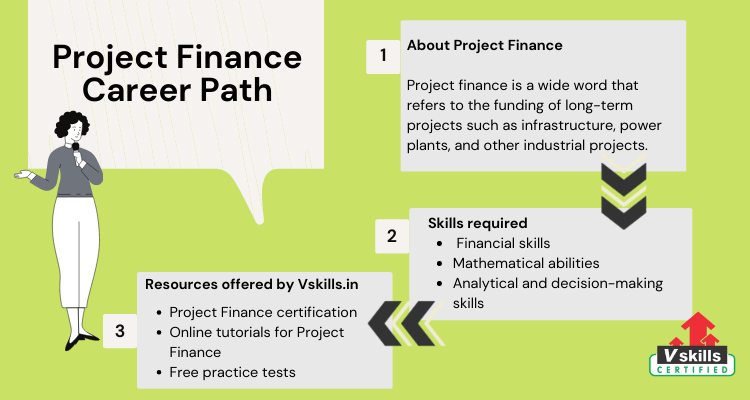

Project finance is a wide word that refers to the funding of long-term projects such as infrastructure, power plants, and other industrial projects. Finance professionals’ responsibilities have expanded beyond standard accounting and reporting tasks in recent years.

Let us know about Project Finance Career Paths!

About Project Finance

Project finance jobs are positions in the field of long-term financial control and management of infrastructure and industrial projects, such as raising funds, negotiating contracts with suppliers, producing project finance, and assessing project feasibility and profitability.

Roles and Responsibilities of Project Finance Analyst

There are numerous responsibilities of Project Finance Analyst, as stated below –

- Firstly, to prepare a finance report which requires careful analyses of cost & revenue drivers market trends, interest rates etc.

- Secondly, to perform financial forecasting and reporting and adding operational metrics trading

- Also, Analysis of financial data and design financial models for the decision-making process.

- Then, Proper analysis of past results, performance analysis

- One of the primary significant responsibilities is to keep the track of trends and identify them.

- Also, give proper recommendations after analysis

- Finally, give proper cost analysis process by introducing policies and procedures

Eligibility

One of the first things to consider if you want to work as a project finance analyst is how much schooling you’ll need. A bachelor’s degree is held by 71.3 percent of analysts, according to a research. In terms of higher education, master’s degrees are held by 17.1 percent of analysts. Despite the fact that most project finance analysts have a college diploma, it is feasible to work as one with only a high school diploma or a GED.

Job Roles

Advisory – Professionals in this field advise customers on the finances to be utilized in large investments. If you are hired as an Advisor in a Project Finance Group, your primary responsibility will be to deal with customers.

Managers – Managers in this profession are responsible for leading a team of people. You must have 3-5 years of experience working as an analyst, creating a detailed model of a company’s structure. You will be required to complete all essential tasks, such as gathering information, developing the projection model, finishing the structure, and so on, in order to fulfil the clients’ financial or funding requirements.

Skills Required

- Three to five years of professional experience in infrastructure project finance, typically gained in a project finance bank or a business house specializing in project development and financing.

- Should be able to evaluate new ideas, define project scope and description, and conduct feasibility studies to establish the financial sustainability of new enterprises, including cash flow projections and growth prospects.

- Should be able to prepare, monitor, and assure cash flows, fund flows, Profitability Statements, IRRs, Payback periods, DSCRs, predicted profitability, and other financial parameters/reports in order to assess inflow/outflow of money and profits/surplus as a consequence.

Salary Insights

Project Finance Jobs are still in great demand; wages vary depending on the job, function, and years of experience, but these are still well-paid occupations when compared to other fields in finance. Senior project finance experts at big investment banks can make up to $200,000.

Many employees had received seven-figure bonuses as a result of their efforts. The directors receive a median salary of $100,000 in the energy sector, with a bonus of usually 100%. Assistant director wages average $70,000 per year, with an average bonus of 80%.

Scope

Because this sector is still in high demand, numerous firms offer these positions. Various infrastructure companies, energy and power companies, large investment banks, steel companies, oil and gas companies, and other companies that require a disproportionately large amount of funds for their projects in comparison to other sectors or companies are looking for professionals in this field.

Project finance professionals, on average, enjoy a similar or better work-life balance than those in investment banking or traditional consulting, although it varies greatly depending on the business. Hours average from 50 to 60 per week, but can increase to 70 to 80 per week if a live transaction necessitates it.

Resources for Project Finance

Before you can become an expert in desired areas, you must first build a solid base. Before you can move on to practical teaching, you’ll need to have the right applied skills. To gain better understanding of the domain, you can use the following tools:

- Firstly, Online Tutorials for learning Project Finance

- Also, Certification Courses from verified sources such as Vskills, Coursera, Udemy and so on.

- In addition, Online communities

- Moreover, Blogs and study material from experts in this field and many more.

Here are some examples of how you can improve your abilities:

- Freelancing

- Internships

- Apprenticeship programs

The above steps will help you to get this domain started. It’s a long way to go, however. You can take an advanced course to reach a new level of skills.

Some resources offered by Vskills

Vskills offer Project Finance Analyst certification for all those interested in working in this field or in advancing their career. This certification course covers the following objectives –

- Firstly, Project Identification and Feasibility

- Secondly, Market, Technical, Financial, and Economic Appraisal

- Financing Capital Structure

- Also, Choice of Securities and Guidelines for their Issue

- Then, External Commercial Borrowing and Euro-Issues

- Venture Capital

- Finally, Lease, and Working Capital Finance

Vskills also offers free practice tests and online tutorials to supplement the learning process. You can check them by clicking on the following links –

Discover the career opportunities and other prospects of Career in Project Finance. Hurry up and start preparing now with Vskills.in!