AML-KYC have gained the spotlight in financial and banking services to address fraud and criminal finance.

AML and KYC expand to Anti-Money Laundering and Know Your Customer. Governments across the globe have united and AML regulations have put in place to address money laundering by criminals and terrorists especially with the formation of the Financial Action Task Force (FATF) having more than 200 countries.

Banks and financial institutions have been mandated to apply KYC norms to address fraud and check money laundering.

AML-KYC professionals are responsible in financial institutions to enforce, collect, verify, validate and submit reports for compliance to regulations.

Jobs for AML and KYC professionals are on rise with increased penetration of existing and new-age financial products like NFTs and bitcoin.

Certification in AML-KYC helps candidates to not only attest to their skills and knowledge of AML-KYC but also enhance their visibility in the job market as well.

Vskills offers certification for AML-KYC professionals – Certified AML-KYC Compliance Officer. Candidates registering for the certification are provided with

- Hard copy reading material

- Online e-learning

- Online assessment

- Certification in hard copy as well as LinkedIn shareable format

- Placement assistance on Monster India and Shine

In Mumbai, many national and international financial institutions require AML-KYC professionals in various capacities. The list of companies having AML-KYC job in Mumbai is as

- Accenture

- Adyen

- AllianceBernstein

- Bank of America

- Barclays

- BNP Paribas

- Citi

- Credit Suisse

- DBS Bank

- IDFC First Bank

- JPMorgan Chase

- Macquarie Group

- Morgan Stanley

- Nium

- Revolut

We will discuss steps to apply directly to the companies in Mumbai which will enable you to be notified of the new openings and apply to the HR department of the respective companies.

Accenture, Mumbai

AML/KYC JOBS IN Mumbai

Accenture is a global professional services company that provides services to Financial Services, Banking, Insurance, and Capital Market.

AML-KYC jobs in Accenture, Mumbai are at the KYC team which provides for Know Your Customer related reviews for corporate or commercial customers or funds. Opening is also at the AML team which provides client on-boarding, sanction screening, remediation, periodical reviews, Customer Due Diligence (CDD), and Enhanced Due Diligence (EDD).

AML-KYC professionals having the following skills can apply directly at Accenture

