GAAP Professionals are responsible for governing the world of accounting according to general rules and guidelines. That is to say, it attempts to standardize and regulate the definitions, assumptions, and methods used in accounting across all industries. However, the main motive of GAAP is to ensure a company’s financial statements are complete, consistent, and comparable.

Role of GAAP

- GAAP Professionals helps businesses to maintain consistency in their appearance of financial information.

- It also helps an organization to figure out whether it is making money or not. Moreover, it makes decisions about cash flow.

- GAAP also offers the chance to compare the financial status of the business with similar types of companies.

- Lastly, GAAP guidelines give assurance that the financial statements were prepared using without fraudulent.

Vskills Certified GAAP Professional: Overview

Vskills GAAP Professional certification examines the candidate according to the latest company’s need for compliance with GAAP. Moreover, the certification validates the candidates in various areas. This includes balance sheet presentation, balance sheet presentation, financial instruments, GN (A)-18, and various accounting standards from AS-1 to 7 and AS-9 to 29. Talking about the course, this course is designed for professionals and graduates who want to excel in their chosen areas.

Certification Benefits

Candidates on earning Vskills GAAP Professional Certification will get advantages in today’s competitive job market. As this will increase their chances to get better job opportunities by showcasing their advanced skills, and result in higher earning potential.

The best thing about getting this certification is that GAAP Professionals are in great demand in companies specializing in finance, compliance, or consulting.

Vskills being India’s largest certification providers gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine Shine.com.

