salary of the employee is higher than Rs 7,000 – Siddharth is working as a Sales officer in one of the shops in Delhi. His basic salary is Rs. 18,000 per month.

Formula: Basic Salary*20% = Bonus per month

7,000*20% = 1400 per month

If the Basic salary of the employee is higher than Rs 21,000 – There is no bonus applicable to employees having a basic salary of more than Rs 21,000.

Exempted Establishments

The payment of bonus act will not apply to the following section of employees:

- The employees of Life Insurance company

- Seamen defined under clause 42 of the merchant shipping act 1958.

- Employees who registered or listed under the dock workers Act 1948 and employed by the registered or listed employers.

- The employees of any industry controlled by central or state government.

- Employees from Indian red cross society or education institutions, institutions not for profit.

- Employees employed by the contractor on building operations

- Reserve Bank Of India(RBI) employees

- Employees of any financial corporation under the Section 3 or Section 3a of the State Financial Corporation act (SFC) 1951

- Employees of IFCI, Deposit Insurance Corporation, agriculture Refinance Corporation.

- Any financial institution is an establishment in public sector which central government notifies.

- The employees of inland water transport establishment

Time limit for payment

The bonus should be paid in cash within 8 months from the close of the accounting year or within one month from the date of enforcement of the award or coming into operation of a settlement following an industrial dispute regarding payment of bonus.

However if there is sufficient cause extension may be applied for.

Duties/Rights of Employer

Duties

- To calculate and pay the annual bonus as required under the Act

- To submit an annual return of bonus paid to employees during the year, in Form D, to the Inspector, within 30 days of the expiry of the time limit specified for payment of bonus.

- To co-operate with the Inspector, produce before him the registers/records maintained, and such other information as may be required by them.

- To get his account audited as per the directions of a Labour Court/Tribunal or of any such other authority.

Rights

An employer has the following rights:

- Right to forfeit bonus of an employee, who has been dismissed from service for fraud, riotous or violent behaviour, or theft, misappropriation or sabotage of any property of the establishment.

- Right to make permissible deductions from the bonus payable to an employee, such as, festival/interim bonus paid and financial loss caused by misconduct of the employee.

- Right to refer any disputes relating to application or interpretation of any provision of the Act, to the Labour Court or Labour Tribunal.

Rights of Employees

- Right to claim bonus payable under the Act and to make an application to the Government, for the recovery of bonus due and unpaid, within one year of its becoming due.

- Right to refer any dispute to the Labour Court/Tribunal Employees, to whom the Payment of Bonus Act does not apply, cannot raise a dispute regarding bonus under the Industrial Disputes Act.

- Right to seek clarification and obtain information, on any item in the accounts of the establishment.

Disqualification, on dismissal of an employee for;

- Fraud; or

- riotous or violent behavior while in the premises of the establishment; or

- theft, misappropriation or sabotage of any property of the establishment or

- Misconduct of causing financial loss to the Employer to the extend that bonus can be deducted for that year {Section 9 & 18}

Bonus Payment

The payment of Bonus for a financial year has to be made within 8 months of its completion. Since the financial year in India ends in March, payments have to be made by the end of October of the next financial year.

Although the bill for the amendment of the Bonus Act has been sanctioned by the government, there has been no formal date that has been declared for the payment of the arrears. It can be assumed that these arrears should be paid out before the due date of the current financial year. However, this hasn’t been officially decided and announced.

Companies can make the payment to current employees using the same medium that they use to transfer salaries. Since most companies directly transfer salaries to employees’ bank accounts, this would be the most convenient method to pay the arrears as well. On the other hand, past employees can be paid by issuing individual cheques.

In order to keep employees at the same CTC with the increased bonus, it’s best to deduct the respective amount from special allowances or other allowances. Changing the mandatory components of salaries like Basic salary or HRA will only make things more complicated. Hence, it’s best to stick to other allowances for this purpose.

Offences and Penalties

For contravention of the provisions of the Act or rules the penalty is imprisonment upto 6 months, or fine up to Rs.1000, or both.

For failure to comply with the directions or requisitions made the penalty is imprisonment upto 6 months, or fine up to Rs.1000, or both.

In case of offences by companies, firms, body corporate or association of individuals, its director, partner or a principal officer responsible for the conduct of its business, as the case may be, shall be deemed to be guilty of that offence and punished accordingly, unless the person concerned proves that the offence was committed without his knowledge or that he exercised all due diligence

Registers to Maintain

- A register showing the computation of the allocable surplus referred to in clause (4) of section 2, in form A.

- A register showing the set-on and set-off of the allocable surplus, under section 15, in form B.

- A register showing the details of the amount of bonus due to each of the employees, the deductions under section 17 and 18 and the amount actually disbursed, in form C. {Section 26 Rule 4}

- The employer is also required to send an annual return to the Inspector appointed under the Act within 30 days from the expiry of time limit specified in Section 19 for payment of bonus. (Form D)