- Problem-solving skills

- Detail orientation

- Agility for quick learning

- Expert in AML and KYC Operations

- Be well versed with basic statistics and general business terms

Apply directly to AML-KYC jobs at Accenture

The steps to directly apply for AML-KYC jobs at Accenture are –

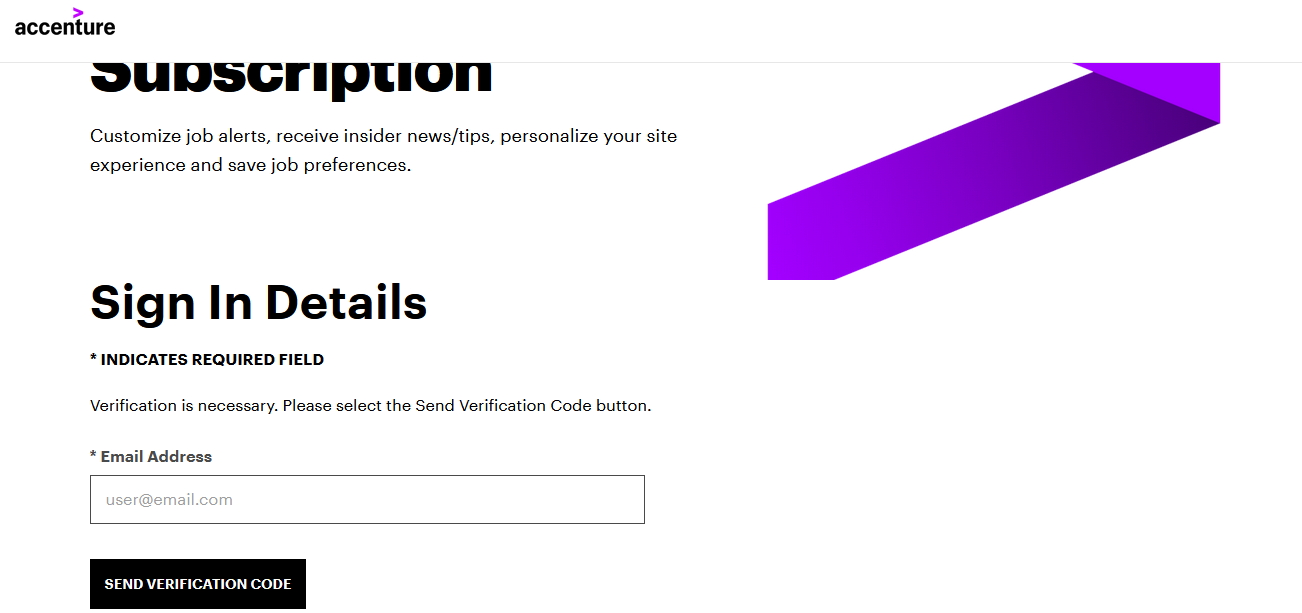

Step 1 – Register at link – Accenture Career Section

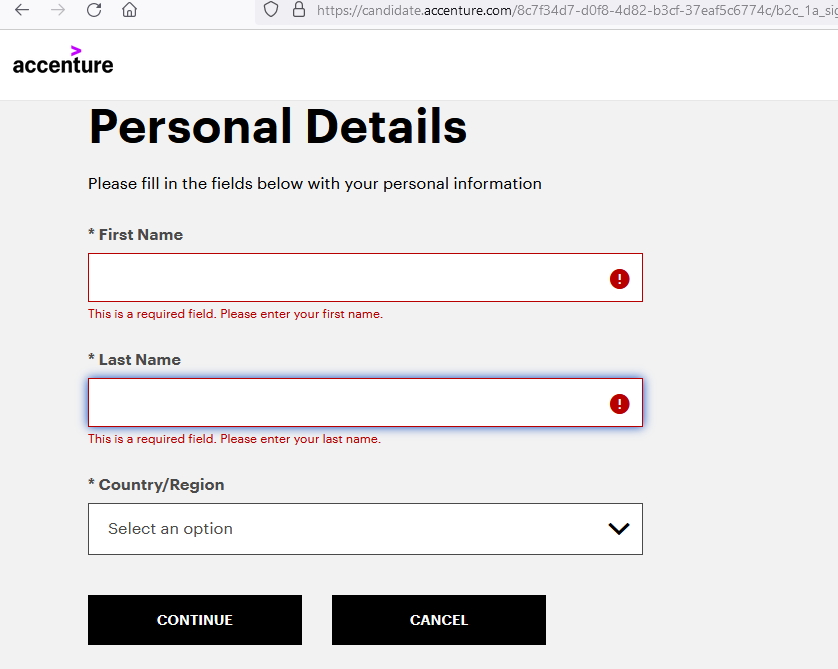

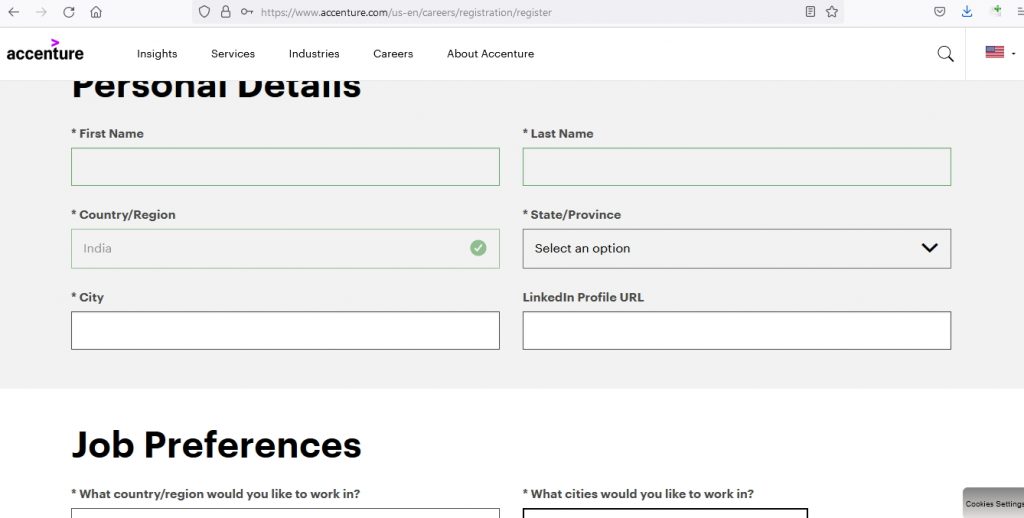

Step 2 – Fill in Personal Details and Verify your contact number

Step 3 – Provide Details and Complete Registration

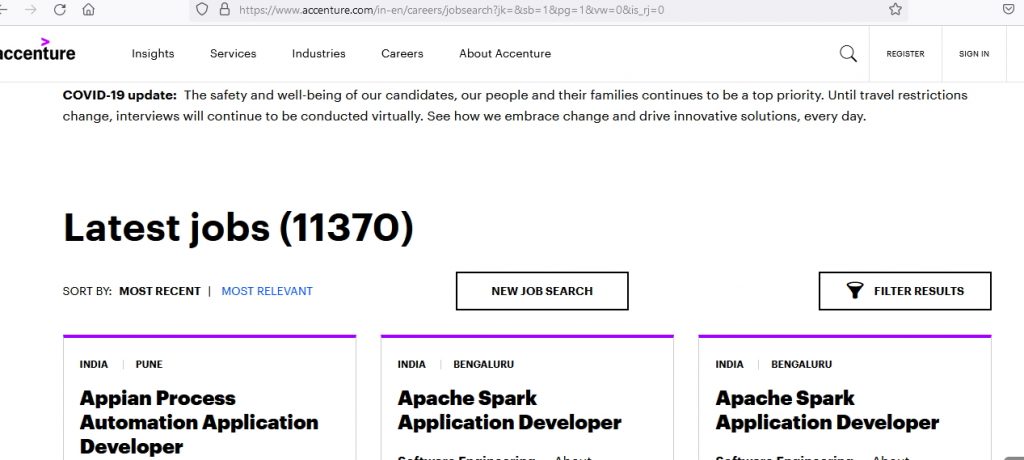

Step 4 – Search the opening at link – Career Job Search Section

Now you will be updated of new job postings at Accenture

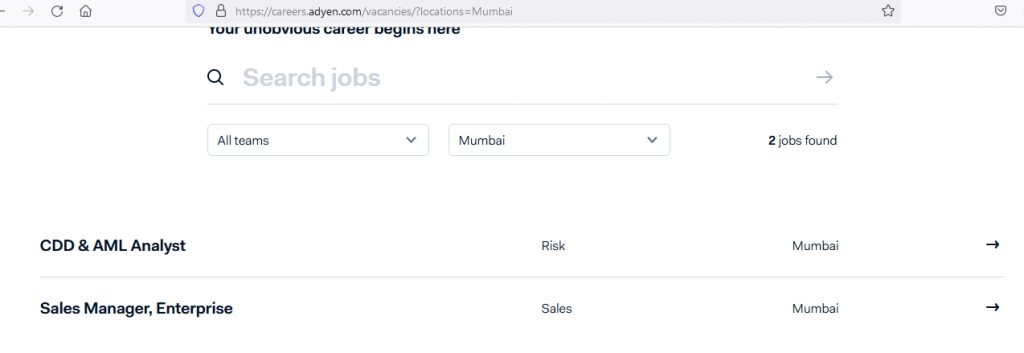

Adyen,Mumbai

AML-KYC JOBS in Mumbai at Adyen

Adyen is the payments platform for the world’s biggest companies like Facebook, Bonobos, Uber, Casper, L’Oreal, Spotify, many U.S. internet companies and worldwide retailers. Adyen provides end-to-end infrastructure connecting directly to Visa, Mastercard or consumers’ other preferred payment methods.

Adyen requires AML-KYC professionals in various capacities for their Underwriting Department in Mumbai to support payment services in India.

AML-KYC professionals having following skills can apply directly to CDD & AML profile at Adyen

- Experience in a risk or compliance related domain

- Good understanding of AML, KYC and Internal Controls

- Are detail oriented, organized and have the ability to multi-task

- Take initiative and ownership

- Strong analytical skills

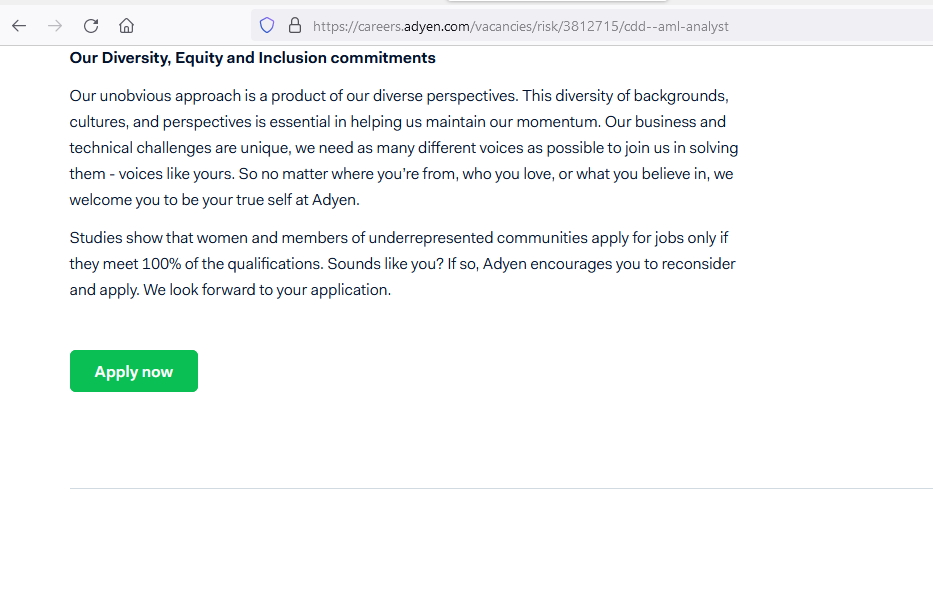

Apply directly to AML-KYC jobs at Adyen

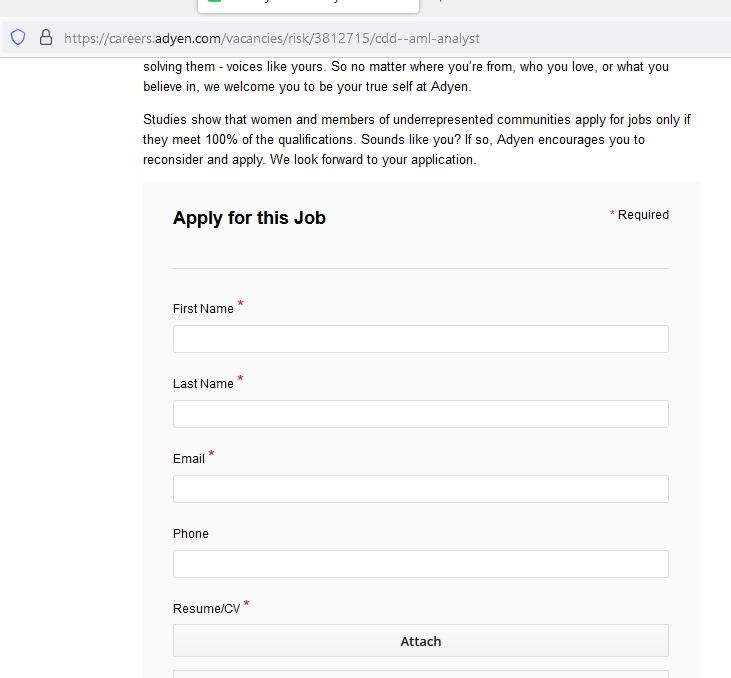

The steps to directly apply for AML-KYC jobs at Adyen are –

Step 1 – Search for jobs at the link – Adyen Career Site

Step 2 – Select the desired job and click Apply Now

Step 3 – Fill the required details and submit your application

AML-KYC professionals are responsible for following activities in their CDD & AML role at Adyen

- Assess new and existing merchant’s accounts on basis of their risk profile as per Indian regulatory requirements and Adyen internal controls

- Setup, monitor and execute checks for merchant on-boarding, periodic reviews and transaction monitoring

- Investigate merchants identified for AML and fraud risk

- Provide advisory and assistance to commercial teams for new and existing merchant on-boarding

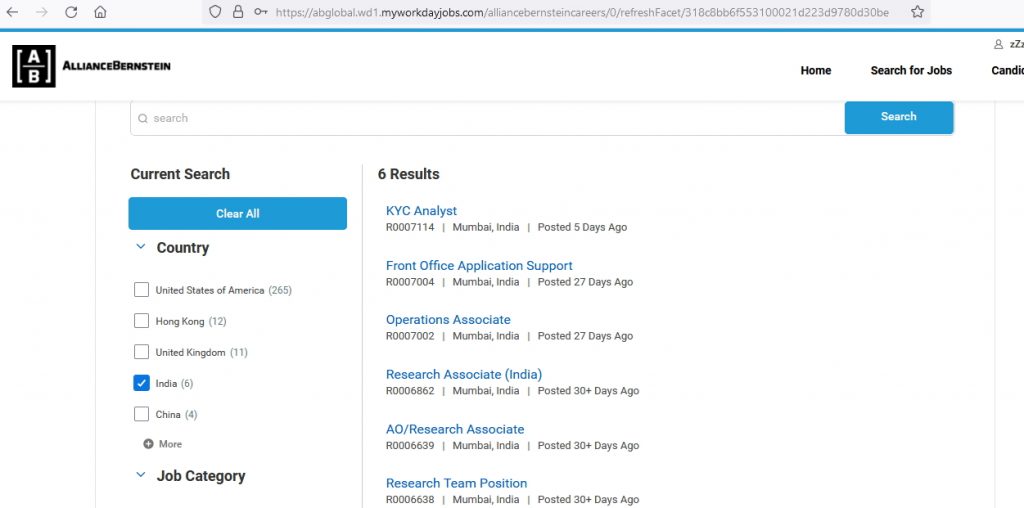

AllianceBernstein,Mumbai

AML-KYC JOBS in Mumbai at AllianceBernstein

AllianceBernstein has institutional sell side trading desk at Mumbai for trade execution in the Indian markets (NSE and BSE). The trading desk executes orders for foreign and domestic customers and custody settled institutional/non-institutional investors using our research product by paying commissions to us. This position interacts with multiple groups including the sales, trading, technology, operations, compliance, global KYC as well as KYC vendor consultants.

