Cost Accountant manages the reduction of a company’s financial waste and increasing profits. They are responsible for determining the actual costs of manufacturing and preparing the company budget. Vskills Certificate in Cost Accountancy will validate the candidate’s skills and knowledge in various areas which include cost concepts and classification, materials, labour costs, overheads analysis, job order costing, single costing, marginal costing and cost-volume-profit analysis. To understand more about the cost accountancy role, check below.

Roles and Responsibilities of a Cost Accountant

- The Cost Accountant Manager collects all the cost information and maintains an expense database.

- They build data accumulation systems as well as determine fixed costs.

- The cost accountant managers also plan and record variable costs that include purchases of raw material and operations costs.

- Next, they review standard and actual costs for inaccuracies. And, prepare budgeting reports.

- Lastly, they analyze and report profit margins. Moreover, they also prepare cost forecasts and assist in month-end and year-end closing.

Career as a Cost Accountant

A Cost Accountant’s profession is well-known because it encompasses a wide range of responsibilities, including finance management, research, and business growth. Let us dive deeper into Career as a Cost Accountant.

Vskills Certificate in Cost Accountancy: Overview

Nowadays, Cost Accountancy is an essential subject for anyone who wishes to make a career in the area of finance and entrepreneurship. The Vskills Cost Accountancy certification will help candidates to learn about the factors affecting the profits in a business. Moreover, they will also understand the importance of the Cost Control and Cost reduction process for improving profits.

Vskills being India’s largest certification providers gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine Shine.com.

Course Outline

Certificate in Cost Accountancy course covers the following topics –

Introduction to Cost and Management Accounting

- Concepts of Cost Costing

- Costing, Cost Accounting and Cost Accountancy

- Objectives of Cost Accounting

- Importance of Cost Accounting

- Scope of Cost Accounting

- Classification of Costs

- Cost Centre and Cost Unit

- Methods of Costing

- Techniques of Costing

- Installation of a Costing System

- Difference between Financial Accounting and Cost Accounting

- Difference between Financial Accounting and Management Accounting

Material Cost

- Inventory Control (Material Control)

- Objectives of Inventory Control

- Techniques of Inventory Control

- Store-Keeping

- Functions of Store-Keeping

- Method of Pricing of Material Issues

- Accounting of Material Losses

- Control of Material Losses

- Inventory Management

Labour Cost

- Introduction to Labour Cost

- Classification of Labour Cost

- Accounting and Control of Labour Cost

- Time Recording

- Time-Keeping

- Overtime

- Idle Time

- Labour Turnover

- Labour Remuneration System

- Basic Methods of Remuneration System

- Incentive schemes

Direct Expenses and Overheads

- Direct Expenses

- Indirect expenses

- Overheads

- Collection of Overheads

- Classification of Overheads

- Allocation and apportionment of overheads (depart-metallization of overheads)

