A trial balance is a statement of ledger account balances within a Ledger, at a particular instance. It is used to check the mathematical/arithmetic accuracy of accounting books.

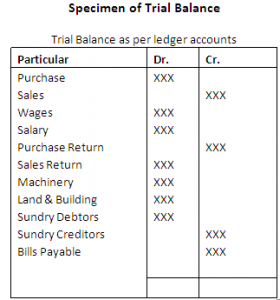

The next step after posting the accounts in the Ledger is to prepare a financial statement, in order to show the debit and credit balances separately. This imply that at the end of the financial year the balance of all the ledger accounts are extracted, and a schedule is prepared to test whether in fact, the total debits equal the total credits. This schedule of balances is called a Trial Balance.

It may also be prepared by listing each and every account and entering in separate columns the totals of the debit and credit sides. Note that whichever way may be adopted to prepare the trail balance, the sum-total of the two columns must always agree. But if the two sides do not match, there is definitely some error or errors.

Reason for the total of the two columns (debit and credit columns) in the trial balance to match

Under the Double Entry System, the amount written to the debit sides of various accounts will always be equal to the amounts entered on the credit sides of other accounts and vice versa. Hence, the total of the debit sides must be equal to the total of the credit sides. Due to such an agreement accounting work is presumably free from error, yet there is no surety of “accuracy”.

Objectives of Preparing the Trial Balance

-Helps in locating error(s).

-Helps to ascertain the arithmetic accuracy of ledger accounts.

-Helps in preparation of final accounts as the financial statements are normally prepared on the basis of the Trial Balance.

-Helps in summarizing the contents of ledger. The ledger may have to be referred only when much detail is required in respect of an account.

Stay Ahead with the Power of Upskilling - Invest in Yourself!

Stay Ahead with the Power of Upskilling - Invest in Yourself!