AllianceBernstein has opening for AML-KYC professionals in the India Broker Dealer KYC team part of the Global KYC – Sales group.

AML-KYC professionals having following experience and skills can apply directly to KYC profile at AllianceBernstein

- Experienced with client onboarding or periodic review or remediation.

- Excellent communication and interpersonal skills.

- Good work experience in AML or KYC or compliance domain in corporate financial services industry such as Equity Brokers/Banks/KPOs etc.

- Understanding of Control, Compliance, Investigation/chasing functions in KYC

- Interpret regulatory guidelines

- Review alerts or negative news

- Good knowledge of end to end KYC process

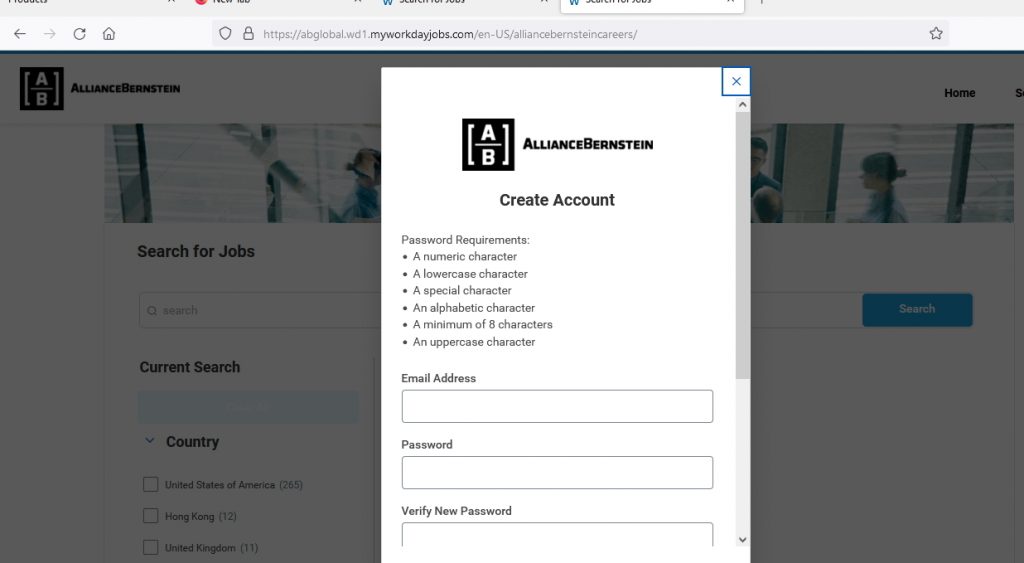

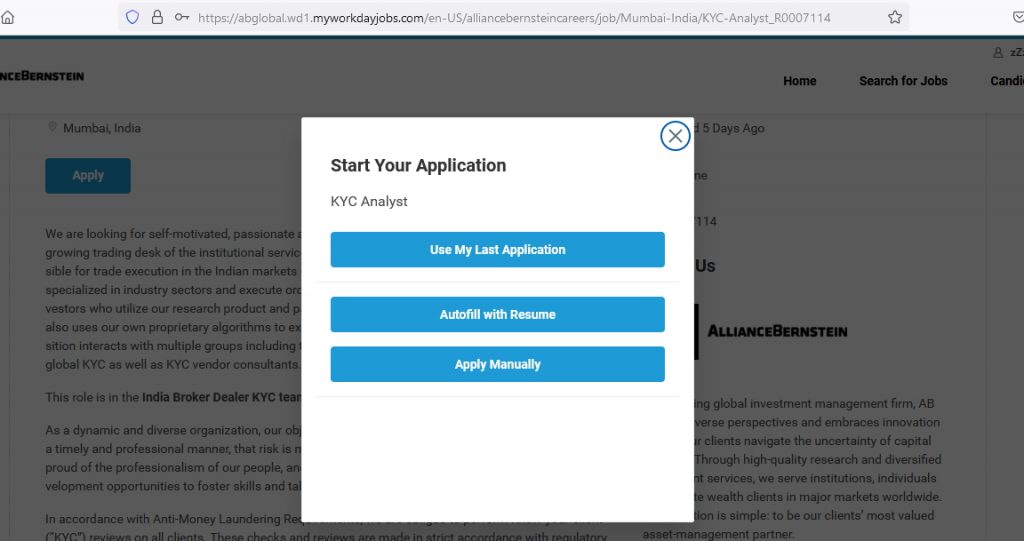

Apply directly to AML-KYC jobs at AllianceBernstein

The steps to directly apply for AML-KYC jobs at AllianceBernstein are-

Step 1 – Click Sign in and then create account at link- AllianceBernstein Career Center

Step 2 – Search and apply for the selected job

Step 3 – Apply as per desired method

AML-KYC professionals are responsible for following activities in their CDD & AML role at AllianceBernstein

- Coordinate with prospective clients

- Obtain the KYC information from the client as prescribed

- Perform name screening on the clients or related parties.

- KYC Review on periodic basis

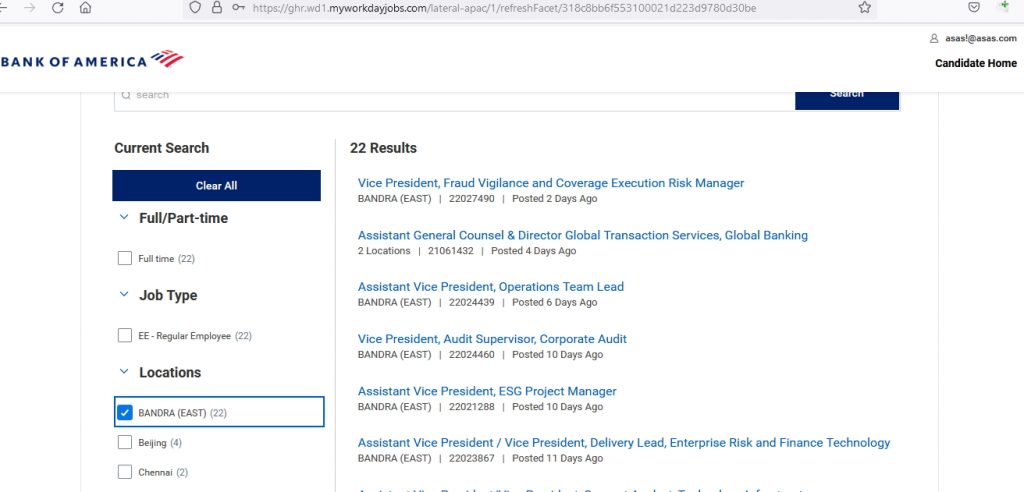

Bank of America ,Mumbai

AML-KYC JOBS in Mumbai at Bank of America

Bank of America is USA based financial institution spread across the globe providing financial products and services, from banking and investments to asset and risk management. The Global Banking & Markets Anti-Money Laundering (GBAM AML) in Bank of America performs AML, KYC, CDD and covers refresh (periodic review) as its core activity. The team also reaches out to clients for KYC/CDD documentations, along with internal/external audits, remediation of AML KYC/CDD of bank clients.

AML-KYC professionals can apply directly to AML profile at GBAM AML, Bank of America, having following skills

- 4-5 years’ experience in AML/KYC and compliance roles.

