In the last discussion, we tried to understand the Options market from the point of view of the Call writer, and this time around, we shall step into the shoes of the call buyer.

As a market participant who is bullish, I can always buy the call, sell the put, purchase the underlying/futures, etc., but I choose to purchase the call option. Why is it so? What is so attractive that about this instrument that I’d choose it over all others? Well, we’ll just discuss them.

Suppose I decide to buy the security, but then what if the market were to go down? Would I just not roll downhill with the market? And the same can be said of futures. So, I make up my mind to not buy the underlying/future. If I now focus on put options, I could always write them in the anticipation that the market would go up and they would go unexercised, so why not? The reason is that if I were to judge the market wrongly, the potential for loss would be unlimited. Of course I can always square off, but why begin a trade I’m not sure of?

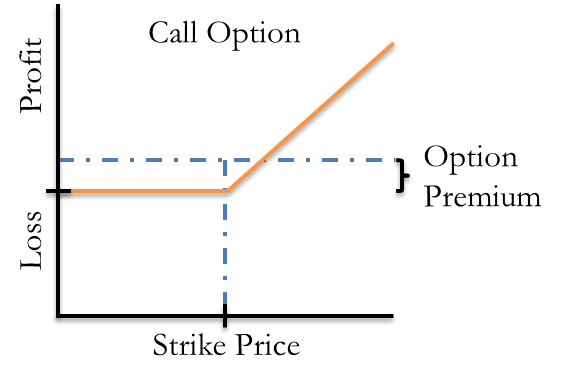

So I think I’ll purchase a call option- I know that I have to pay an upfront fee, but the fee is quite minimal in the way that if I were to be proved wrong, I can always come off with the loss of the premium only. Clean, huh?

Here, we have seen the market from the perspective of the call buyer, but we’ll soon realize that the market, for it involves such huge amounts of money, isn’t always content with this amount of risk too, and that people are always trying to develop strategies to incur the least cost and come out with a assured profit. We’ll learn about them when we talk about spreads and strategies in our future discussions.

Click here for government certification in Accounting, Banking & Finance

11 Comments. Leave new

good

Short and informative.

very nice!

Nice..

Short and precious information..!

Essential assessment of an important practice in the market

Short and gud:);)

Short and crisp yet good one 🙂

Informative piece of article.

Good job, Anant!

Short and crisp, very well written