Attention! All grads and ambitious finance professionals, fasten your seat belts as GST unlocks a whole new world of opportunities. But are you qualified to grab it and outshine in your career?

GST law is the latest and emerging indirect tax law in India. Thus, it is adhered to raise apprehensions in the minds of taxpayers concerning registrations, return filings, refund claims and other compliances under GST. Therefore, the government has proposed the concept of GST Practitioners to assist taxpayers in GST compliances. Thereby, raising a huge demand for GST Practitioners. So, now it becomes all the more important for a GST Practitioner to be highly skilled as well as certified. As a result, the market is overflowing with GST Certification programs. However, one should be very careful while choosing the right certification body. So, in this article, not will we discuss the salary of a GST Practitioner but also all the related relevant information regarding the same.

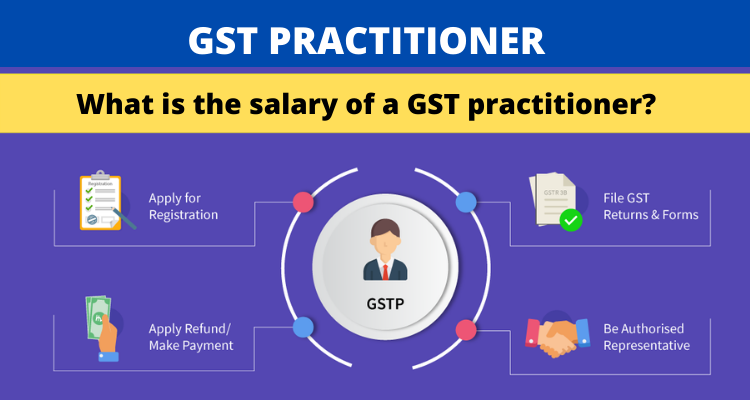

Who is a GST Practitioner?

GST Practitioner is a sort of adviser who provides services to other taxpayers through online mode. In order to accomplish all the tasks, a GST Practitioner must have obtained a GST certificate before he starts his or her practice. Most importantly, he/she must be registered on the GSTN portal.

Role of a GST Practitioner

GST is one of the notable tax laws that has changed India. And on top of that, it has levied the cascade effect from the taxation laws successfully. However, there are various roles and responsibilities of a GST Practitioner.

So, the moment you are certified, you can easily operate below-mentioned activities on GSTN Portal-

- First of all, you can examine the entire list of taxpayers who are engaged in the account.

- Secondly, you can provide details of inward as well as outward supplies.

- Not to mention, you can also provide the monthly, quarterly, as well as the annual return on behalf of your taxpayer client.

- Further, you can generate a deposit for credit into the electronic cash ledger.

- After this, you can file an application for his claim for refund.

- Also, you can file an application for amendments or cancellation of his registration.

- Moreover, you are also permitted to make changes in the profile of his taxpayer client like a place of his business, his contact details, his other business information.

- In addition, you can also help the client to generate an e-waybill for various movement of his goods.

- Furthermore, you can assist your client in the issuance of tax invoices, delivery challan, a procedure for GST registration, cancellation, and any GST Updates.

- Lastly, you are qualified to accept or reject the application as a consultant from a fellow taxpayer.

Now that you very well understand all the roles of a GST Practitioner, let’s move and understand the salary perspective.

Salary of GST Practitioner

Goods and Services taxes are the modes of indirect tax, which has drawn all other indirect taxes under one umbrella. As a result, it has emerged as a new career opportunity for many. Not to mention, it also has an adequate salary slab.

The average annual salary for Accounts Manager in GST Practitioner is INR 4.9 – 6.4 lakhs in India. But, remember salary depends on your skills sets as well the organisation you work from. So, make you master your field and live a great career.

Benefits of a Certified GST Practitioner

Every opportunity taps with different benefits. And, besides salary, GST Practitioner enjoys several benefits. Likewise, Certification also plays an important role in elevating your career. Not only it’s validation but also sharpens your skills. Therefore we have curated a list of benefits enjoyed by a certified GST Practitioner.

- First of all, you will definitely earn a competitive advantage.

- Secondly, it also enhances efficiency.

- Subsequently, there is a raise in your earning potential.

- Besides this, the certification also helps to increase knowledge and skills.

- Last but not least, it helps you establish professional credibility.

As you can easily view the benefits of certified GST Professionals, therefore, we highly recommend being a certified professional. So, make sure you are certified from a valid certification body. And, for your convenience, we are providing you with a list of certification bodies, that our experts picked out.