Course Outline for Certified GAAP Professional

Certified GAAP Professional covers the following topics –

1. The Conceptual Framework

1.1. Objectives of Financial Reporting

1.2. Characteristics and Limitations of a Financial Report

2. Accounting Standard-1, Disclosure of Accounting Policies

2.1. Indian GAAP on Disclosure of Accounting Policies

3. Accounting Standard-2, Valuation of Inventories

4. Accounting, Standard-3, Cash Flow Statement

4.1. Objective

4.2. Presentation of a Cash Flow Statement

5. Accounting Standard-4, Contingencies and Events Occurring

5.1. Accounting for Events Occurring After the Balance Sheet Date Under AS-4

5.2. Disclosure

6. Accounting Standard-5, Net Profit or Loss for the Period

6.1. Presentation of Income Statement under AS-5

7. Accounting Standard-6, Depreciation

7.1. Accounting for Depreciation Under AS-6

7.2. Depreciation

7.3. Methods of Depreciation

7.4. Change in Method of Depreciation

8. Accounting Standard-7, Construction Contracts

8.1. Accounting for Construction Contracts under AS-7

8.2. Terms Used in AS-7

8.3. Combining and Segmenting Construction Contracts

8.4. Contract Revenue

8.5. Contract Costs

8.6. Recognition of Contract Revenue and Expenses

9. Accounting Standard-9, Revenue Recognition

9.1. Accounting for Revenue under AS-9

9.2. Sale of Goods

9.3. Interest, Royalties and Dividends

9.4. Effect of Uncertainties on Revenue Recognition

9.5. Disclosure

10. Accounting Standard-10, Accounting for Fixed Assets

10.1. Identifying Fixed Assets

10.2. Components of Cost

10.3. Self-constructed Fixed Assets

10.4. Non-monetary Consideration

10.5. Improvements and Repairs

10.6. Retirements and Disposals (derecognition)

10.7. Hire Purchases

10.8. Joint Ownership

10.9. Goodwill

10.10. Disclosure

11. Accounting Standard-11, Changes in Foreign Exchange Rates

11.1. AS-11

11.2. Classification of Foreign Operations as Integral or Non-integral

11.3. Change in the Classification of a Foreign Operation

11.4. Disclosure

12. Accounting Standard-12, Accounting for Government Grants

12.1. Accounting for Government Grants Under the Indian GAAP (AS-12)

12.2. Accounting Treatment of Government Grants

12.3. Recognition of Government Grants

12.4. Non-monetary Government Grants

12.5. Presentation of Grants Related to Revenue

12.6. Presentation of Grants of the nature of Promoters’ contribution

12.7. Refund of Government Grants

12.8. Disclosure

13. Accounting Standard-13, Accounting for Investments

13.1. Accounting for Investments under Indian GAAP

13.2. Forms of Investments

13.3. Cost of Investments

13.4. Investment Properties

13.5. Disposal of Investments

14. Accounting Standard-14, Accounting for Amalgamations

14.1. Accounting for Amalgamation under the Indian GAAP (AS-14)

14.2. Types of Amalgamations

14.3. Methods of Accounting for Amalgamations

14.4. Treatment of Reserves of the Transferor Company on Amalgamation

14.5. Disclosures

15. Accounting Standard-15, Employee Benefits

15.1. Accounting for Employee Benefits

15.2. Short-term Employee Benefits

15.3. Termination Benefits

15.4. Accounting Treatment

15.5. Disclosures

16. Accounting Standard-16, Borrowing Costs

16.1. Accounting for Borrowing Cost in AS-16

16.2. Borrowing Costs

16.3. A Qualifying Asset

16.4. Borrowing Costs Eligible for Capitalisation

16.5. Commencement of Capitalisation

16.6. Disclosure

17. Accounting Standard-17, Segment Reporting

17.1. Segment Reporting Under AS-17

17.2. Accounting Standards Interpretation (ASI 22)

17.3. Allocation

17.4. Primary and Secondary Segment Reporting Formats

