| Traditional Absorption Costing | Activity Based Costing | ||||

| Overheads are first related to departments cost centers (Production and Service Cost Centers) | Overheads are first related to activities or grouped into Cost Pools. | ||||

| Only two types of activities viz. Unit Level Activities and Facility Level Activities are identified. | All levels of activities in the manufacturing cost hierarchy viz. Unit Level, Batch Level, Product Level and Facility Level are identified. | ||||

| This method relates overheads to cost centers i.e. locations. It is not realistic of the behavior of costs. | This method relates overheads to the causal factor i.e. driver. Thus, it is more realistic of cost behavior. | ||||

| Overhead Rates can be used to ascertain cost of products only. | Activity Cost Driver Rates can be used to ascertain cost of products and also cost of other cost objects such as customer segments, distribution channels. etc. |

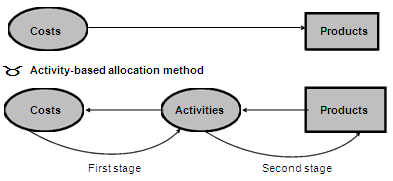

We can summaries the main difference between ABC and traditional costing by following picture:

Traditional allocation method