‘The bottom line’ that is management, focuses on short term for decision making, investment in brands, in R&D and in capacity may well be curtailed if there is no prospect of an immediate payback. Strong positive cash flow (second financial dimension) has become as much a desired goal of management as profit. The third financial dimension to decision making is resource utilization and specifically the use of fixed and working capital. To improve the productivity of capital ROI can be used. Return on investment is the ratio between the net profit and the capital that was employed to produce that profit, thus:

This ratio can be further expanded,

= Margin x Capital turnover/Asset turnover

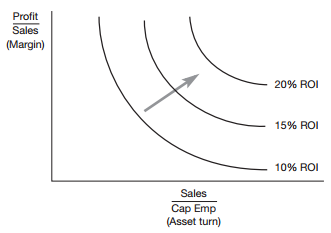

To gain improvement on ROI one or other, or both, of these ratios given above must increase. Many companies will focus their main attention on the margin to increase ROI, yet it can be more effective to use the leverage of improved capital turnover to boost ROI. For example, many successful retailers have long since recognized that very small net margins can lead to excellent ROI if the productivity of capital is high, e.g. limited inventory, high sales per square foot, premises that are leased rather than owned and so on.

Figure below illustrates the opportunities that exist for boosting ROI through either achieving better margins or higher assets turns or both. Each ‘iso-curve’ reflects the different ways the same ROI can be achieved through specific margin/asset turn combination. The challenge to logistics management is to find ways of moving the iso-curve to the right.

Figure : The impact of margin and asset turn on ROI

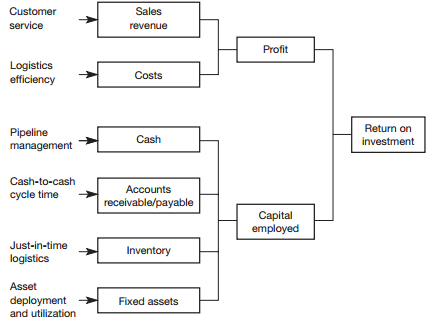

The ways in which logistics management can impact on ROI are many and varied. Figure below highlights the major elements determining ROI and the potential for improvement through more effective logistics management.

Figure : Logistics impact on ROI