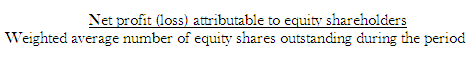

Basic earnings per share is calculated as

All items of income and expense which are recognised in a period, including tax expense and extraordinary items, are included in the determination of the net profit or loss for the period unless AS – 5 requires or permits otherwise.

The amount of preference dividends and any attributable tax thereto for the period is deducted from the net profit for the period (or added to the net loss for the period) in order to calculate the net profit or loss for the period attributable to equity shareholders.

The amount of preference dividends for the period that is deducted from the net profit for the period is:

- The amount of any preference dividends on non-cumulative preference shares provided for in respect of the period; and

- The full amount of the required preference dividends for cumulative preference shares for the period, whether or not the dividends have been provided for. The amount of preference dividends for the period does not include the amount of any preference dividends for cumulative preference shares paid or declared during the current period in respect of previous period.

If an enterprise has more than one class of equity shares, net profit or loss for the period is apportioned over the different classes of shares in accordance with their dividend rights.

The number of shares used in the denominator for basic EPS should be the weighted average number of equity shares outstanding during the period. The weighted average number of equity shares outstanding during the period is the number of shares outstanding at the beginning of the period, adjusted by the number of equity shares bought back or issued during the period multiplied by a time-weighting factor. The calculation is based on all shares outstanding during the period. Whether or not a particular class or tranche of shares ranked for dividends in respect of the period is irrelevant (except in the case of partly paid shares).

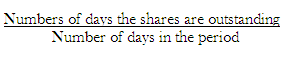

The time-weighting factor is:

Although the Standard defines the time-weighting factor as being determined on a daily basis, it acknowledges that a reasonable approximation of the weighted average is adequate in many circumstances.

Depending on the relative size of share movements, this might, for example, be based on the number of months for which shares were outstanding.

In most cases, shares are included in the weighted average number of shares from the date the consideration is receivable, for example:

- Equity shares issued in exchange for cash are included when cash is receivable;

- Equity shares issued as a result of the conversion of a debt instrument to equity shares are included as of the date of conversion;

- Equity shares issued in lieu of interest or principal on other financial instruments are included as of the date interest ceases to accrue;

- Equity shares issued in exchange for the settlement of a liability of the enterprise are included as of the date the settlement becomes effective;

- Equity shares issued as consideration for the acquisition of an asset other than cash are included as of the date on which the acquisition is recognised; and

- Equity shares issued for the rendering of services to the enterprise are included as the services are rendered.

In these and other cases, the timing of the inclusion of equity shares is determined by the specific terms and conditions attaching to their issue. Due consideration should be given to the substance of any contract associated with the issue.

Equity shares issued as part of the consideration in an amalgamation in the nature of purchase are included in the weighted average number of shares as of the date of the acquisition because the transferee incorporates the results of the operations of the transferor into its statement of profit and loss as from the date of acquisition. Equity shares issued as part of the consideration in an amalgamation in the nature of merger are included in the calculation of the weighted average number of shares from the beginning of the reporting period because the financial statements of the combined enterprise for the reporting period are prepared as if the combined entity had existed from the beginning of the reporting period. Therefore, the number of equity shares used for the calculation of basic earnings per share in an amalgamation in the nature of merger is the aggregate of the weighted average number of shares of the combined enterprises, adjusted to equivalent shares of the enterprise whose shares are outstanding after the amalgamation.

Partly paid equity shares are treated as a fraction of an equity share to the extent that they were entitled to participate in dividends relative to a fully paid equity share during the reporting period.

Where an enterprise has equity shares of different nominal values but with the same dividend rights, the number of equity shares is calculated by converting all such equity shares into equivalent number of shares of the same nominal value.

Equity shares which are issuable upon the satisfaction of certain conditions resulting from contractual arrangements (contingently issuable shares) are considered outstanding, and included in the computation of basic earnings per share from the date when all necessary conditions under the contract have been satisfied.

Equity shares may be issued, or the number of shares outstanding may be reduced, without a corresponding change in resources. Examples include:

- A bonus issue;

- A bonus element in any other issue, for example a bonus element in a rights issue to existing shareholders;

- A share split; and

- A reverse share split (consolidation of shares).

In case of a bonus issue or a share split, equity shares are issued to existing shareholders for no additional consideration. Therefore, the number of equity shares outstanding is increased without an increase in resources. The number of equity shares outstanding before the event is adjusted for the proportionate change in the number of equity shares outstanding as if the event had occurred at the beginning of the earliest period reported.

Since the bonus issue is an issue without consideration, the issue is treated as if it had occurred prior to the beginning of the year 2011, the earliest period reported.

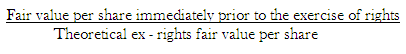

In a rights issue, on the other hand, the exercise price is often less than the fair value of the shares. Therefore, a rights issue usually includes a bonus element. The number of equity shares to be used in calculating basic earnings per share for all periods prior to the rights issue is the number of equity shares outstanding prior to the issue, multiplied by the following adjustment factor:

The theoretical ex-rights fair value per share is calculated by adding the aggregate fair value of the shares immediately prior to the exercise of the rights to the proceeds from the exercise of the rights, and dividing by the number of shares outstanding after the exercise of the rights.