The traditional approach to credit analysis calls for assessing a prospective customer in terms of the ‘5Cs of credit’

- Character: The willingness of the customer to honour his obligations. It reflects integrity, a moral attribute that is considered very important by credit managers.

- Capacity: The ability of the customer to meet credit obligations from the operating cash flows

- Capital: The financial reserves of the customer. If the customer has difficulty in meeting his credit obligations from its operating cash flows, the focus shifts to its capital.

- Collateral: The security offered by the customer in the form of pledged assets

- Conditions: The general economic conditions that affect the customer

A firm may rely on the following sources to obtain information on the 5Cs.

- Financial Statements: provide useful insights into the creditworthiness of the Ratios such as current ratio, acid-test ratio, debt-equity ratio, EBIT to total assets ratio and return on equity

- Bank References: To ensure higher degree of candour, the customer’s banker may be approached indirectly through the bank of the firm granting credit.

- Experience of the firm: If the firm had previous dealings with the customer, then it is worth: How prompt has the customer been in making payments? How will has the customer honoured his word in the past? Where the customer is being approached for the first time, the impression of the company’s sales personnel is useful.

- Prices and Yield on securities: Higher the price earnings multiple and lower the yield on bonds, other things being equal, lower will be the credit risk.

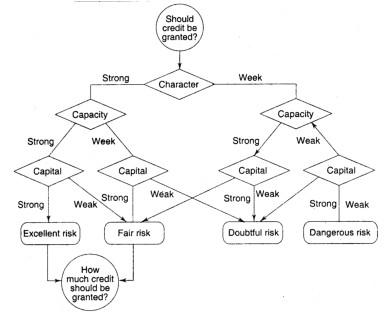

For the sake of simplicity, only 3Cs namely Character, Capacity and capital are considered. For judging a customer on these dimensions, the credit analyst may use quantitative measures (like financial ratios) and qualitative assessments ( like ’trustworthy’)

Stay Ahead with the Power of Upskilling - Invest in Yourself!

Stay Ahead with the Power of Upskilling - Invest in Yourself!