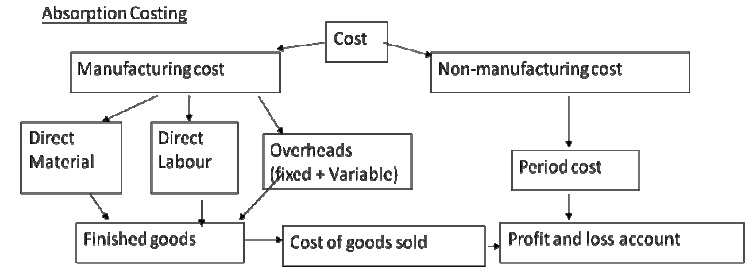

Absorption costing is a costing technique that includes all manufacturing costs, in the form of direct materials, direct labour, and both variable and fixed manufacturing overheads, while determining the cost per unit of a product.

In the context of costing of a product/service, an absorption costing considers a share of all costs incurred by a business to each of its products/services. In absorption costing technique; costs are classified according to their functions. The gross profit is calculated after deducting production costs from sales and from gross profit, costs incurred in relation to other business functions are deducted to arrive at the net profit. Absorption costing gives better information for pricing products as it includes both variable and fixed costs.

Absorption costing technique absorbed fixed manufacturing overhead into the cost of goods produced and are only charged against profit in the period in which those goods are sold. In absorption costing income statement, adjustment pertaining to under or over-absorption of overheads is also made to arrive at the profit. Absorption costing is a simple and fundamental method of ascertaining the cost of a product or service.

It is based on sharing of all indirect costs and direct cost to cost units/cost centers. Following chart shows the ascertaining the profit under absorption costing:

Stock Valuation

Finished goods inventories are over-stated in absorption costing as it includes one more cost element in inventory value than under variable costing, i.e. the fixed manufacturing cost.

Inventory value under absorption costing

= Direct material + direct labour + variable manufacturing costs + Fixed manufacturing costs

| Absorption costing | Marginal costing |

| Fixed production overheads are charged to the product to be subsequently released as a part of goods sold i.e., it is included in cost per unit | Fixed production costs are regarded as period cost and are charged to revenue along with the selling and administration expenses, i.e., they are not included while computing cost per unit. |

| Profit is the difference between sales and cost of goods sold. | Profit in marginal costing is ascertained by establishing the total contribution and then deducting therefore the total fixed expenses. Contribution is the excess of sales over variable cost. |

| Costs are seldom classified into variable and fixed. Although such a classification is possible, it fails to establish a cost-volume profit relationship. | Cost-volume profit relationship is an integral part of marginal costing studies. Costs have to be classified into fixed costs and variable costs. |

| If inventories increase during a period, this method will reveal more profit than marginal costing. When inventories decrease, fewer profits are reported because under this method closing stock is valued at higher figures. Since inventories are valued at total cost, a portion of fixed overheads are also included in inventories. | If inventories increase during a period, this method generally reports less income than absorption costing; but when inventories decrease this method reports more net income. The difference in the net income is due to difference in accounting for fixed manufacturing costs as compared to inventory valuation. |

| Arbitrary apportionment of fixed costs may result in under or over recovery of overheads. | Since fixed costs are excluded, there is no question of arbitrary apportionment of fixed overheads and thus under or over absorption of overheads. |

Income Measurement under Marginal Costing and Absorption Costing

Under marginal costing, only factory overheads costs that tend to vary with volume are charged to product cost in addition to prime cost. While evaluating inventory only direct materials, direct labour and variable factory overhead are included and are considered as product costs. Fixed factory overhead under direct or marginal costing is not included in inventory. It is treated as a period cost and charged against revenue when incurred. Under absorption costing, sometimes called full or conventional costing, all manufacturing costs, both fixed and variable are charged to product costs. Thus Absorption costing is “a principle whereby fixed as well as variable costs are allotted to cost units”. It means a system under which cost per unit includes fixed expenses, especially fixed production overheads in addition to the variable cost.

