Once the component costs have been calculated, they are multiplied by the weights of the various sources of capital to obtain a weighted average cost of capital (WACC). The composite, or overall cost of capital is the weighted average of the costs of various sources of funds, weights being the proportion of each source of funds in the capital structure. It should be, remembered that it is the weighted average concept, not the simple average. Which is relevant in calculating the overall cost of capital. The simple average cost 0\ capital is 80t appropriate to use because firms hardly use various sources of funds equally in’ the capital structure. The following steps are used to calculate the weighted average cost of capital:

- To calculate the cost of the specific sources of funds (i.e., cost of debt, cost of equity, cost of preference capital etc.)

- To multiply the cost of each source by its proportion in the capital structure.

- To add the weighted component costs to get the firm’s weighted average cost of capital.

In financial decision-making, the cost of capital should be calculated on an after-tax basis. Therefore, the component costs to be used to measure the weighted cost of capital should be the after-tax costs. If we assume that a firm has only debt and equity in its capital structure, then its weighted average cost of capital (ko) will be:

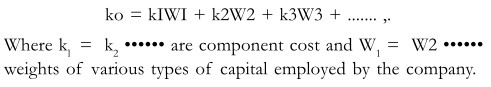

Where ko is the weighted average cost of capital, kd (1 – T) and ke are respectively the after-tax cost of debt and equity, D is the amount of debt and S is the amount of equity. In a general form, the formula for calculating W ACC can be written as follows: