What is GST (Good & Services Tax)

GST stands for Goods and Services Tax, it is a proposed comprehensive indirect tax which would be levied on all goods and services consumed and it will replace all the current different indirect taxes levied by the government on different consumed goods and services. In simple words right now there a number of different taxes levied on goods and services which cause a lot of problems in the economy, hence GST is a uniform tax which will be levied on all goods and services to put an end to these problems.

Replacing Existing Indirect Taxes

Before getting into what these problems are and also the effects GST will have on the economy, let us first see some of the existing indirect taxes that GST will be replacing.

At the Central level, it will subsume Central excise duty, service tax and additional customs duties while at the state level it will include value-added tax, entertainment tax, purchase tax, luxury tax, lottery taxes and electricity duty. Central sales tax (CST) will be completely phased out. Entry tax would be included in GST from the start. But state taxes on petroleum products will continue for a few years after GST is introduced, as per the deal between the Centre and states. State taxes on alcohol and tobacco, too, would remain. As we can see GST will serve the purpose of unifying all such taxes and integrate them systematically to introduce one uniform tax.

How GST will affect the existing tax system?

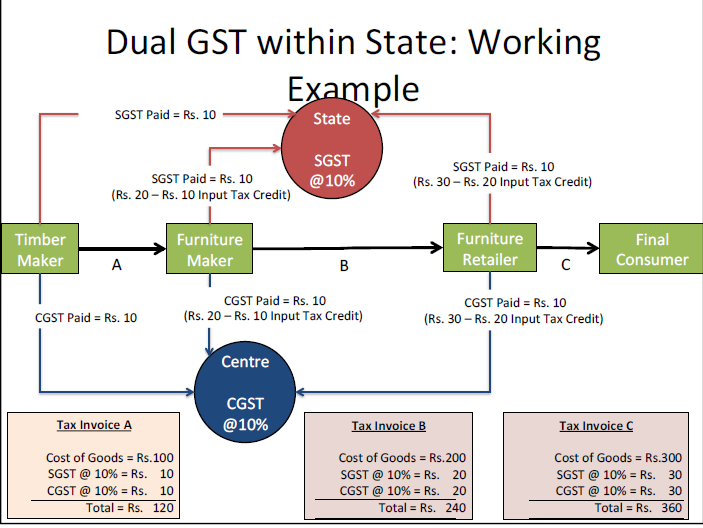

Now the question is why is GST being introduced? The current tax system has been the way it is since independence so why now is there a need for changing the system? The answer is that the current tax system is unfair to the manufacturing sector or the producers, the different taxes at each stage of production added with the insufficient setting off mechanism results in a huge amount of tax being levied upon the producers. This was one reason, another reason for the introduction of GST is that the inefficient solutions mechanism has made it extremely difficult for the foreign companies who have invested in India especially in SEZs (Special Economic Zones) to get their grievances dealt with, this inefficiency has made them prefer China as their system is much more efficient and helpful. So what is this proposed GST structure? GST structure basically will be two tiered i.e. tax would be levied by both the Centre and the States on the intra supply of goods and services through CGST (Central Goods and Services Tax) and SGST (State Goods and Services Tax).

Source : http://www.pradhanmantriyojana.in

Source : http://www.pradhanmantriyojana.in

Source : http://www.pradhanmantriyojana.in

Source : http://www.pradhanmantriyojana.in

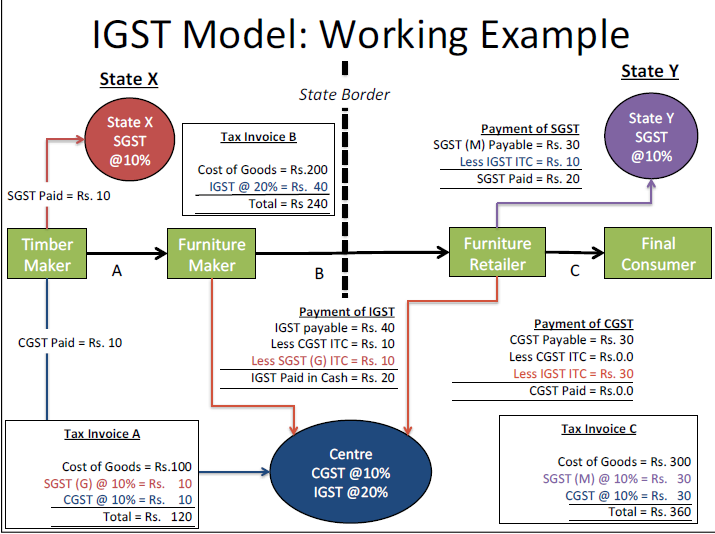

Now a tax is collected for a reason, the government invests it somewhere which benefits the citizens of the country, so the question is where will the revenues from CGST and SGST be utilized? Basically the revenues from these taxes will be made available as a form of credit to the entire supply chain i.e. the manufacturers and producers to aid their process of manufacturing and the burden of the taxes will be entirely on the customer or consumer. Now other than SGST and CGST, there is also IGST (Inter-State Goods and Services Tax), this tax would be levied on all inter-state transactions of goods and services by the Centre. The introduction of such a structure then requires management and for that the GST Constitutional Amendment bill provides for creation of a GST Council comprising all the stakeholders across the Center and the state. The Council would recommend the rate of tax to be charged with bands.

How GST will affect the Indian Economy?

Now coming to the most important questions, what will be the impact of GST on the economy? Will the impact be all positive? Does it have any negative impacts as well? Let us take these questions one by one.

The biggest impact of GST on the economy will be that it will unify the Indian market and make it one common market, GST would ensure taxes at each stage are creditable and make sure there is no double taxation. Some of the positive impacts of GST would be as follows:

Firstly it will bring a layer of transparency in the business accounting system as GST can be listed in every sales invoice unlike the other indirect taxes which were not mentioned leading to unfair high taxes. Secondly and very importantly, it will reduce administrative corruption, for instance, in the present scenario if a good or service is sold, a tax is levied on the product at the time it is manufactured i.e. comes out of the factory and when it is sold i.e. at the retail front, With GST this system will stop and only one tax will be levied and will have to be paid once. Thirdly, it will make it much easier to do business in India, something which the current government seems to promote a lot, as introduction of GST will lead to lowering the cost of production of business and it will not appear as a cost to registered retailers, and hence will wipe out the tax evaders and hence increase market for the registered retailers. Fourthly, GST will lead to a holistic development of the common Indian market by removing economic distortions, how? As GST will be levied only on the final stage of consumption and not through every stage of the entire supply chain. Fifthly, the main beneficiaries of GST introduction are the manufacturing sector and the producers, right now at different stages these producers have to pay different taxes which includes great complications and rising compliance costs. GST would reduce the cost of manufacturing both from a tax perspective as well as on compliance front, hence ensuring that there is equitable distribution of tax burden between the manufacturing and service sector. Finally, the most obvious effect, if taxes are reduced at the production phase it will bring down the prices of products like cars, FMCG (Fast Moving Consumer Goods) like soft drinks, toiletries etc. Hence it will make goods and services from basic to higher needs more affordable.

Benefits of implementing GST

All these were positive impacts basically on the manufacturing sector but how does it benefit the government? It does as GST promotes exports and indirectly makes it easier for foreign companies to invest in India, in addition to this on a macroeconomic level it leads to creation of job opportunities and overall growth of the economy. The negative impacts of GST are a few, Firstly most services like telecom, banking, airline will get expensive according to the tax rate. Secondly, in theory the bill seems very attractive but only time will tell how well it is implemented. Thirdly some economists have the view that it will have a bad effect on real estate, it would increase the cost of purchasing a new home and reduce demand. Fourthly, it is not as big an achievement for India as promoted as some say that CGST, SGST, IGST are all just different names for Central/State excise duty and VAT (Value Added Tax) and the concept of GST has already being used by numerous countries like Australia, Canada, Germany & Japan.

Effect of GST on the consumer

So far we have seen GST impact on government and manufacturing sector, but what about the consumer sector? Does the common man benefit from introduction of GST? This is a very tricky question and there is no definitive answer to this as for the producers and the government, the straight answer was YES, GST will benefit them but for the common man it is not that simple. This is because GST will have different impact on different goods and services used by consumers. One thing is for certain that it will bring down prices leading to increasing demand of goods and services which would benefit individual companies, but not everything will become cheaper.

Let us see a few examples. Eating out will get expensive as right now when you eat out, a tax of 18.5% is laid on the bill, GST fixes this tax at a rate of 18 or above, this may mean one is charged 20% tax for the same meal. As mentioned earlier telecom sector will get expensive i.e. phone bills, the current tax charged on phone bills is 15% but with the introduction of GST it will rise up to at-least 18%. This was about the phone bills, but with GST purchasing phones themselves will become expensive, the current tax rate on phone purchase being 12.8%, with GST it will again rise to at-least 18%. Jewellery is also likely to get expensive as right now only 2 percent of tax is passed on to consumers but with GST it may rise to 6 percent .But it is not like everything will become expensive, some products will become cheaper, for example, Buying a car will get cheaper, currently a car purchased has an excise duty of 12.5% laid plus VAT on purchase, GST is said to bring this down to 18%. Watching TV, the favorite pass time could get cheaper, as LED TVs which currently have a tax of 24.5% laid on them will be reduced to 18%. There are many other examples we can discuss and each will have its own impact, hence I said there will not be one definite effect of GST on the common man, some may benefit, some may not.

In conclusion GST is a step forward for India to integrate its market and systematically develop its economy as a whole. GST will show its benefits in the long run.

Article Written By :

Tanmay Puri (Vskills Intern)

Student of BA (Hons.) Philosophy ,Hindu College, University of Delhi