- Relevant experience on Client Due Diligence review on corporate clients

- Knowledge of APAC regulations and prior Onboarding and Periodic Review

- Control focused mindset

- Good understanding of regulatory and reputational risks

- Excellent communications skills and ability to present to audience

- Able to liaise with internal and external stakeholders

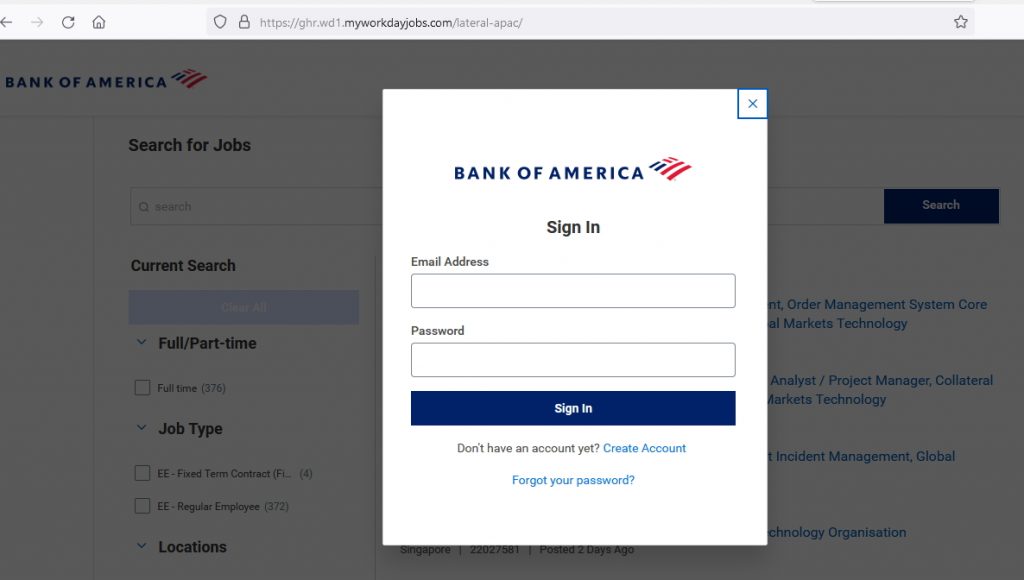

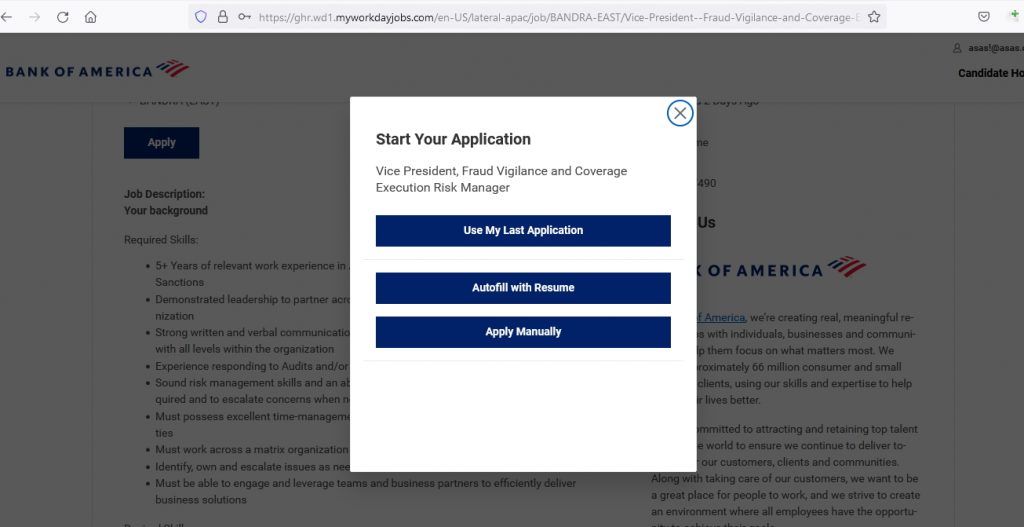

Apply directly to AML-KYC jobs at GBAM AML, Bank of America

The steps to directly apply for AML-KYC jobs at GBAM AML, Bank of America are –

Step 1 – Click Sign in and then create account at link- BOA Career Center

Step 2 – Search and apply for the selected job

Step 3 – Apply as per desired method

The role of AML-KYC professionals at GBAM AML, Bank of America includes

- Review and refresh requirements for India jurisdiction in line with India CIP/CDD Procedures

- Liaise with clients to obtain and validate correct documentation.

- Performs documentations review

- Support business with KYC related queries and requests.

- Creation and updation of records in Central KYC Registry.

- Participate in Remediation, internal/external Audits

- Maintain KYC records and documents for regulatory adherence.

Barclays,Mumbai

AML-KYC JOBS in Mumbai at Barclays

Barclays is a British bank providing consumer banking and payments operations around the world supported by Service Company which provides technology, operations and functional services across the Group.

AML-KYC professionals having following skills can apply directly to KYC profile at Barclays

- Time management skills with the ability to multi-task

- Service focused with strong written and oral communication skills

- Strong Integrity

- Previous experience in KYC is a must.

- Display good interpersonal skills

- Team player

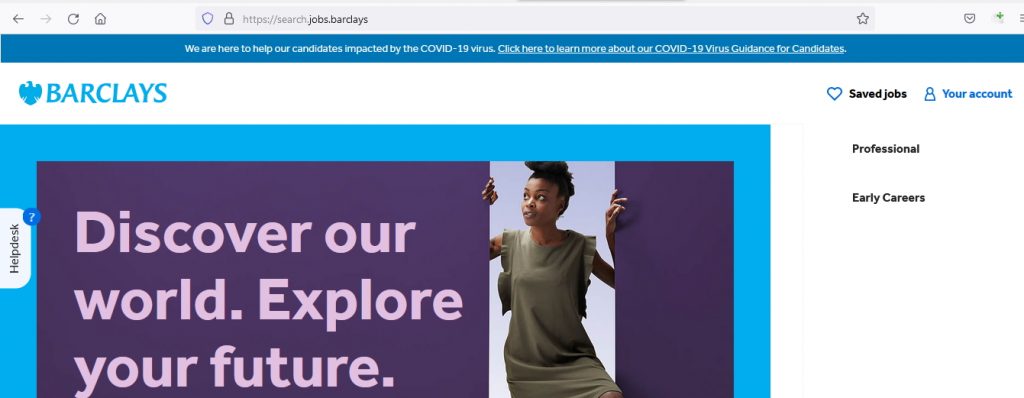

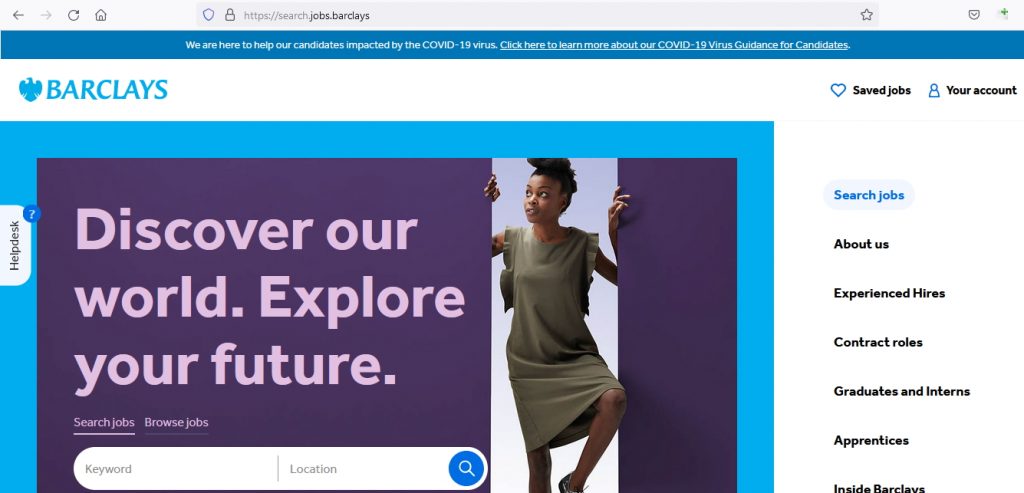

Apply directly to AML-KYC jobs at Barclays

The steps to directly apply for AML-KYC jobs at Barclays are –

Step 1 – Register Your Account at the link – Barclays Career Center

Step 02 –Click Search Jobs and Apply

AML-KYC professionals are responsible for following activities in their CDD & AML role at Barclays

- Review and check all client onboarding documentation

- Conduct client screening, onboarding of clients on Core Banking System and Risk Management Platform.

- Conducting Ongoing Review of client’s basis their risk levels.

- Tracking and Updating KYC fresh received from customers.

- Preparation of FATCA and CRS returns for filing with Tax authorities on an annual basis.

BNP Paribas ,Mumbai

AML-KYC JOBS in Mumbai at BNP Paribas

BNP Paribas is one of the top European bank which operates in 71 countries. BNP Paribas offers Domestic Markets and International Financial Services. BNP Paribas India Solutions is a wholly owned subsidiary of BNP Paribas SA and has delivery centers at Bengaluru, Chennai and Mumbai assisting in Corporate and Institutional Banking, Investment Solutions and Retail Banking.

BNP Paribas needs AML professionals for Client Management Operations team which is responsible for referential data management, KYC, Due Diligence preparation (client recertification and onboarding), credit administration and post-trade client services, AML transaction monitoring and support.

AML-KYC professionals having following skills can apply directly to CDD-AML profile at BNP Paribas

- At least 3 years’ experience in banking /financial industry or handling AML transaction monitoring and investigation.

- Good understanding of corporate banking and trade finance transactions.

