Nowadays, almost every company or business requires a business accountant for examining finances and preparing financial reports. Moreover, they also make sure that the data is correct and taxes are paid correctly. However, below we will discuss the responsibilities of a business accountant.

- Business accountants recognize problems that include disappearing inventory, increased costs for products or equipment, or customers who aren’t paying on time.

- They maintain cash flow at acceptable levels. And also point out potential areas of growth by analyzing pricing, cash flow patterns, inventory management, etc.

- They also prepare tax returns accurately and ensure the accuracy of financial documents.

- Further, they also evaluate financial operations to recommend best-practices, identify issues and strategize solutions.

- Lastly, they conduct forecasting and risk analysis assessments

Vskills Certified Business Accountant: Overview

Vskills Certified Business Accountants have the ability to record and analyze the financial information of the companies for which they work. And, they are usually part of executive and finance teams.

Certification Benefits

Role of a Business Accountant is to record and analyze the financial information of the companies. However, this certification will teach candidates about essential accounting and financial tools for understanding business as well as knowledge in the building blocks of creating statements. In addition, this course will help candidates to learn the tools for recording and analyzing the financial information of the companies.

Talking about the career, business accounting various areas to specialize with a wide variety of job opportunities. Business accountants are always in demand. That is to say, almost every company needs a business accountant. And, they will find opportunities for employment in both the government and private sectors. Further, business accountants have the advantage to start their own business using required knowledge and skills.

Vskills being India’s largest certification providers gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine Shine.com.

Career in Accounting

Accountants are the practitioners and professionals of accounting. Chartered Accountants are the certified experts in these disciplines. Let us know about Career in Accounting!

Course Outline for Certified Business Accountant

Certified Business Accountant covers the following topics –

MEANING AND SCOPE OF ACCOUNTING

- Meaning of Accounting

- Basics of Bookkeeping and Accounting

- Accounting Concepts and Principles

- Branches of Accounting

- Classification of Expense, Income, Assets and Liabilities

- Financial Statements

- Systems of Accounting

- Source Document

- Journal

- Ledger

- Trial Balance

- Subsidiary Books

- Purchases Books

- Journal Proper

- Cash Book

- Bank Pass Book

- Petty Cash Book

- Imprest system

- Bank Reconciliation Statement

- Rectification of Errors

- Suspense Account

- Capital Expenditure and Revenue Expenditure

- Capital Receipts and Revenue Receipts

- Depreciation

- Company Final Accounts

- Shares

TAXATION

- Terminologies

- Residential Status of an entity

- Income Tax Liability

- Computation of Total Income

- Heads of Income Tax

- Taxability of Income

- Income under House and Property

- Deductions from Gross Total Income

- Income from other source

- Advance Tax

- Tax Deduction at Source (TDS)

- Wealth Tax in India

- Service Tax and statutory provisions

- VAT General Provisions

- CENVAT

BANKING & FINANCE

- Introduction

- Banking Acts and Regulations

- Types of Banks

- Services offered by a Bank

- Deposit Products

- Mortgage and Loans

- Banking Instruments

- Clearing House

- MICR – Magnetic Ink Character Recognition

- ATM – Automated Teller Machine

- Electronic Banking

- Corporate Banking

- Telebanking/Telephone Banking

- Voice-Mail Facility

- Plastic Money

- Loan Scheduling and Development

COSTING & AUDITING

- Introduction to Costing

- Concept of Cost Accounting

- Material / Inventory

- Activity Based Costing (ABC)