17.5. Matrix Presentation

17.6. Business and Geographical Segments

17.7. Identifying Reportable Segments (Quantitative Thresholds)

17.8. Segment Accounting Policies

17.9. Primary Reporting Format

17.10. Secondary Segment Information

17.11. Disclosures

18. Accounting Standard-18, Related Party Disclosures

18.1. Related Party Disclosures

18.2. Accounting Standards Interpretation (ASI)21

18.3. The Related Party Issue

18.4. Disclosure

19. Accounting Standard-19, Accounting for Leases

19.1. Accounting for Lease

19.2. Classification of Leases

19.3. Leases in the Financial Statements of Lessees

19.4. Leases in the Financial Statements of Lessors

19.5. Sale and Leaseback Transactions

20. Accounting Standard-20, Earnings Per Share

20.1. Presentation and Calculation of EPS

20.2. Basic Earnings per Share

20.3. Diluted Earnings Per Share

20.4. Presentation

21. Accounting Standard-21, Consolidated Financial Statements

21.1. Consolidation Principles under AS-21

21.2. Circumstances for Consolidated Financial Statements

21.3. Loss of Control

21.4. Consolidation Procedures

21.5. Cost of Control

21.6. Minority Interest

21.7. Other Points

21.8. Disposal of Holding

21.9. Disclosure

22. Accounting Standard-22 Accounting for Taxes on Income

22.1. Income Taxes Under AS-22

22.2. Recognition

22.3. Measurement

22.4. Review of Deferred Tax Assets

22.5. Disclosure

22.6. Relevant Accounting Standards Interpretations

23. Accounting Standard-23, Accounting for Investments in Associates in Consolidated

23.1. Accounting for Investment in Associates

23.2. Associates Accounted for Using the Equity Method

23.3. Contingencies

23.4. Disclosure

23.5. Relevant Accounting Standards Interpretations

24. Accounting Standard-24, Discounting Operations

24.1. Accounting for Discontinuing Operations under AS-24

24.2. Discontinuing Operation

24.3. Initial Disclosure Event

24.4. Recognition and Measurement

25. Accounting Standard-25, Interim Financial Reporting

25.1. Interim Financial Reporting

25.2. Selected Explanatory Notes

25.3. Periods for which Interim Financial Statements are required to be presented

25.4. Materiality

25.5. Disclosure in Annual Financial Statements

25.6. Accounting Policies

25.7. Revenue Received Seasonally or Occasionally

25.8. Accounting Standards Interpretation (ASI 27): Applicability

26. Accounting Standard-26, Accounting for Intangible Assets

26.1. Accounting for Intangible Assets in AS-26

26.2. Intangible Assets

26.3. Recognition and Initial Measurement of an Intangible Asset

26.4. Separate Acquisition

26.5. Internally Generated Intangible Assets

26.6. Cost of an Internally Generated Intangible Asset

26.7. Items to be Recognised as an Expense

26.8. Amortisation Period

26.9. Retirements and Disposals

26.10. Disclosure

27. Accounting Standard-27, Financial Reporting of Interests in Joint Ventures

27.1. Accounting for Joint Ventures

27.2. Contractual Arrangement

27.3. Forms of Joint Ventures

27.4. Consolidated Financial Statements of A Venturer

27.5. Transactions between a Venturer and Joint Venture

27.6. Disclosures

28. Accounting Standard-28, Impairment of Assets

28.1. Accounting for Impairment Loss under AS-28

28.2. Assessment

28.3. Measurement of Recoverable Amount

28.4. Basis for Estimates of Future Cash Flows

28.5. Composition of Estimates of Future Cash Flows

28.6. Recognition and Measurement of an Impairment Loss

28.7. Identification of the Cash-Generating Unit

28.8. Goodwill

28.9. Corporate Assets

28.10. Impairment Loss for a Cash-Generating Unit

28.11. Disclosure

