Acquisitions involve the purchase of a company or business unit. Acquisitions can be friendly, as in a merger, or unfriendly, as in a hostile takeover. The vast majority of restructuring transactions are friendly purchases of a single business unit or subsidiary. Hostile takeovers of large companies by equally large bidders happen less frequently but get more attention.

The difference between the actual costs for acquiring a target firm versus the estimate made of its value before the acquisition. During a merger and acquisition, companies will first estimate the cost that they wish to pay for a target firm. As the entire M&A process takes many weeks, the price paid for the target firm may in fact be higher or lower than its market price at the time of completion because of economic fluctuations.

In either friendly or hostile acquisitions, the difference between the acquisition price, and the market price prior to the acquisition is called the acquisition premium. The acquisition price, in the context of mergers and consolidations, is the price that will be paid by the acquiring firm for each of the target firm’s shares. This price is usually based upon negotiations between the acquiring firm and the target firm’s managers. In a tender offer, it is the price at which the acquiring firm receives enough shares to gain control of the target firm. This price may be higher than the initial price offered by the acquirer, if there are other firms bidding for the same target firm or if an insufficient number of stockholders tender at that initial price.

For instance, in 1991, AT&T initially offered to buy NCR for $80 per share, a premium of $25 over the stock price at the time of the offer. AT&T ultimately paid $110 per share to complete the acquisition.

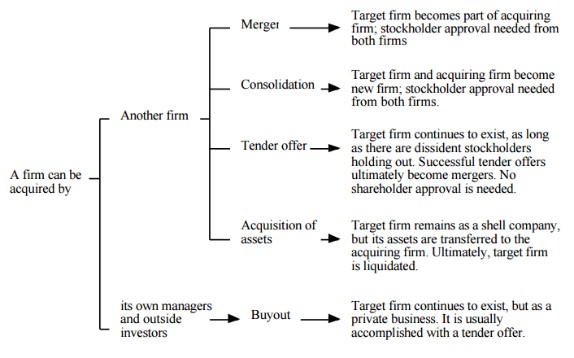

Acquisitions can range from one firm merging with another firm to create a new firm to managers of a firm acquiring the firm from its stockholders and creating a private firm.