Profit emerges only after charging all costs minus fixed and variable. In marginal costing also this is true; only profit is ascertained by charging the fixed expenses costs to contribution.

Contribution is the difference between selling price and marginal costs. Fixed costs are written off against contribution during the period. Thus:

Selling price −Variable cost = Contribution

Contribution −Fixed costs = Profit

If profit and fixed costs are known,

Fixed costs + Profit = Contribution

This gives us a basic marginal equation:

Sales −Marginal costs = Contribution = Fixed costs + Profit (if there is a profit) or Sales = Marginal costs + Fixed costs + Profit.

Since the closing stocks do not have any element of fixed costs, profit shown by marginal costing technique may be different from that shown by absorption costing. When the entire stock is sold, there is no inventory i.e., neither there is opening nor closing stock, the profit revealed by both the methods will be same. But when sales and production are out of balance, difference in net profit is reported. When absorption costing is applied, the fixed manufacturing costs are shifted from one year to another year as a part of the inventory cost i.e. stock. If a company produces more than it sells in a given period, not all of the current manufacturing overheads will be deducted from sales i.e., closing stock will include a portion of fixed overheads. In other words, in absorption costing inventory will be valued at a higher figure; therefore, profit will be more as revealed by absorption costing than marginal costing. Hence, profits will not necessarily increase with an increase in sale value. The position will be reverse, in case a company produces less than it sells in a given period. Thus, marginal costing can produce a net profit figure which is similar than or greater than or equal to the net profit as shown under absorption costing.

An example illustrating the variations in the results obtained under the two methods is given below:

The basic production data are:

Normal volume of production = 19,500 units per period

Sale price – 4 per unit

Variable cost – 2 per unit

Fixed cost – 1 per unit

Total fixed cost = 19,500 (1 x 19,500 units, normal)

Selling and distribution costs have been omitted.

The opening and closing stocks consist of both finished goods and equivalent units of work-in-progress.

The profit and loss calculated under the two methods for the various periods are as follows:

| Period I | Period II | Period III | Period IV | Total | |

| Opening stock units Production units Sales units Closing stock units | —- 19,500 19,500 —- | —– 22,500 18,000 4,500 | 4,500 18,000 21,000 1,500 | 1,500 22,500 24,000 | —- 82,500 82,500 —- |

| Marginal Costing Method | |||||

| Sales Direct cost Opening stock @2 per unit Variable cost @ 2 per unit Closing stock @ 2 per unit Cost of goods sold Contribution Fixed cost Profit | 78,000 – 39,000 – 39,000 39,000 19,500 19,500 | 72,000 – 45,000 9,000 36,000 36,000 19,500 16,500 | 84,000 9,000 36,000 3,000 42,000 42,000 19,500 22,500 | 96,000 3,000 45,000 – 48,000 48,000 19,500 28,500 | 3,30,000 – 1,65,000 – 1,65,000 1,65,000 78,000 87,000 |

| Absorption Costing Method Sales Opening stock @ 3 per unit Cost of production @ 3 per unit Less: Cost of closing stock @ 3 per unit Cost of sales (actual) Less: Over-absorbed fixed cost Add: Under-absorbed fixed cost Profit | 78,000 – 58,500 – 58,500 – – | 72,000 – 67,500 13,500 54,000 3,000 – | 84,000 13,500 54,000 4,500 63,000 – 1,500 | 96,000 4,500 67,500 – 72,000 3,000 – | 3,30,000 – 2,47,500 – 2,47,500 6,000 1,500 |

| 19,500 | 21,000 | 19,500 | 27,000 | 87,000 |

The above example reveals the following features:

- Since there is no opening or closing stock in the accounting period I, the profit under the marginal costing and absorption costing methods is the same. Production being at the normal level, there is no under or over-absorption of the fixed costs under the absorption costing method. Marginal costing does away with the problem of over-absorption or under-absorption of fixed overheads.