- Aware of international AML regulations and sanctions.

- Good communication skills

- Analytical and with an investigative eye for accurate details.

- Ability to work in a team as well as independently.

- Must evidence an attention to detail and have an investigative and questioning nature.

- Strong interpersonal skills

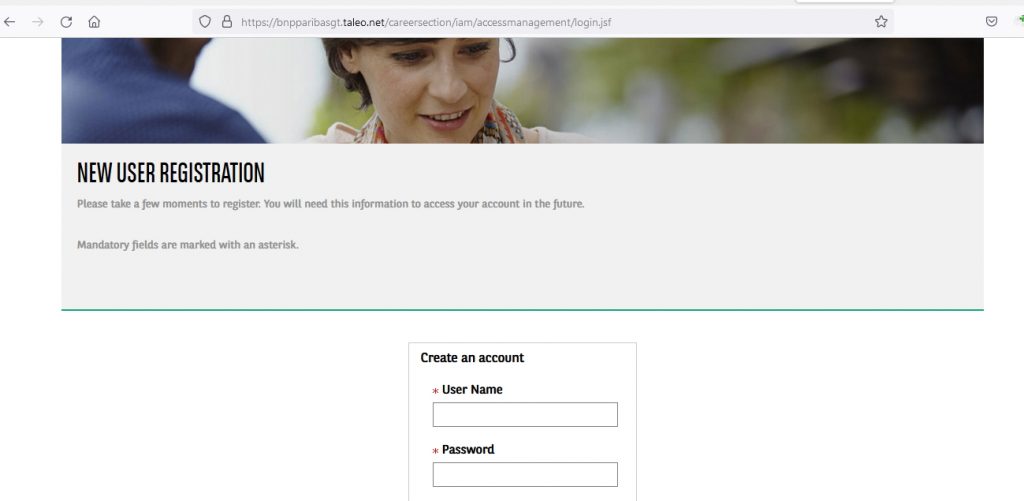

Apply directly to AML-KYC jobs at BNP Paribas

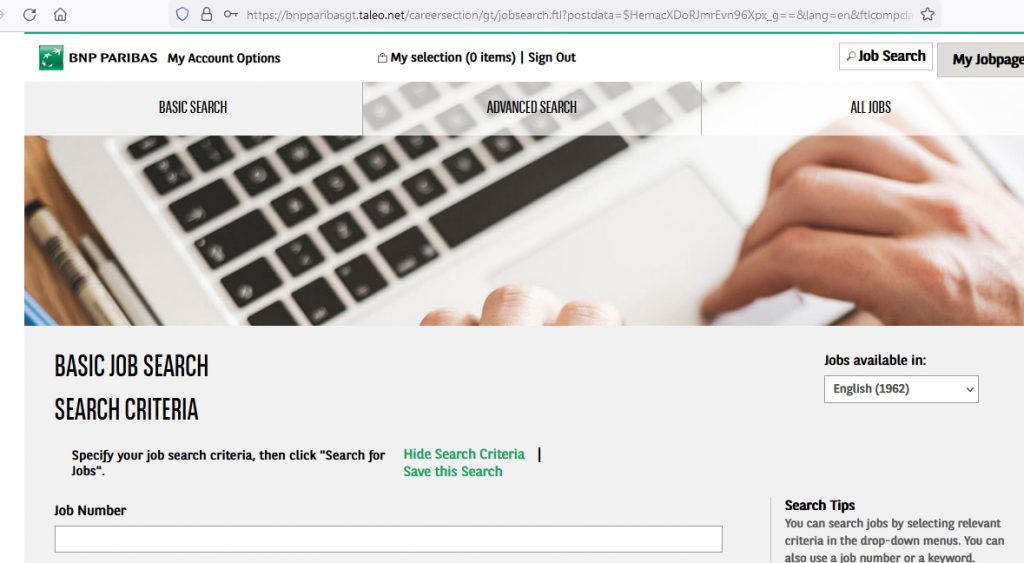

The steps to directly apply for AML-KYC jobs at BNP Paribas are –

Step 01 – Create your account at the link – BNP Paribas Job Site

Step 02 – Search and Apply for the jobs

AML-KYC professionals are responsible for following activities in their CDD & AML role at BNP Paribas

- Perform ongoing AML/CTF risk monitoring on clients and account transactions

- Review, analyze and dispose of alerts

- Obtain and upload alert analysis results and relevant material for record keeping purposes.

- Prioritize alerts and conclude the alerts quickly without compromising the quality and completeness of the analysis.

- Ensure escalation of alerts to Country Compliance

- Be updated of AML/CFT/Sanctions laws and regulations

Citi,Mumbai

AML-KYC JOBS in Mumbai at Citi

Citi is the largest financial institution spread across the globe, offering financial services. Citi has Compliance AML Execution team which has AML-KYC job openings.

AML-KYC professionals having following skills can apply directly to AML profile at Citi

- 5-8 years of relevant AML experience

- AML Certification required

- Consistently demonstrates clear and concise written and verbal communication

- Proven analytical skills

- Fluent in English

Apply directly to AML-KYC jobs at Citi

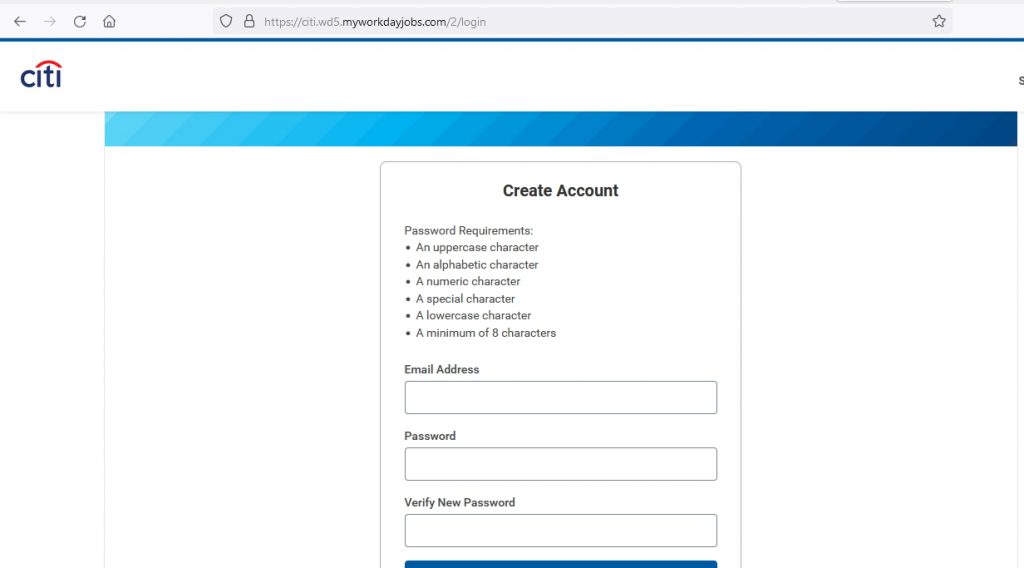

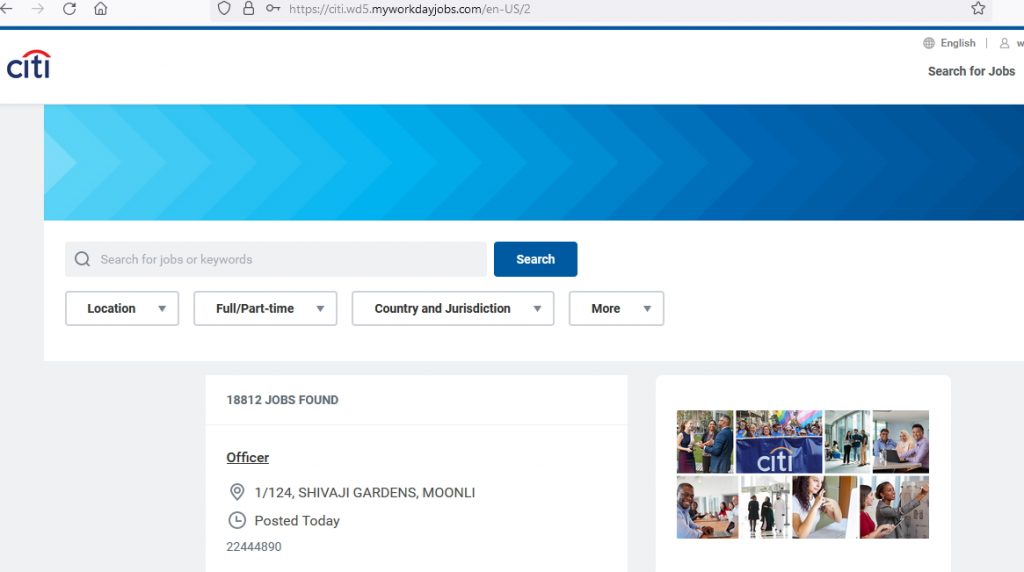

The steps to directly apply for AML-KYC jobs at Citi are –

Step 01 – Register at the link – Citi Job Website

Step 02 – Search and Apply for jobs

AML-KYC professionals are responsible for following activities in their CDD & AML role at Citi

- Research and analyze data on potentially suspicious or high risk client

- Write summaries on the findings of investigations

- Analyze the root cause of issues and impact to business

- Make recommendations to senior management on filing Suspicious Activity Reports (SARs) and/ or relationship termination or retention

- Conduct Cross Sector reviews among multiple Citi business lines

- Acts as SME to senior stakeholders and /or other team members.

