Asset Liability Management (ALM)

Asset Liability Management (ALM) is a critical component of financial risk management that involves managing the risk associated with a financial institution’s assets and liabilities.

ALM aims to ensure that the institution has sufficient assets to cover its liabilities, both in terms of their timing and size, while also optimizing the institution’s overall profitability and risk profile.

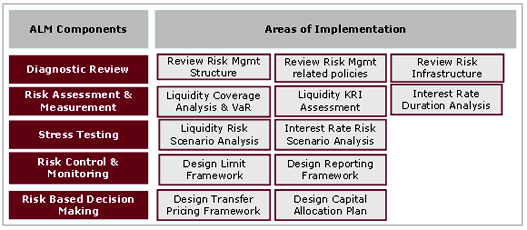

The process of ALM involves identifying, measuring, monitoring, and managing the various risks associated with the institution’s assets and liabilities, including interest rate risk, credit risk, liquidity risk, and market risk.

To effectively manage these risks, financial institutions use a range of tools and techniques, such as cash flow matching, duration matching, gap analysis, stress testing, and scenario analysis.

By implementing a robust ALM framework, financial institutions can ensure that they are well-positioned to withstand adverse market conditions and changes in the interest rate environment, while also delivering sustainable returns to their shareholders.

Asset liability management is an approach whose detailed formulation varies from company to company. It is an integral part of planning process of commercial banks and may be considered as one of the three principal components of a planning system. It is short-term in nature focusing day to day, week to week balance sheet management to achieve near term financial goals. Corporations have to continually adjust assets and liabilities both by varying the terms they offer to constituents and trading in financial markets.

The management of both assets and liabilities is pursued not merely for growth but with greater concern for asset quality, profitability and capital ratios.

Apply for Financial Risk Management Certification Now!!

https://www.vskills.in/certification/certificate-in-financial-risk-management