Both national and international bodies around the globe manage Anti-Money Laundering (AML) guidelines for the finance industry. These require serious screening and monitoring methods on all financial institutions. The measures to complete a successful anti-money laundering (AML) program constitute a key process which is ‘Know Your Customer (KYC). So, before you decide to begin it is essential to know about the career opportunities in AML and KYC Compliance sector.

Let us know the career prospects for AML and KYC Compliance domain.

What does it mean by AML and KYC ?

AML is a broader, more holistic practice than KYC. AML is a holistic practice. Compliance with AML is the comprehensive policy set used by a company to protect against criminal infiltration, cash laundering, terrorism finance, trafficking in human beings and more. For companies, banks, finance institutions, and other financial institutions, KYC is an important part of AML

Know your customer (KYC) is a regulatory system in which a financial institution verifies the identity of a customer by evaluating its credentials prior to the use of a service. KYC policies provide companies with an increased understanding of their clients and financial transactions that help mitigate and manage risk efficiently.

How are KYC and AML related?

The AML program of an enterprise has numerous steps, and the first step is KYC. KYC is the process used to verify the identity and the risk profile of a client, but further steps are necessary to fully protect the client from financial crimes.

KYC as an initial step to verify the identity of a client, to control their Risk Factor and to monitor their accounts comprises a comprehensive AML compliance program. KYC is the most important step in the AML policy of an institution. It is important that a client’s identity is carefully checked, its risk assessed, the general financial habits of a client understood and procedures in place for the detection of abnormalities.

Why is it important to learn KYC and AML Compliance?

Financial asset security is every organization’s top priority. Securities are granted in the retail or insurance sectors by the terms of the Agreement, but the software itself should include the tools and processes to mitigate the risk of financial fraud in the financial technologies (FinTech). So, proper training about KYC and AML is important because –

Companies don’t want their money to lose

Although creation of CDD may seem expensive, the risks associated with this lack are usually more expensive. In addition, banks and other financial institutions that fail to comply with the correct regulations, which account every year for money laundering, also have a risk of being punished.

The unified global effort to combat money laundering and terrorist financing

Financial institutions and governments are joining forces to fight against illegal cash flows and terrorist funding. Organizations like FATF create a secure financial environment. It is only possible, however, if sufficient governments and companies agree to comply with certain regulations. Even an unregulated small company could become a crime loophole, compromising global security and destroying its very reputation.

This is because of the above reasons why Know Your Customer (KYC) and Anti Money Laundering (AML) abbreviations have been included in the common business vocabulary.

Required Skill Set

The candidates are required to have following skills. these are not mandatory but can help to perform better-

- Can demonstrate experience in KYC work within the financial service industry

- Good understanding of AML and CTF framework

- Hedge fund industry and/or Trust business experience is an advantage

- Experience with AML monitoring and screening is an advantage

- Compliance qualification is an advantage

- Strong research and analytical skills

- Excellent communication skills in English, both verbal and written

- Must have good planning and time management/prioritization skills

- Ability to work independently and also to liaise with other departments

- Good interpersonal skills

- Must have good knowledge of Microsoft office applications

How can you start your career in AML and KYC Compliance?

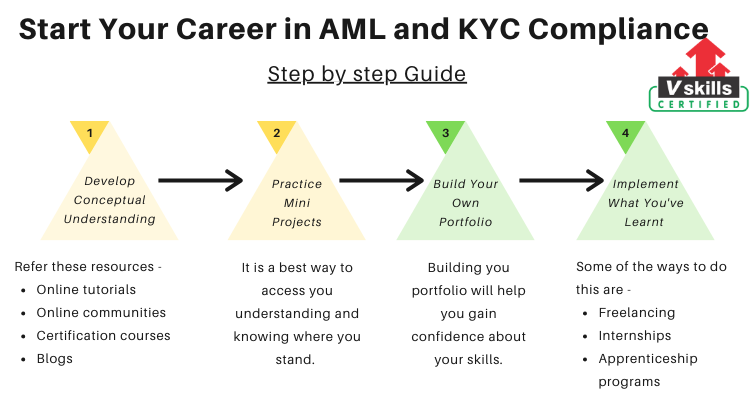

It is very much important to have a decent beginning with proper assets and learning material to be acceptable at something. Therefore, you initial steps towards learning must be apt in order to be pro in this field. Let look at some steps that you can take in order to begin your learning process –

Step 1 – Learn about the basics and Develop Conceptual understanding

It is very important that you have a strong foundation before you become an expert in certain fields. Even before you reach the pragmatic practical portion, an appropriate applied information is required. Somewhere everybody begins. If you want a successful career in this domain, you have to take baby steps. You can use the following resources to gain full knowledge and understand the concept –

- Firstly, Online Tutorials for AML and KYC training

- Also, Certification Courses from verified sources such as Vskills, Coursera, Udemy and so on.

- In addition, Online communities

- Moreover, Blogs and study material from experts in this field and many more.

Vskills also provide Online tutorials, certification courses and free practice tests for the same. You can check them out on our official site.