- Marginal Costing/ Break Even Analysis

- Variance Analysis

- Introduction to Auditing

- Book-keeping, Accountancy and Auditing

- Advantages of Auditing

- Limitations of Auditing

- Purpose of Audit

- Types of Audit

- Vouching

- Verification of Assets and Liabilities

- Valuation

INVESTMENT & FINANCIAL MARKET

- Investment Market and its operation

- Risk and Return

- Financial Market, Participants and Instruments

- Security Market and Emerging Trends

- Company Capital/Shares

- Portfolio Management

- Bonds and Debentures

- Derivatives

- Hedging

- Depository

- Dematerialisation and Rematerialisation

- Mutual Funds

- Stock Exchange/Screen Based Trading

- Investors Protection, Grievance and Education

- Time Value Money

- Ratio Analysis

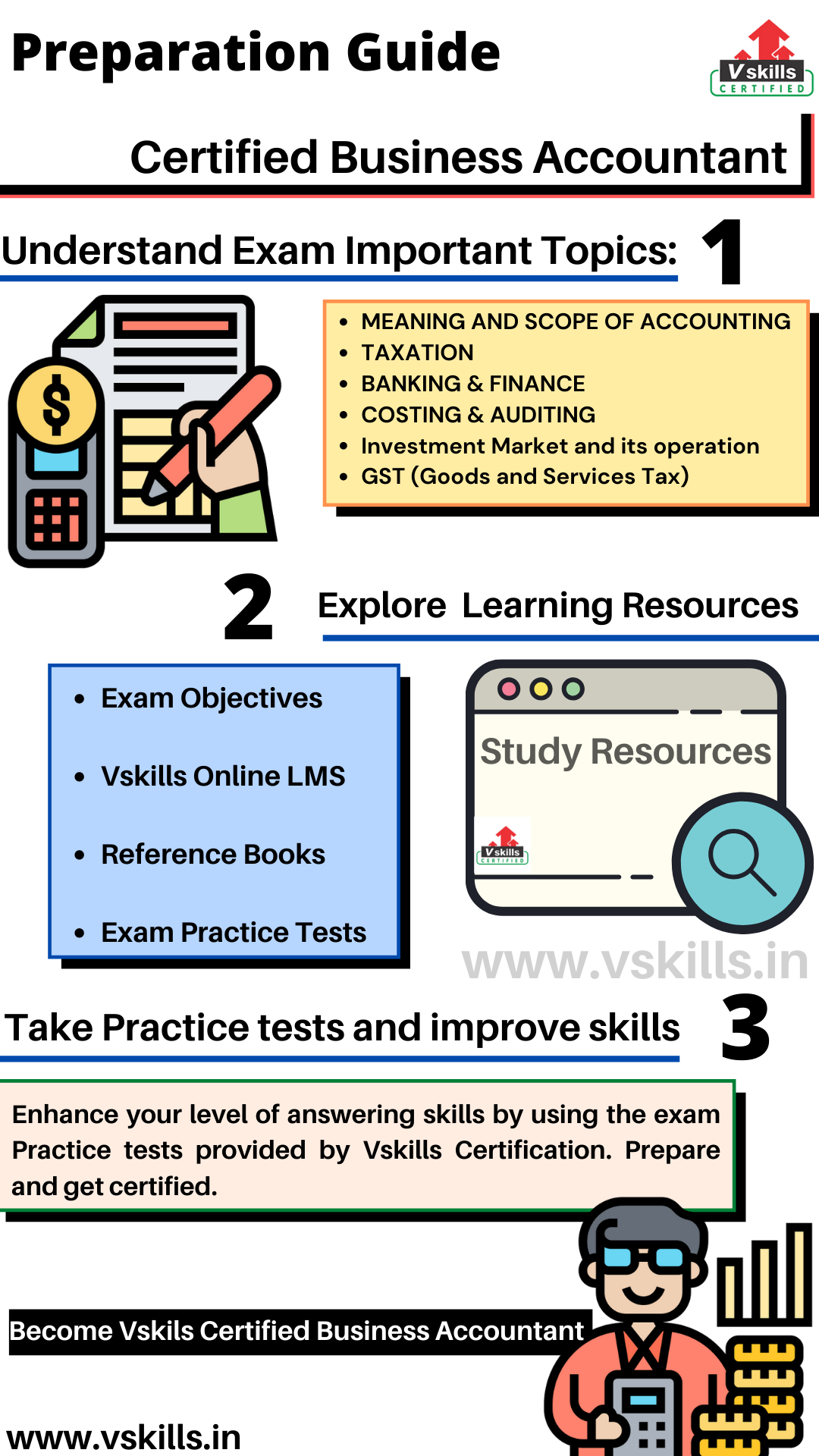

Preparation Guide for Vskills Certified Business Accountant

Candidates preparing for the exam should understand the importance of exam resources. During the exam preparation, it is essential to get all the required exam study resources. This will provide an advantage to understand the concepts and meaning more accurately. In the Certified Business Accountant exam preparation guide, we will discuss some of the most important resources to help you prepare well for the exam.

Study Resource: Exam Objectives

For every examination, the first task should be to get all the exam related details including the important contents and its topic. This will help candidates to easily start preparing for the exam and to understand things more accurately. For the Certified Business Accountant exam the topics include:

- MEANING AND SCOPE OF ACCOUNTING

- TAXATION

- BANKING & FINANCE

- COSTING & AUDITING

- Investment Market and its operation

- GST (Goods and Services Tax)

Study Resource: Vskills Online LMS

Vskills Certified Business Accountant provides candidates access to prepare for the exam using the online learning material for a lifetime. The online material for this is regularly updated. Furthermore, e-learning is bundled with hard copy material which helps candidates to improve and update the learning curve for superior and better opportunities.

Study Resource: Books for Reference

Reference Books can provide an advantage to learn and understand things more accurately. For the Certified Business Accountant exam, there are various books available which you can find online or in libraries. Some of the books are as follows:

- JUNIOR ACCOUNTANT GUIDE by M R AGRAWAL

- Business Accounting: An Introduction to Financial and Management Accounting by Jill Collis

Study Resource: Practice Test

After understanding and learning about the Certified Business Accountant exam topics, it is time for practice tests. That is to say, practice tests are important for better preparation as by assessing yourself with these tests you will know about your weak and strong areas. Moreover, you improve your answering skills for getting better results. So, make sure to find the best practice sources.

Prepare for Job Interview

If you are looking for a role as a accounts manager or any accounts related job, then you must checkout these interview questions to fully prepare for the job interview, become job ready with Vskills Interview Questions, checkout now.