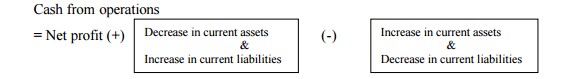

In the Net Profit Method, the cash from operations is determined by adding the net profit with the increase in current assests or decrease in current liabilities, and subtracting the increase in current assets or decrease in current liabilities.

Ascertainment of cash from operations based on the net profit of the business is called as Net Profit Method. Under this method, cash from operations is calculated as under:

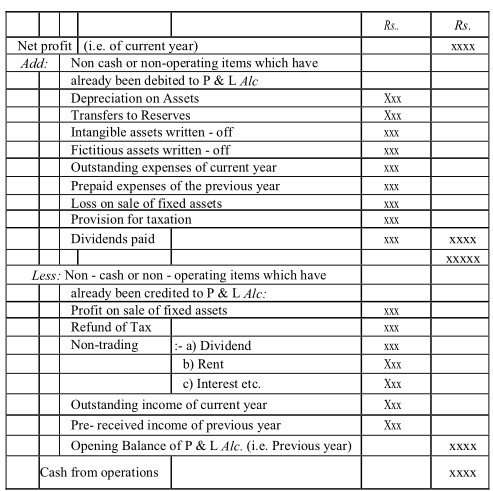

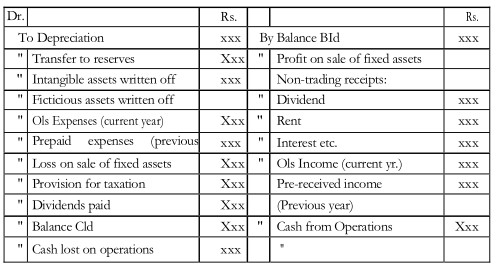

Alternatively,

Adjusted Profit and Loss A/c

Important useful points to be noted while calculating cash from operations under the method:

- Outstanding Expenses: Outstanding Expenses are those expenses which are due to be paid. They are charged, to profit and loss a/c but no cash is paid in this respect during the current year. Hence, they are added back while calculating the cash from operations. However, if any expenses of the previous year are given, they may be assumed to have been paid during the year and are shown as the outflow of cash in the cash flow statement.

- Prepaid Expenses: Are the expenses of the next or subsequent accounting year paid in the current account year or expenses paid in advance. These expenses are not charges to profit and loss a/c. Hence, they are shown as outflow of cash in the cash flow statement. However, if there are prepaid expenses (previous year) given, they are paid in the last or previous accounting year for the current accounting year, and as such they are added back while ascertaining cash from operation.

- Outstanding or Accrued Income: It is an income due to be received, it is credited to profit and loss account but no cashes received. Hence, it is deducted from sources from these However, if there is any outstanding income relating to previous year is given, it may be assumed to have been received during the year and shown as inflow of cash in the cash flow statement.

- Pre-received Income: It is the income received in advance. If there is any pre-received income in the current year, it is shown as inflow of cash in cash flow statement. However, if there is any pre-received income (in previous year), it is deducted from sources from operations while ascertaining cash from operations.

Proceeds from Sale of Fixed Assets: Amount received from the sale fixed assets or investments results in the in (low of cash. Hence, it is shown as inflow of cash in cash flow statement.

Issue of Shares or Debentures: When the shares or debentures are issued for cash, there is inflow of cash. As such, it is shown as inflow of cash in the cash flow statement.

Raising of Loans: When the money is borrowed from financial institutions in terms loans or cash credits, it amounts to inflow of cash. As such, it is shown as inflow of cash in the cash flow statement.