- Allocation of Overheads

- Apportionment of Overheads

- Absorption of Overheads

- Methods of Absorbing Production Overheads

- Over or Under Absorption Of Overheads

- Treatment of Factory Overheads

- Treatment of Administrative Overheads

- Treatment of Selling And Distribution Overheads

- Control of Overheads

- Preparation of Cost Sheet

Activity Based Costing

- Introduction to Activity Based Costing

- Meaning of Activity Based Costing

- Basics of Activity Based Costing

- Distinction Between Traditional Absorption Costing and Activity Based Costing

- Objectives of Activity Based Costing

- Terminology of Activity Based Costing

- Stages in Developing Activity Based Costing System

- Different Types of Activities

Cost Records

- Introduction to cost records

- Non-Integrated Accounting System

- Advantages of Non-Integrated Accounting

- Limitations of Non-Integrated Accounting

- Integrated (Integral) Accounting System

- Need For Reconciliation

- Causes of Differences

- Preparation of Reconciliation Statement or Memorandum Reconciliation Account

Costing Systems

- Introduction to Costing Systems

- Single/Output/Unit Costing

- Cost Sheet

- Job Costing

- Batch Costing

- Contract Costing

- Process Costing

- Service Costing

Marginal Costing

- Features of Marginal Costing

- Advantages of Marginal Costing

- Limitations of Marginal Costing

- Break-Even Analysis/Cost-Volume Profit Analysis

- Uses of Cost-Volume-Profit Analysis

- Contribution

- Marginal Cost Equation

- Profit-Volume Ratio

- Margin of Safety

- Methods For Determining Break Even Points

- Applications of Marginal Costing

- Composite Break Even Point

- Absorption Costing

- System of Profit Reporting

Standard Costing

- Introduction to Standard Costing

- Definition and Meaning

- Applications of Standard Costing

- Various Types of Standards

- Standard Costing System

- Variance Analysis

- Material Cost Variances

- Material Usage Variance

- Material Mix Variance

- Materials Yield Variance

- Overhead Cost Variances

- Variable Overhead Variance

- Fixed Overhead Variance

Budget, Budgeting and Budgetary Control

Cost Accounting Records and Cost Audit

- Cost Audit

- Purpose of Cost Audit

- Advantages of Cost Audit

- Appointment of Cost Auditor

- Rights and Responsibilities of Cost Auditor

- Implementing Authorities of Cost Audit

- Cost Audit Techniques

- Cost Audit Programme

- Cost Audit Report

Analysis and Interpretation of Financial Statements

- Financial Statements

- Importance of Financial Statements

- Analysis of Financial Statements

- Types of Financial Statement Analysis

- Methods of Analyzing Financial Statements

- Ratio Analysis

- Uses of Ratio Analysis

- Classification of Ratios

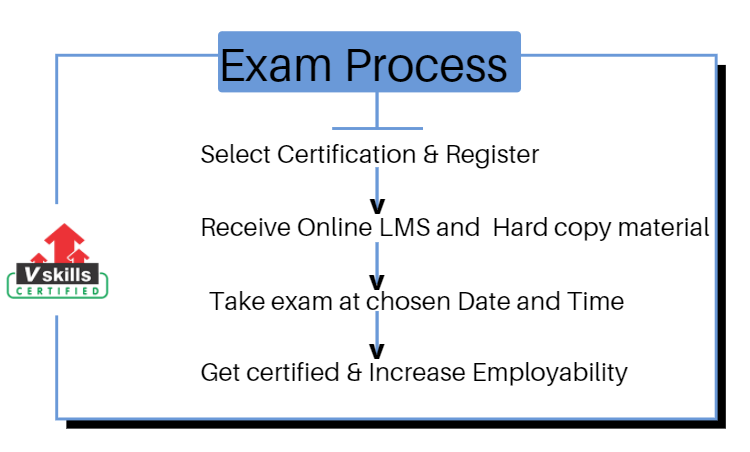

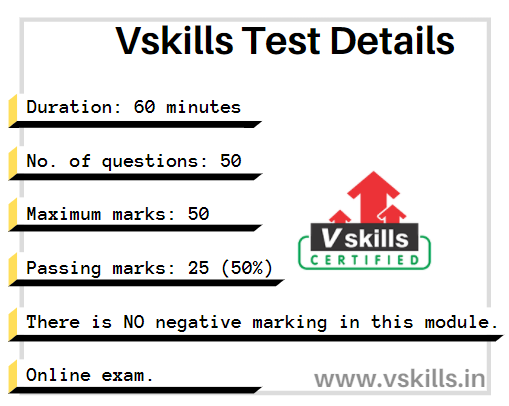

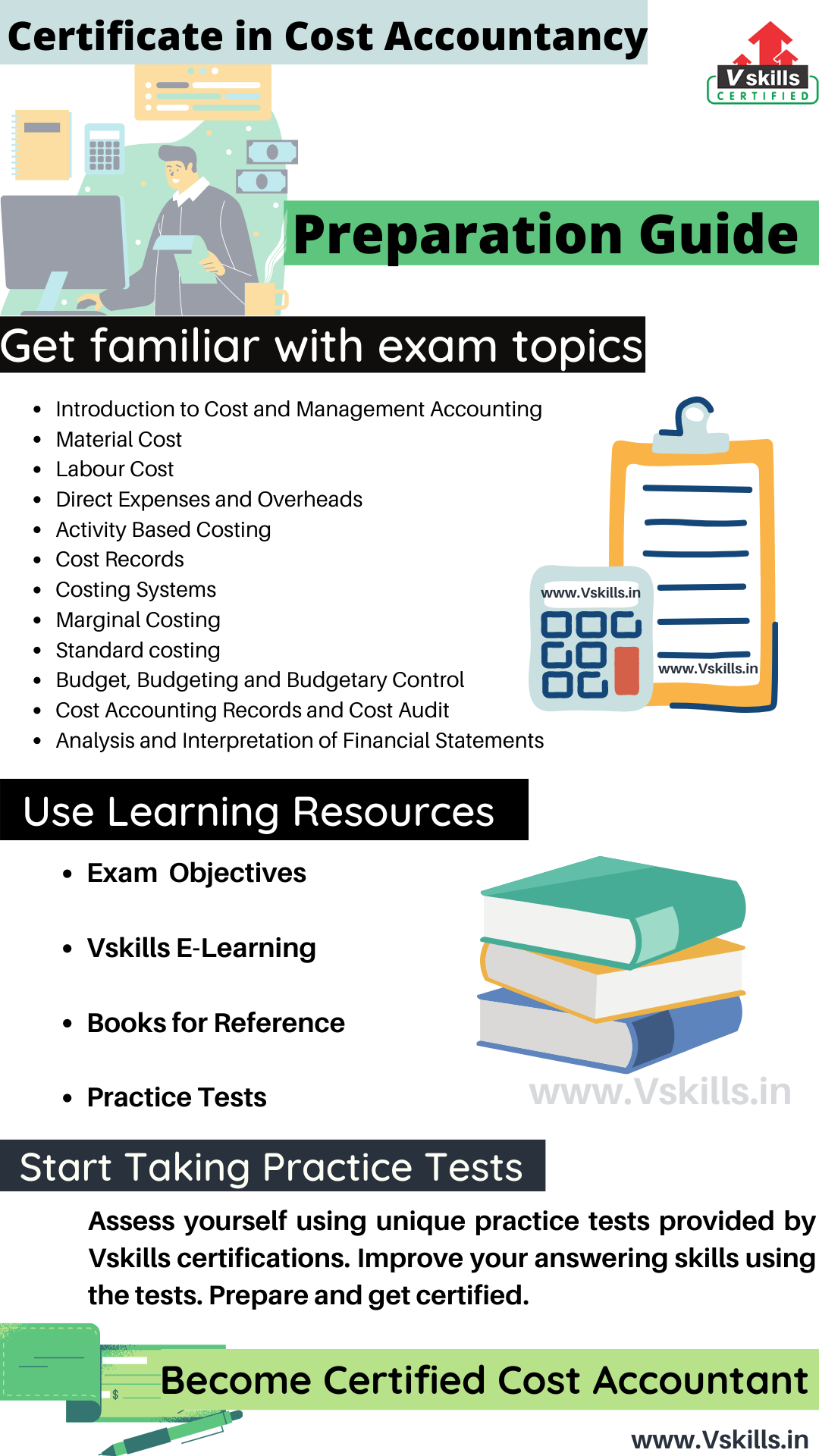