29. Accounting Standard-29, Provisions, Contingent Liabilities, and Contingent Assets

29.1. AS-29 Provisions, Contingent Liabilities, and Contingent Assets

29.2. Provisions

29.3. Present Obligation

29.4. Reliable Estimate of the Obligation

29.5. Contingent Liabilities

29.6. Contingent Assets

29.7. Future Events

29.8. Expected Disposal of Assets

29.9. Reimbursements

29.10. Changes in Provisions

29.11. Application of the Recognition And Measurement Rules

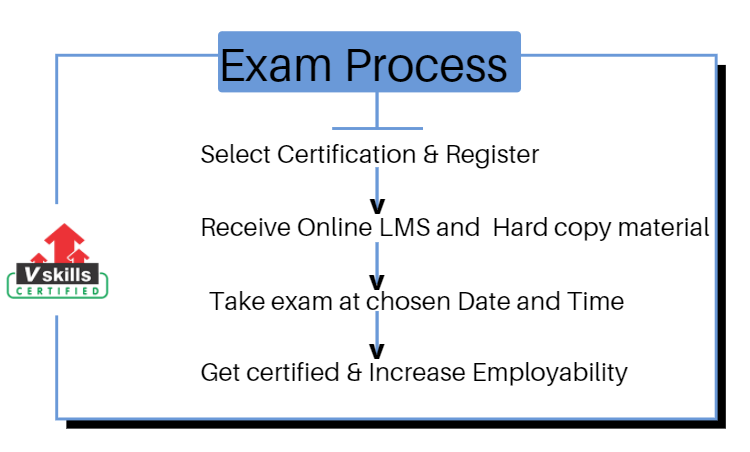

Preparation Guide for Vskills Certified GAAP Professional

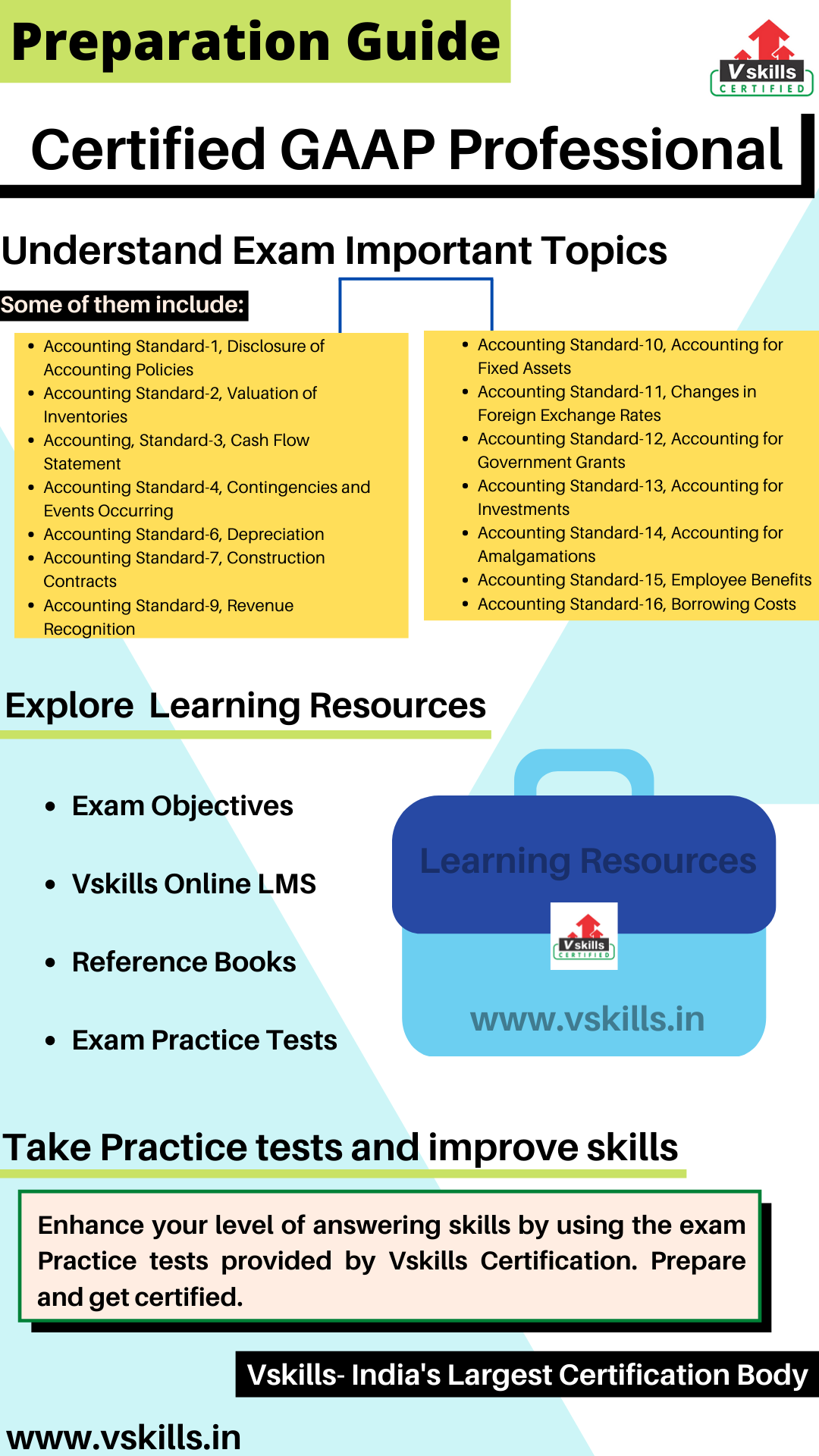

Candidates preparing for the exam should understand the importance of exam resources. During the exam preparation, it is essential to get all the required exam study resources. This will provide an advantage to understand the concepts and meaning more accurately. In the Certified GAAP Professional exam preparation guide, we will discuss some of the most important resources to help you prepare well for the exam.

Study Resource: Exam Objectives

For every examination, the first task should be to get all the exam related details including the important contents and its topic. This will help candidates to easily start preparing for the exam and to understand things more accurately. For the Certified GAAP Professional exam the topics include:

- Accounting Standard-1, Disclosure of Accounting Policies

- Accounting Standard-2, Valuation of Inventories

- Accounting, Standard-3, Cash Flow Statement

- Accounting Standard-4, Contingencies and Events Occurring

- Accounting Standard-6, Depreciation

- Accounting Standard-7, Construction Contracts

- Accounting Standard-9, Revenue Recognition

- Accounting Standard-10, Accounting for Fixed Assets

- Accounting Standard-11, Changes in Foreign Exchange Rates

- Accounting Standard-12, Accounting for Government Grants

- Accounting Standard-13, Accounting for Investments

- Accounting Standard-14, Accounting for Amalgamations

- Accounting Standard-15, Employee Benefits

- Accounting Standard-16, Borrowing Costs

Refer: Certified GAAP Professional Sample Tests

Study Resource: Vskills Online LMS

Vskills Certified GAAP Professional provides candidates access to prepare for the exam using the online learning material for a lifetime. The online material for this is regularly updated. Furthermore, e-learning is bundled with hard copy material which helps candidates to improve and update the learning curve for superior and better opportunities.

Refer: Certified GAAP Professional

Study Resource: Books for Reference

Reference Books can provide an advantage to learn and understand things more accurately. For the Certified GAAP Professional exam, there are various books available which you can find online or in libraries. Some of the books are as follows:

- Wiley GAAP 2020: Interpretation and Application of Generally Accepted Accounting Principles Book by Joanne M. Flood

- GAAP Guide (2020) Book by Jan R. Williams and Joseph V Carcello

Study Resource: Practice Test

After understanding and learning about the Certified GAAP Professional exam topics, it is time for practice tests. That is to say, practice tests are important for better preparation as by assessing yourself with these tests you will know about your weak and strong areas. Moreover, you improve your answering skills for getting better results. So, make sure to find the best practice sources.

Prepare for Job Interview

If you are looking for a role in GAAP Accounting, then you should checkout these interview questions which might help you to ace the job interview. Checkout now !