Demand forecasting is the activity of estimating the quantity of a product or service that consumers will purchase. Demand forecasting involves techniques including both informal methods, such as educated guesses, and quantitative methods, such as the use of historical sales data or current data from test markets. Demand forecasting may be used in making pricing decisions, in assessing future capacity requirements, or in making decisions on whether to enter a new market.

Planning is an integral part of a manager’s job. Forecasts help managers by reducing some of the uncertainty in planning. A forecast is a statement about the future value of a variable such as demand.

Features of Forecasting

- Forecasting in concerned with future events.

- It shows the probability of happening of future events.

- It analysis past and present data.

- It uses statistical tools and techniques.

- It uses personal observations.

Importance of Forecasting

- Forecasting provides relevant and reliable information about the past and present events and the likely future events. This is necessary for sound planning.

- It gives confidence to the managers for making important decisions.

- It is the basis for making planning premises.

- It keeps managers active and alert to face the challenges of future events and the changes in the environment.

Disadvantages of Forecasting

- The collection and analysis of data about the past, present and future involves a lot of time and money. Therefore, managers have to balance the cost of forecasting with its benefits. Many small firms don’t do forecasting because of the high cost.

- Forecasting can only estimate the future events. It cannot guarantee that these events will take place in the future. Long-term forecasts will be less accurate as compared to short-term forecast.

- Forecasting is based on certain assumptions. If these assumptions are wrong, the forecasting will be wrong. Forecasting is based on past events. However, history may not repeat itself at all times.

- Forecasting requires proper judgment and skills on the part of managers. Forecasts may go wrong due to bad judgment and skills on the part of some of the managers. Therefore, forecasts are subject to human error.

Forecasting Accuracy

A forecast error is the difference between the actual or real and the predicted or forecast value of a time series or any other phenomenon of interest.

In simple cases, a forecast is compared with an outcome at a single time-point and a summary of forecast errors is constructed over a collection of such time-points. Here the forecast may be assessed using the difference or using a proportional error. By convention, the error is defined using the value of the outcome minus the value of the forecast.

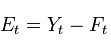

The forecast error is the difference between the actual value and the forecast value for the corresponding period.

Where E is the forecast error at period t, Y is the actual value at period t, and F is the forecast for period t.

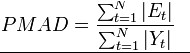

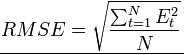

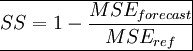

Measures of aggregate error are

| Error | Formulae |

| Mean absolute error (MAE) | |

| Mean Absolute Percentage Error (MAPE) | |

| Mean Absolute Deviation (MAD) | |

| Percent Mean Absolute Deviation (PMAD) |  |

| Mean squared error (MSE) or Mean squared prediction error (MSPE) | |

| Root Mean squared error (RMSE) |  |

| Forecast skill (SS) |  |

| Average of Errors (E) | |

Various methods are used for forecasting which can be classified on the basis taken for forecasting and are as

Qualitative assessment Prediction Methods

These are forecasting methods based on expert opinion and includes –

- Personal Insight

- Panel Consensus

- Delphi technique

- Market Surveys

- Scenario Analysis

- Forecast by Analogy or Historical Analogy

Quantitative Data Prediction Methods

- Extrapolation

- Reference class forecasting

- Neural networks

- Data mining

- Causal models

Based on Time Series Projection

- Moving Average Method

- Exponential Smoothing Method

- Trend Projection Methods

- Extrapolation

- Growth Curve

Other Casual Methods

- Chain-Ratio Method

- Consumption Level Method

The above methods are illustrated as

- Judgmental Approach – The essence of the judgmental approach is to address the forecasting issue by assuming that someone else knows and can tell you the right answer. That is, in a judgment-based technique we gather the knowledge and opinions of people who are in a position to know what demand will be. For example, we might conduct a survey of the customer base to estimate what our sales will be next month.

- Experimental Approach – Another approach to demand forecasting, which is appealing when an item is “new” and when there is no other information upon which to base a forecast, is to conduct a demand experiment on a small group of customers and to extrapolate the results to a larger population. For example, firms will often test a new consumer product in a geographically isolated “test market” to establish its probable market share. This experience is then extrapolated to the national market to plan the new product launch. Experimental approaches are very useful and necessary for new products, but for existing products that have an accumulated historical demand record it seems intuitive that demand forecasts should somehow be based on this demand experience. For most firms (with some very notable exceptions) the large majority of SKUs in the product line have long demand histories.

- Relational/Causal Approach – The assumption behind a causal or relational forecast is that, simply put, there is a reason why people buy our product. If we can understand what that reason (or set of reasons) is, we can use that understanding to develop a demand forecast. For example, if we sell umbrellas at a sidewalk stand, we would probably notice that daily demand is strongly correlated to the weather – we sell more umbrellas when it rains. Once we have established this relationship, a good weather forecast will help us order enough umbrellas to meet the expected demand.

- “Time Series” Approach – A time series procedure is fundamentally different than the first three approaches we have discussed. In a pure time series technique, no judgment or expertise or opinion is sought. We do not look for “causes” or relationships or factors which somehow “drive” demand. We do not test items or experiment with customers. By their nature, time series procedures are applied to demand data that are longitudinal rather than cross-sectional. That is, the demand data represent experience that is repeated over time rather than across items or locations. The essence of the approach is to recognize (or assume) that demand occurs over time in patterns that repeat themselves, at least approximately. If we can describe these general patterns or tendencies, without regard to their “causes”, we can use this description to form the basis of a forecast.

In one sense, all forecasting procedures involve the analysis of historical experience into patterns and the projection of those patterns into the future in the belief that the future will somehow resemble the past. The differences in the four approaches are in the way this “search for pattern” is conducted. Judgmental approaches rely on the subjective, ad-hoc analyses of external individuals. Experimental tools extrapolate results from small numbers of customers to large populations. Causal methods search for reasons for demand. Time series techniques simply analyze the demand data themselves to identify temporal patterns that emerge and persist.