Credit Suisse,Mumbai

Credit Suisse,Mumbai

Credit Suisse is a leading wealth manager having global investment banking capabilities. Credit Suisse is headquartered in Zurich, Switzerland.

Credit Suisse has the CCU team at Mumbai, which is part of the APAC Compliance Operations division. The team is responsible for identifying and mitigating AML/KYC risks for the APAC division.

AML-KYC professionals having following skills can apply directly to compliance profile at Credit Suisse

- At least 5 to 6 years of relevant AML-KYC compliance experience

- Strong understanding of AML/CFT regulations and requirements in Asia-Pacific countries

- Good analytical and problem solving skills

- Good interpersonal and people management skills

- Able to deal with regulators and auditors

- Good proficiency in Microsoft Excel

Apply directly to AML-KYC jobs at Credit Suisse

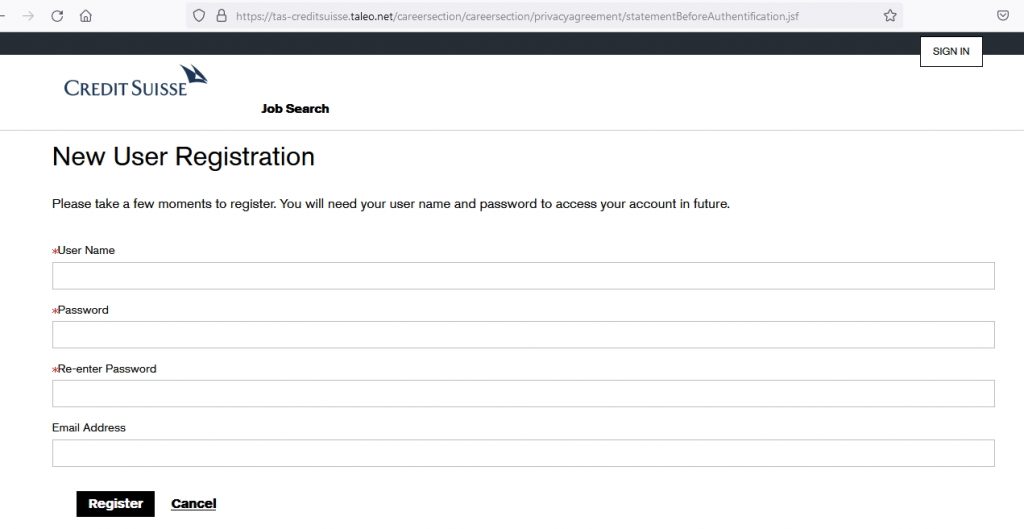

The steps to directly apply for AML-KYC jobs at Credit Suisse are –

Step 01 – Create your account at the link – Credit Suisse CareerWebsite

Step 02 – Click Search Jobs and Apply

AML-KYC professionals are responsible for following activities in their compliance role at Credit Suisse

- Provide Compliance approvals across all risk levels for all account opening cases

- Ensure all high risk issues have been appropriately been identified, escalated and relevant approvals have been acquired

- Ensure all accounts approved satisfy the required standards

- Provide advisory support for the onboarding of high risk or complex clients

- Provide Compliance advice

- Support the design, development and implementation of Global and APAC projects

- Drive and implement APAC Compliance Operations projects and deliverables

DBS Bank,Mumbai

AML-KYC JOBS in Mumbai at DBS Bank

DBS Bank Limited, is a Singaporean multinational banking and financial services multi-national company earlier known as The Development Bank of Singapore Limited. DBS Bank has FCSS & Legal Compliance unit at Mumbai and have openings for AML-KYC professionals.

AML-KYC professionals having following skills can apply directly to financial crimes profile at DBS Bank

- 4-6 years of experience in AML or compliance monitoring

- Any certifications on KYC-AML

- Strong analytical and surveillance skills

- In depth understanding of AML risks

- Strong understanding of filing regulatory reportings viz. STR’s, CTR, NTR, CWTR.

- Knowledge of KYC and Customer Due Diligence

- Project management

- Team handling

- Strong proficiency in MS Excel

- Able to work closely with team members within

Apply directly to AML-KYC jobs at DBS Bank

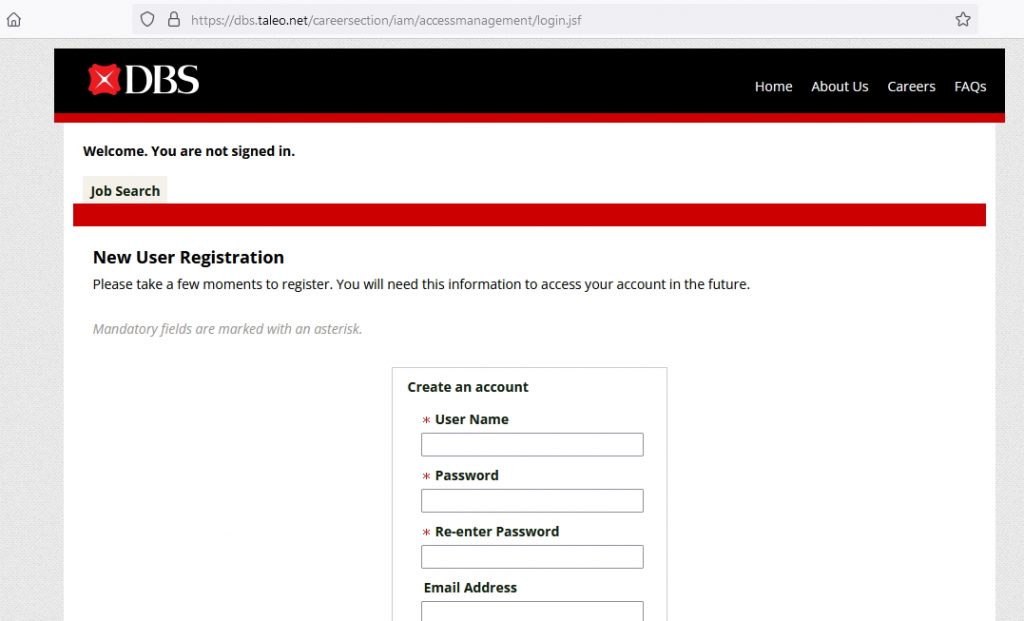

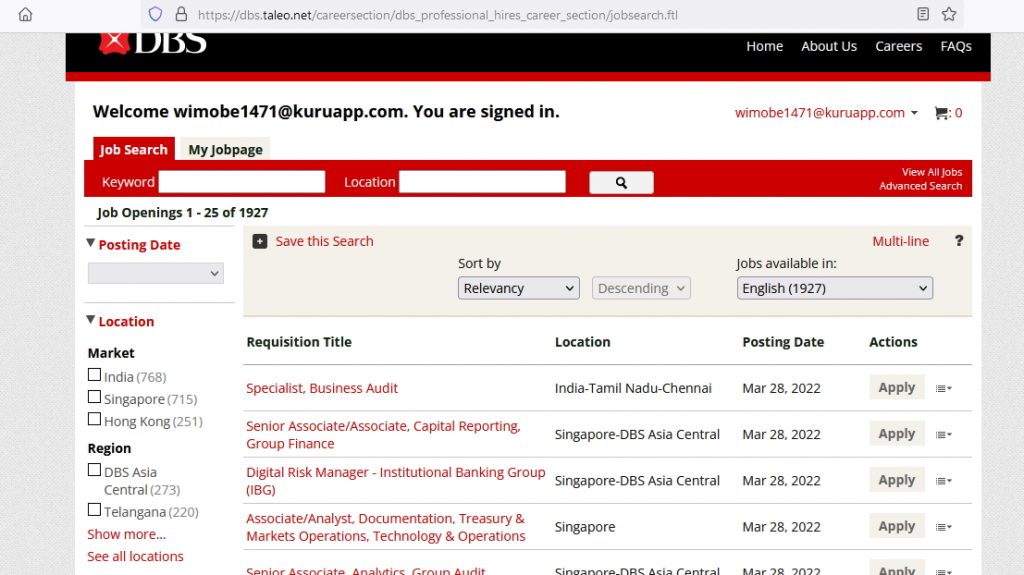

The steps to directly apply for AML-KYC jobs at DBS Bank are –

Step 01 – Create your Account at the link – DBS Bank Career Site

Step 02 –Click Search Jobs and Apply

AML-KYC professionals are responsible for following activities in their CDD & AML role at DBS Bank

- Timely monitoring of alerts generated by AML monitoring system

- Provide support for other AML /KYC requirements

- Providing support on updation of watch lists, filing of regulatory reports

- Assistance to other adhoc AML/KYC related activities

- Assist the department in audit / compliance related activities.