Preparation Guide for Vskills Certificate in Cost Accountancy

Before starting preparing for the examination, candidates should get all the exam related resources. This is done so that the candidates can start preparation in a proper manner. Moreover, doing this will not only help them understand things better but it will also help them to quickly complete the syllabus. Further, this will provide an advantage to better understand the concepts. However, in the Certificate in Cost Accountancy exam preparation guide, we will discuss some of the most important resources to help you prepare well for the exam.

Review Exam Objectives

For any exam, understanding exam objectives provide a huge benefit to candidates during the preparation time. So, before starting preparing, the first task should be to get all the exam-related details that include the important contents and its resources. This will help candidates to easily start preparing for the exam and to understand things more accurately. For the Certificate in Cost Accountancy exam the topics include:

- Introduction to Cost and Management Accounting

- Material Cost

- Labour Cost

- Direct Expenses and Overheads

- Activity-Based Costing

- Cost Records

- Costing Systems

- Marginal Costing

- Standard costing

- Budget, Budgeting and Budgetary Control

- Cost Accounting Records and Cost Audit

- Analysis and Interpretation of Financial Statements

Vskills Online E-Learning

Vskills Certificate in Cost Accountancy provides candidates access to prepare for the exam using the online learning material for a lifetime. The online material for this is regularly updated. Moreover, the e-learning that is provided comes with hard copy material for helping candidates to improve and update the learning curve for getting better opportunities.

Refer: Certificate in Cost Accountancy Sample Chapters

Books for Reference

Reference Books can provide an advantage to learn and understand things more accurately. For the Certificate in Cost Accountancy exam, there are various books available which you can find online or in libraries. Some of the books are as follows:

- Cost Accounting Book by Seema Srivastav

- Cost Accounting and Management Essentials by Vibrant Publishers

Evaluate with Practice Test

After completing the topics for the Certificate in Cost Accountancy exam, candidates should start assessing using practice tests. Using practice tests will help them for better preparation. By assessing yourself with these tests candidates will know about their weak and strong areas. So, prepare well for the certification and get yourself Certified Tag.

Prepare for Job Interview

If you are preparing for a role in cost accounting, then you must checkout these interview questions. The questions are designed by experts to help you to over the job interview obstacle. Checkout now !