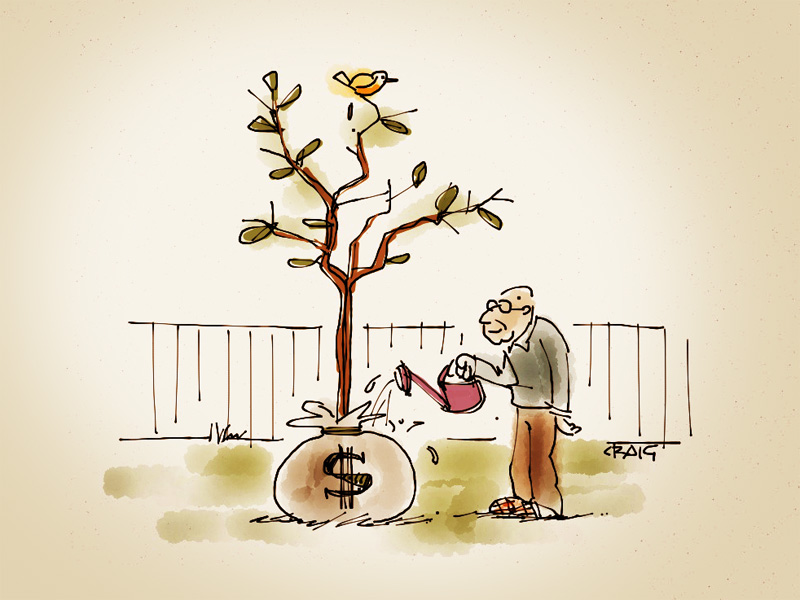

Before investing your money into the stock market,it is important that you understand yourself as an investor to avoid falling into a money trap. Let us find out and determine what is your investing style.

Before you determine your investment style, it is very important that you first determine your investment goal and also your risk tolerance level. First, you will need to know how much you want to make and achieve over a specific period of time. This period can be five years, ten years or even twenty years. After that, you will need to determine how much you can actually set aside for investment purposes without drastically affecting or altering your lifestyle. Ask yourself important questions like: (i) Do you have a family to take care of?, (ii) Is the income generated from your business or your job consistent?, (iii) Are there any recurring monthly payments that you need to settle? Based on these questions, you can then adjust your investment goals accordingly and calculate how much you can comfortably set aside for your investments. This is extremely important because when it comes to investing, emotion plays an important part in your decision-making. By touching only the money that does not affect your life, you will not be bounded by pressure that often results in regrettable decisions.

Once you have calculated or figured out your appetite for risk, you can actually group yourself with the high-risk or the risk-averse investors. High risk investors are usually people who don’t have a lot of liability. The lack of liabilities is a clear advantage they have over others as they can set aside more funds to grow their money into bigger amounts. If you fall into this group, you may want to choose the stocks that are more risky in nature but are able to give you a higher capital appreciation. If you have a lot of liabilities and are risk -averse, you may want to focus on stocks that pay you dividends every quarter. You can use the dividends to pay for your expenses.

By knowing your investment style and risk appetite, you will be able to invest smartly and prevent yourself from getting into any bad financial situation.

Click here for government certification in Accounting, Banking & Finance

7 Comments. Leave new

Good one!

Nicely written. The things or the factors that have been pointed out are sufficiently important for an investor beginner. The work has appreciated.

A must read for all the young investors.

Very well written..

Very informative.

nice one.

interesting…