IDFC First Bank,Mumbai

AML-KYC JOBS in Mumbai at IDFC First Bank

IDFC First Bank is an private sector bank in India with branches across India. It is headquartered at Mumbai and has job openings for AML-KYC professionals across India.

AML-KYC professionals having following skills can apply directly to regulation and compliance profile at IDFC First Bank

- Good experience in AML-KYC regulations

- Has an understanding of FIG Compliance & correspondent banking

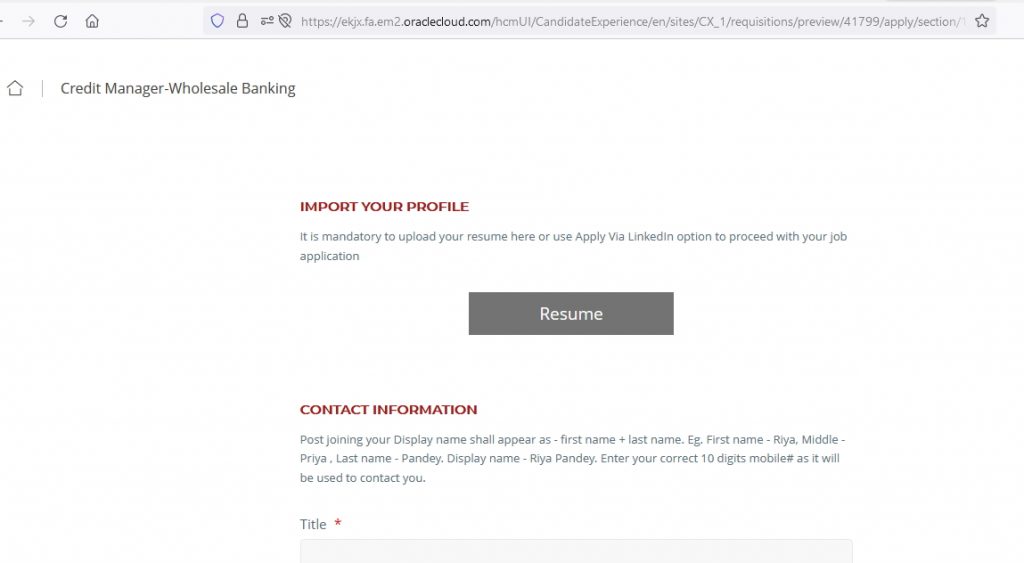

Apply directly to AML-KYC jobs at IDFC First Bank

The steps to directly apply for AML-KYC jobs at IDFC First Bank are –

Step 01 – Click Search Jobs at the link – IDFC First Bank Career Section

Step 02 –Create your Account and Apply for the position

AML-KYC professionals are responsible for following activities in their regulation and compliance profile role at IDFC First Bank

- Review of KYC document of Foreign Banks on periodic basis as per RBI regulations

- Conduct Customer Due Diligence and Entrance Due Diligence

- Sanction checks in Virtual Currencies and Downstream relationship etc.

- Review FB’s AML policies and KYC documents

- Timely monitor Wolfsburg questionnaire

JPMorgan Chase,Mumbai

AML-KYC JOBS in Mumbai at JPMorgan Chase

JPMorgan Chase & Co. is the oldest financial institution, offering investment banking, consumer and small business banking, commercial banking, financial transaction processing and asset management.

The Corporate & Investment Bank in JPMorgan Chase & Co. provides strategic advice, raise capital, manage risk and extend liquidity in markets around the world.

JPMorgan Chase & Co. has oversight and control team in Mumbai which support JP Morgan’s client within Corporate Investment Banking (CIB) and Commercial Banking (CB).

AML-KYC professionals having following skills can apply directly to KYC profile at JPMorgan Chase & Co.

- Must be detail oriented and self-directing

- Adaptable and flexible

- Strong working experience with Microsoft Word, Excel and PowerPoint

- At least 4 years of KYC experience in the banking industry

- Strong working knowledge of KYC / CIP / AML rules and regulations

- Experienced in Client Due Diligence, risk assessment and vetting of negative news.

- Excellent technical, analytical and research skills.

Apply directly to AML-KYC jobs at JPMorgan Chase

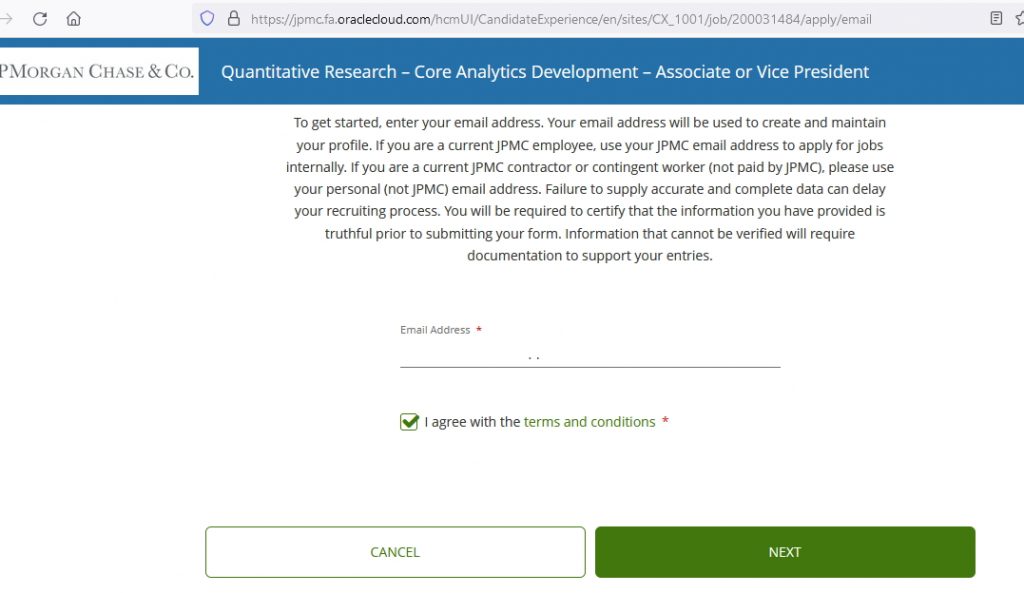

The steps to directly apply for AML-KYC jobs at JPMorgan Chase & Co. are –

Step 01 – Search jobs at the link – JPMorgan Chase Career Center

Step 02 – Click Apply and register your account

AML-KYC professionals are responsible for following activities in their KYC role at JPMorgan Chase & Co.

- Reviewing and managing various KYC exceptions/gaps

- Monitoring CSA and action plans

- Tracking, monitoring progress, escalate KYC controls and remediation

- Clean up data, documentation and coordinate with Onboarding and Compliance

- Partner on various external and internal audit RFIs and submissions

- Ascertaining that all KYC and AML policies are adhered to and conduct reviews of client’s KYC profile and documentation stored in internal repositories and publicly available information.

Macquarie Group,Mumbai

AML-KYC JOBS in Mumbai at Macquarie Group

The Corporate Operations Group of Macquarie Group at Mumbai provides support services in Digital Transformation & Data, Technology, Market Operations, Human Resources, Business Services, Business Improvement & Strategy, and the Macquarie Group Foundation.

AML-KYC professionals having following skills can apply directly to KYC profile at Macquarie Group

- At least 1 year of KYC/CLM experience

- Be detail-oriented with a strong risk mindset

- Highly organized and able to manage multiple tasks.

- Be flexible and able to quickly adapt to changing priorities

- Strong communication skills

- Team collaboration and client engagement

Apply directly to AML-KYC jobs at Macquarie Group

The steps to directly apply for AML-KYC jobs at Macquarie Group are –

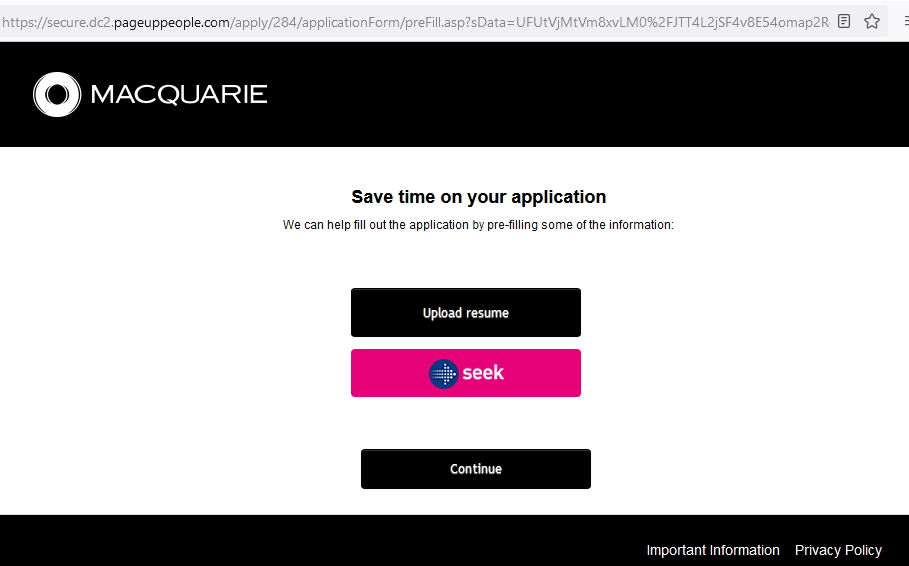

Step 01 – Search jobs at the link – Macquarie Group Career Center

Step 02 – Register and Apply

AML-KYC professionals are responsible for following activities in their KYC role at Macquarie Group

- Performing Anti-Money Laundering (AML) and non-AML due diligence on existing clients and counterparties

- Conducting research and obtaining information from publicly available resources

- Screening entities for adverse news, sanctions or politically exposed persons.

