Diversifiable risk is the part of total risk that is specific to the company or industry and hence can be eliminated by diversification. This is also known as unsystematic risk or specific risk. Factors causing such risk are management capability, consumer preferences, and labour strikes. These factors affect one firm and they must be examined for each firm.

Unsystematic Risk

The uncertainty surrounding the ability of the issuer to make payments on securities has two sources (i) the operating environment of the business and (ii) the financing of the firm.

They are

Business Risk: is a function of the operating conditions faced by a firm and the variability these conditions inject into operating income and expected dividends. The degree of variation from the expected trend would measure business risk.

Business risk can be divided into two categories. They are:

- External business risk is the result of operating conditions imposes upon the firm by circumstances beyond its control.

- Internal business risk is largely associated with the efficiency with which a firm conducts its operations within the broader operating environment imposed upon it.

Financial risk: is associated with the way a firm finances its activities. By engaging in debt financing, the firm changes the characteristics of the earnings stream available to the common stock holders, as interest on debt is paid before dividend payment.

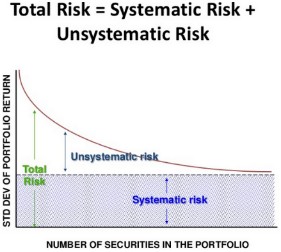

The relationship between total risk, diversifiable risk and non-diversifiable risk is given by the equation

Total risk = Diversifiable risk + Non-diversifiable risk.

Diversifiable risk can be eliminated by holding large enough portfolios of securities, the only relevant risk to be considered is non-diversifiable risk. Non-diversifiable risk is unavoidable, and each security possesses its own level of non-diversifiable risk, measured using the beta coefficient.