Certification Bodies

Now, keep this very clear in your head that there are only a few certification bodies that are widely trusted. So, make sure you’re choosing wisely. In order to make things simpler for you, we are providing you with the list of certification bodies that we highly suggest. Therefore, we will render you with a list of certification bodies to choose from. So, let’s start-

- Vskills: Vskills tops our list, as it is a certified Government body. But, other than that Vskills provides the candidate with tutorials and Practice sets.

- Cleartax: This is also a good option to choose from. Not to mention, they provide detailed information regarding the same.

- ICT Academy: You may have come across this one. If not, let’s be clear they are also a suitable match for GST Certification.

- CAclubIndia: This is also among the leading certification organisations. They do offer training that will definitely be beneficial.

After you’re a certified candidate you’ll be able to perform the following tasks –

- First thing first, you will attain an overall insight of the GST laws including its implementation, compliance & enforcement.

- Subsequently, understand how GST affects the functioning of any organization. Further, you will be proficient in understanding how it beneficial in the business process.

- In addition, build practical knowledge of the several methods necessary under the GST Act, such as Registration, Filing of Returns, availing Input Tax Credit, TDS compliance, and refunds.

After your completion of the GST certification course, you must be thriving upon the benefits you will enjoy. So, let’s understand all the benefits of the GST Certification Course.

Roadmap to be a certified GST practitioner

To become a successful GST Practitioner, the following steps must be followed by an individual.

Prerequisites

A GST Practitioner must fulfil the following conditions he/she can enrol on the GST Portal:

- First of all, the candidate must have a valid PAN Card.

- Secondly, the candidate must have a valid mobile number.

- Subsequently, the candidate must have a valid e-mail ID.

- Also, the candidate must have a Professional address.

- Moreover, the candidate ought to have prescribed documents and particulars on all mandatory fields as required for Enrolment.

- Last but not least, the candidate must satisfy the eligibility criteria of the GST Practitioner.

Intended Audience

- Firstly, Chartered Accountant holding COP

- Secondly, Company Secretary holding COP

- After this, a Cost and Management Accountant holding COP

- Subsequently, Advocate

- Moreover, graduate or postgraduate degree in Commerce

- In addition, graduate or postgraduate degree in Banking

- Not to mention, graduate or postgraduate degree in Business Administration

- Further, graduate or postgraduate degree in Business Management

- Also, degree examination of any recognized Foreign University

- Furthermore, Retired Government Officials

- Also, Sales Tax Practitioner under existing law

- Lastly, Tax Return Preparer under existing law

Enrol in a Certification Program

Before enrolling yourself into a certification program, make sure you are eligible and have ticked all the above boxes. Now, that you’re ready, make sure to choose a valid certification body. We cannot stress enough on this fact. As you all know there are various fake institutions as well. And, we definitely don’t want you to be caught in that mess. So, try choosing and picking the right certification from the above list of certification bodies.

Understand the Syllabus

Before, appearing for any certification examination, make sure you’re well versed with all the syllabus. So, for your convenience, we have laid down a few important topics, you must be proficient in.

- Firstly, The Central Goods and Services Tax Act

- Secondly, The Integrated Goods and Services Tax Act

- Subsequently, State-specific Goods and Services Tax Act

- Also, The Union Territory Goods and Services Tax Act

- Not to mention, The Goods and Services Tax (Compensation to States) Act

- Don’t forget, The Central Goods and Services Tax Rules

- Moreover, The Integrated Goods and Services Tax Rules

- Also, All-State Goods and Services Tax Rules

Popular Learning resources for GST

Learning resources are the most important part while preparing for GST certifications. So make sure you go through all the tutorials and forums

- Online Tutorials: While preparing, tutorials play an important role. Each and every tiny detail is mentioned in tutorials. Not to mention, each and every topic is explained with various examples. So, make sure to check out professional tutorials on GST certification.

- Books: Once you are done with the tutorials, don’t forget to check out books on GST Certification. As books are a liable resource to rely on. So, here are a few books to go with-

- Goods and Services Tax (GST) Bare Act with Rules, Forms and Amendments 2020 Edition by Government of India

- Goods and Services Tax GST by H.C. Mehrotra, V.P. Agarwal.

- Mock Test: After going through all the learning resources, you must take time out to self evaluate. So, make sure to go through GST practice papers.

Expert’s Corner

Getting certified as a GST Practitioner can be your stepping stone to begin and elevate your career in finance. This can be the best chance for you. Therefore, we highly suggest getting a certification from a valid institution. Acquire proper training and guidance for the certification process.

Join Certified GST Professional and become a part of one of the best known and trustworthy Government body without a second thought.