- In the accounting period II, the marginal costing method shows a profit of 16,500 and as against this, the absorption costing method shows profit of 21,000. Under the absorption costing method, a portion of the fixed cost, instead of being charged against the profit for the period is charged to the closing stock and carried over to the next period.

- In the accounting period III, the profit calculated in absorption costing is less than that of marginal costing. This is because when sales exceeds output, a portion of the fixed cost carried over as part of the opening stock under absorption costing, is charged to the product sold in the current period.

- In the accounting period IV, the profit shown under the absorption costing system is lesser than under the marginal costing system. This is because the fixed cost pertaining to the opening stock of 1,500 units now sold is brought over to the current accounting period.

- In the long run when sales and output tend to equate, there is no difference or very little difference in the results under the two methods. In the example above the net profit for the four accounting periods taken together are the same under both the methods.

The relationship shown above may be summarized as follows:

- When output is equal to sales i.e. with no opening or closing stock the profit under absorption costing and marginal costing is equal;

- When output is less than sales i.e. closing stock is less than opening stock, the profit under marginal costing is greater than the profit under absorption costing;

- When output is greater than sales i.e. closing stock is more than the opening stock, the profit under the marginal costing is less than the profit under absorption costing.

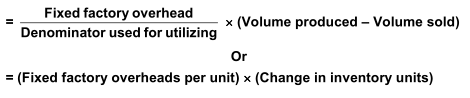

The differences between the profits revealed by absorption costing and marginal costing can be computed with the help of the following formula:

Analysis regarding the net operating income under absorption costing and marginal costing presented above, although often correct, is not universally valid.

The net operating income under both the methods of costing can be analyzed in relation to four methods of inventory costing: Average costing, FIFO, LIFO and standard costing. This would show that the usual generalizations about full and direct costing hold good only under the LIFO and standard costing methods. Further, under the LIFO and the average costing methods, the results are more complex than those considered by the usual generalizations which therefore do not apply.

In absorption costing the effects of sales and production are combined, in marginal costing on the other hand, the emphasis is placed on sales. The cost of one unit of product manufactured is not affected due to the changes in the level of activities. The variable costs of a unit are assumed to remain constant over certain ranges of output though both unit variable costs and total fixed cost may change at certain levels of production. The data used for marginal costing applied to a range of output at which variable costs and total fixed costs are relatively constant. Variable costs serve as a useful tool in bringing out relationships between price, cost and volumes. But reliance on variable costing system may make the management think that the company can operate profitably at low contribution margin, only to find that profit does not come up to expectations.

Selling below the normal price may help on short term but in the long run this may result in margins that are not sufficient in relation to resources invested. Thus, both costing method can be useful when applied to appropriate circumstances.

Illustration 17

A company makes and sells a single product. At the beginning of period 1, there is no opening stock of the product, for which the variable production cost is 4 and the sale price is 6 per unit. Fixed costs are 2,000 per period of which 1,500 are fixed production costs.

The following details are available:

Period 1 Period 2

Sales 1,200 units 1,800 units

Production 1,500 units 1,500 units

What would be the profit in each period using –

- Absorption costing. (Assume normal output is 1,500 units per period); and

- Marginal costing?

Solution:

(a) Absorption Costing Method

The absorption rate for fixed production overhead is:

units = 1 per unit

| Period 1 | Period 2 | Total | ||||

| Sales Production costs Variable @ 4 Fixed @ 1 5 Add: Opening stock Less: Closing stock (300 units @ Rs.5) Production cost of sales Other costs Total cost of sales | 6,000 1,500 7,500 – 7,500 1,500 6,000 500 | 7,200 6,500 | 6,000 1,500 7,500 1500 9,000 9,000 500 | 10,800 9,500 | 12,000 3,000 15,000 – 15,000 1,000 | 10,800 16,000 |

| Profit | 700 | 1,300 | 2,000 |