Step 2 – Practice Mini Projects and Writing research Papers

If you want to land in a good place, practicing is essential. It is also a best way to understand and to know where you stand when it comes to implementing your knowledge. With regard to practical aspects such as the implementation of your training and knowledge in projects and research papers, experience can help you outlive other aspects. With reading the blogs and tutorials, you can supplement your learning by different sites to understand the practical aspects more effectively.

Step 3 – Build Your Portfolio

Building you portfolio will help you gain confidence about your skills and will also get you a platform to implement your learnings. Your portfolio shows your abilities to carry out and plan various principles or how impeccably you execute your abilities in this domain. These tasks ought to incorporate a few diverse datasets and should leave readers with intriguing bits of knowledge that you’ve gathered. Your portfolio needn’t bother with a specific subject; pick any principle that interest you, at that point think of an approach to assemble them.

Step 4 – Implement your skills in Real world

It is very important to implement your skills because that is why you have learned to do this perfectly! It is also important that you stay up-to-date and continue to work and develop your own skills. Some of the advanced courses also show you know advanced skills. You can also attend. Some ways to achieve your skills are –

- Freelancing

- Internships

- Apprenticeship programs

Above mentioned steps will help you to get started in this domain. However, there is a long way to go. You can take up an advanced course to take your skills to a new level.

Tools used to perform KYC

KYC is a constantly developing technology. Biometric identification is one of the latest tools used in modern KYC.

Prints of fingers

Fingerprint technology is now more accessible than ever before. Fingerprint scanners are used by many of the flagship smartphones. Whilst many internet banks and e-wallets, like Apple Pay, use this technology instead of string passwords for customer verification. The most exact and fastest authentication method are by far fingerprint scanners.

Recognition of the face

Many eKYC providers use facial recognition technology to match the image of a person in the document to a video or a photo. A facial identification is also used to unlock your telephone and certain financial services. In particular the top-ranking smartphone manufacturers are fast developing this technology.

Voice Reconnaissance

Voice recognition among KYC suppliers and FinTechs is still to be seen. However, solutions such as an automatic video call interview cannot yet be as secure.

Job prospects

The major circumstances stoking the Anti-money laundering market involve increasing rigorous regulations and compliances for AML, the growing center of financial institutions on digital payment-related problems, and the necessity to get a holistic picture of data to curb financial scandals. Moreover, the growing adoption of superior analytics in AML and the combination of AI, ML, and big data technologies in originating AML solutions would present lucrative possibilities for AML Solution vendors. Further, the market demand for Certified AML-KYC Compliance Officers is high.

Most of these people are engaged with private money lending organizations or with nationalized banks. These days, larger firms in the world of negotiating, technology, and manufacturing need the services of the AML/KYC officers as well.

Who is an AML and KYC compliance Officer?

The KYC/AML Officer is a member of the KYC department responsible for opening, amending, reviewing and exiting clients according to established policies and procedures. The KYC/AML officer should also review client’s transactions to detect and report either proposed or completed unusual transactions. This is the job role you can expect after learning about AML and KYC Compliance.

Main Job Functions

The responsibilities required to carry out by an AML/KYC Officer are –

- Due Diligence on new customers, information requested from KYC, documents, reviewed and verified documentations received and analysis of risk for new customers

- Document in depth and succinctly, for a group comprising management, regulators, internal audit, managers as well as internal compliance, the research and analytics related to financial activity and related client entities

- Assess current clients on a regular basis in accordance with established policies and procedure

- Periodic review of KYC records, including verification of the due diligence and compliance with the standards of CBC (due diligence)

- Investigate and report high risk customers and political exposed persons where necessary and obtain all documents necessary to complete client files

- Process entries on our KYC / Related Parties and CDD databases for opening/close-down of customer account and instruction to open/close accounts at the equation level as applicable;

- Customer records of our KYC/RP and CDD database modified; processing;

- Efficient and effective communication with internal and external parties concerned in order to obtain KYC documents

have a thorough understanding of customer and related parties to monitor customer activities in the context of unusual transactions;

Average Salary and Working conditions

A compliance officer has an average salary of 3,66,078 Rs annually. This applies to persons with the above certifications completed. The salary is slightly lower without the certificates. Experienced candidates, on the other hand, are paid annually significantly more money. Your geography has also a say in the wages you bring home in this field of work.

These people handle documentation and work with minimum or no weekend work under strict office requirements. As the majority of work can be done on a desk and on a computer with a decent Internet connection, many organizations allow their employees to work in their homes.

For candidates working as a third-party employee in organizations, certain demands may apply in accordance with the time zones of the client. It is obvious from the nature of the job that candidates must have high integrity and respect for themselves. Only such a person can identify anything suspected in the organization and thus do justice to their role as an Officer of Compliance. However, there is nothing that can stop you carving a name for yourself here if you are confident of your sense of values and work ethics with the required skill and certifications.

Conclusion

With the frequent legal consequences of AML compliance, it is vital to have sufficient powers for you to ensure that you as compliance officer are able to effectively fulfil its role and responsibilities. In addition to monitoring and handling a range of sensitive financial data, AML Officers should regularly interact with the senior managers, the board and the financial authorities. An AML officer should ideally be an employee in the industry with experience and trust in each aspect of his or her profession.