The efficiency, with which the assets are utilized or converted into sales, is evaluated with these ratios. The speed at which assets are converted into sales is reflected in these ratios.

Inventory or Stock Turnover Ratio

Inventory Turnover Ratio measures the velocity of the movement of goods. It measures the relationship between the Cost of Goods Sold and the Inventory level.

Inventory Turnover = Cost of Goods Sold / Average Inventory

Cost of goods sold = Opening stock + Purchases and Manufacturing Cost – Closing Stock

Average Inventory = (Opening Stock + Closing Stock) / 2

The average time taken for clearing the stocks is calculated as follows:

Inventory conversion period = Number of days in a year / Inventory Turnover Ratio

Generally, high inventory ratio implies good inventory management. But it may indicate under-investment which means loss of business opportunities. Similarly, a low inventory turnover may be indicative of over-investment which is still worse evil. Hence what is required is the optimum inventory level.

The Inventory Turnover Ratio can be extended to the components of inventory: (i) Raw materials and (ii) Work-in-progress. This may examine the efficiency with which the raw materials are converted into work-in-progress and work-in-progress to finished goods. Raw Materials inventory is related to Materials Consumed and work-in-progress to the Cost of Goods Manufactured.

Debtors or (Accounts) Receivables Turnover Ratio and Average Collection Period

Debtors Turnover Ratio measures the efficiency at which the sales are converted into cash

Debtors Turnover = Credit Sales / Average Trade Debtors

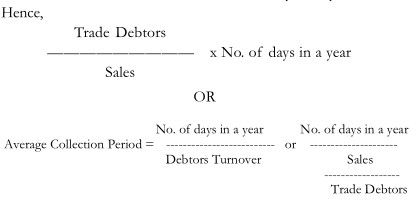

Average Collection Period:

Average Collection Period represents the average number of days for which a firm has to wait for converting a receivable into cash.

Average Collection Period = Trade Debtors / Average Sales per day

Average Sales per day= Sales / No. of days in a year

To supplement the information, Ageing Schedule may be use to ascertain the quality of the trade debtors to identify the areas of problems in debtors.

Assets Turnover Ratios

Assets Turnover Ratios measure the efficiency of the assets in generating sales

Total Assets Turnover

To ascertain the ability to generate sales from all financial resources

Cost of Goods Sold or Sales / Total Assets

Fixed and Current Assets Turnover Ratio

To ascertain the adequacy of investment in fixed and current assets

Fixed Assets Turnover Ratio = Cost of Goods Sold or Sales / Fixed Assets

Current Assets Turnover Ratio = Cost of Goods Sold or Sales / Current Assets

Working Capital Turnover Ratio

To ascertain the efficiency with which working capital is utilized in the business

Working Capital Turnover Ratio = Cost of Goods Sold or Sales / Net Working Capital

Profitability Ratio

All the stakeholders are interested in assessing the profitability of a firm, more interested are the owners and the management. Profit is the final measure of performance of a firm. Profit is the basic thing for survival and growth of a business.

Profitability Ratios can be related to sales as well as investments.