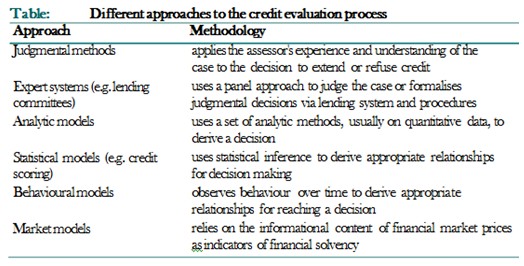

It is important to study the credit to be rendered in order to determine its quality that is the counterparty’s creditworthiness. This is an obligor’s ability and willingness to honour its agreement with the party extending the credit. To determine the status of the counterparty, credit analysts use a blend of financial/accounting data, non-financial variables, and different analytical tools. Some methods involve a subjective approach, such as judgmental methods. Others are more systematic as they use quantitative techniques to measure a credit against objective benchmarks. There are a number of different approaches and underlying methodology. These are laid out in the table below.

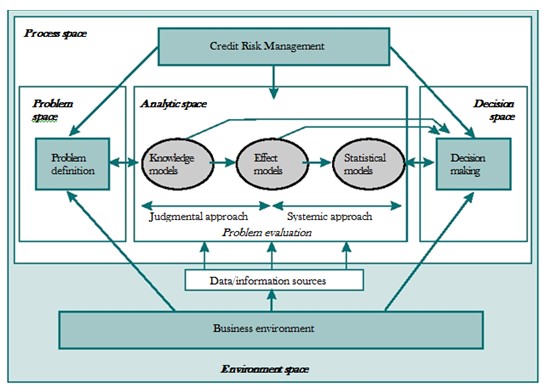

One method to characterise the credit risk management process is shown in the following figure. The schematic needs to be worked as a continuum from left to right. The first step is to define the problem, where this is simply a no-default/default variable. In certain systems, it might be more complicated as the manager may prefer to monitor and evaluate changes in credit quality, and not simply non-performance.

No matter how the problem is defined, the problem is then analysed.The various methods given in the above table can be mapped into the analytic space using data from the business environment such as company reports, news reports etc. The different analytical approaches can be categorized into:

- knowledge models- these have a degree of subjectivity (use of expert judgment by an analyst)

- effect models – these combine some elements of subjectivity and systemic analysis; ratio analysis would fall into this category

- statistical models – these can be considered more systemic in approach (credit scoring models are of this kind). The results of the analysis are then used in the decision space, namely to reach a decision whether to grant, or not grant, credit.

The main method of classifying credit risk is to undertake financial investigation in order to measure the probability of default. Because the analysis of credit worthiness is a complex multidimensional procedure, the probability is often not generally expressed as a probability but as an opinion instead. The process can be divided into two principal areas:

- qualitative assessments

- quantitative assessments

These are then often used together to produce an accurate credit assessment, where the two are usually carried out in parallel. Insights obtained from one aspect of the investigation leads to investigation in the other. While the various approaches are used to assess credit quality, they are often used as a combination in the decision-making process.