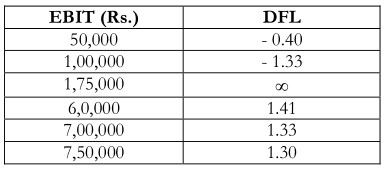

Financial leverage when measured for various levels of EBIT will aid in understanding the behavior of DFL and also explain its utility in financial decision-making. You will under- stand better with the following example: –

The DFL at EBIT level of Rs.1, 75,000 is undefined and this point is the financial break-even point. It can be defined as

EBIT = I + Dp / (1 – T)

You can also make following observation by studying the behaviour of DFL

Each level of EBIT has a distinct DFL\

- DFL is undefined at the financial break-even point

- DFL will be negative when EBIT level goes below the financial break-even point.

- DFL will be positive for all values of EBIT that are above the financial break-even point. This will however start to decline as EBIT increases and will reach a limit of I

By assessing the DFL, you can understand the impact of change in EBIT on the EPS of the company. In addition to this it also helps in assessing the financial risk of the firm.

In the field of finance, the use of debt or borrowing to increase the size or profitability of a venture is called leverage. While borrowing incurs interest expense and risk, it can also yield rewards.

- Magnification of Shareholder Profits: If a company is solely financed by shareholder equity, then its profitability to the shareholders will change in proportion to its own change in profitability. For example, should profits increase by ten percent, the shareholders’ dividends or share value will increase by ten percent. If the firm is leveraged, then that increase in profitability of the operation will not increase the payments needed to service the debt. Thus the excess profit is all passed to the shareholders and will necessarily increase the value of shares or dividends to a greater degree than the increase in the operation’s profitability.

- Improvement in Credit Rating: A firm that successfully uses leverage demonstrates by its success that it can handle the risks associated with carrying debt. This can become an important factor when additional financing is needed. Not only will loans more likely be available, but they will be available at more attractive interest rates. Like individuals, companies with solid financials, but little credit history, sometimes have trouble convincing lenders that they are deserving of a good rate.

- Capturing Economies of Scale: Some activities become more efficient when conducted on a larger scale. Industrial mass production is an example of such an activity. Larger production facilities incur a lower unit cost to produce goods. Since it is advantageous to the company both to offer many items for sale and to compete by offering the consumer a lower price, larger facilities are often better. If the firm cannot afford such a facility, borrowing may be the best solution.

- Increased Free Cash: By borrowing funds, the firm incurs a debt that must be paid. But, this debt is paid in small installments over a relatively long period of time. This frees funds for more immediate use.