It is the oldest and most established investment decision rules. Here, accounting statements in particular accounting measures of income has been used. I.e., return on capital and return on equity.

AAR: Average net income/Average book value. A project is acceptable if its average accounting return exceeds a target return.

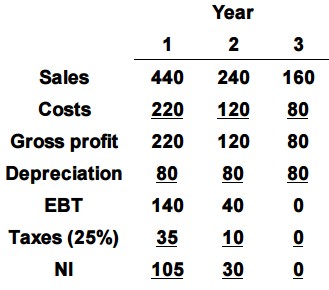

Example of AAR: Assume the initial investment required is $240.

Average net income = (105 + 30+ 0)/3 = $45

Average book value = (240 + 160 + 80 + 0)/4 = $120

AAR = Ave NI/Ave BV = $45/120 = 37.5%