- Determining and escalating high risk triggers and other potential risk findings

Morgan Stanley ,Mumbai

AML-KYC JOBS in Mumbai at Morgan Stanley

Morgan Stanley is a global financial services firm providing investment banking, securities, investment management and wealth management services.

Morgan Stanley has Legal & Compliance (LCD) division at Nirlon Knowledge Park, Mumbai is a part of Morgan Stanley’s Global In-house Center, which provides global support to LCD and is an integral part of firm and LCD strategy for AML activities.

AML-KYC professionals having following skills can apply directly to AML profile at Morgan Stanley

- Proficient with MS Office

- Team player to manage multiple projects and priorities

- Ability to think independently, form opinions and make decisions

- Ability to anticipate ahead of time and escalate issues as appropriate

- Pragmatic and analytical problem solving skills

- Good interpersonal and communication skills

- Efficient time management skills

- Ability to research and resolve issues independently

- Attention to detail

Apply directly to AML-KYC jobs at Morgan Stanley

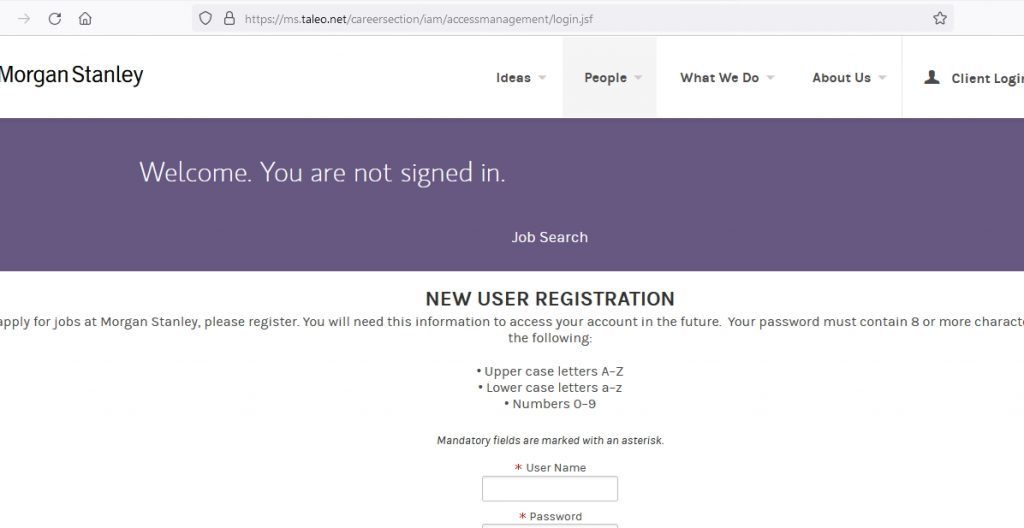

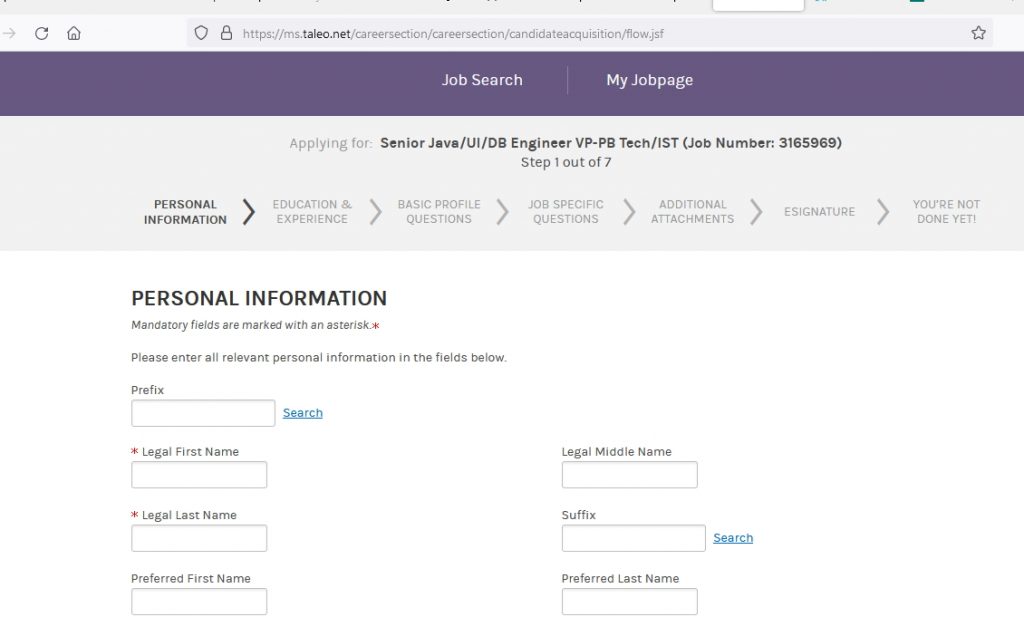

The steps to directly apply for AML-KYC jobs at Morgan Stanley are –

Step 01 – Create your account at the link – Morgan Stanley Career Center

Step 02 – Complete your details and apply for the job

AML-KYC professionals are responsible for following activities in their AML role at Morgan Stanley

- Review EDD – escalations, notes and matrix

- Escalate any possible true hits to the relevant on-shore GFC team

- Review the quality of work delivered by the team.

- Recommend enhancements to AML policies or procedures

Nium,Mumbai

AML-KYC JOBS in Mumbai at Nium

Nium is a new age fintech offering payment services to collect and disburse funds in local currencies to over 100 countries for B2B and B2C customers.

Nium has Compliance team in Mumbai to prevent Financial Fraud, Terrorism Financing, Evasion of International Sanctions, and all types of Money Laundering activities.

AML-KYC professionals having following skills can apply directly to compliance profile at Nium

- Experience in financial crime compliance

- At least 3 years of experience in KYC and Transaction Monitoring

- Strong creative problem solving and analytical thinking.

- Good hands-on experience with Advanced MS-Excel

Apply directly to AML-KYC jobs at Nium

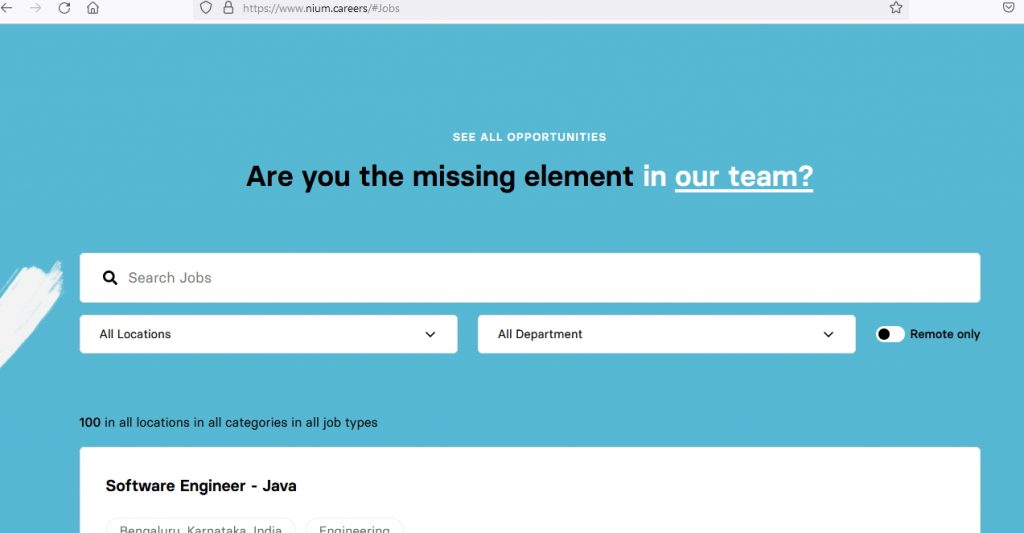

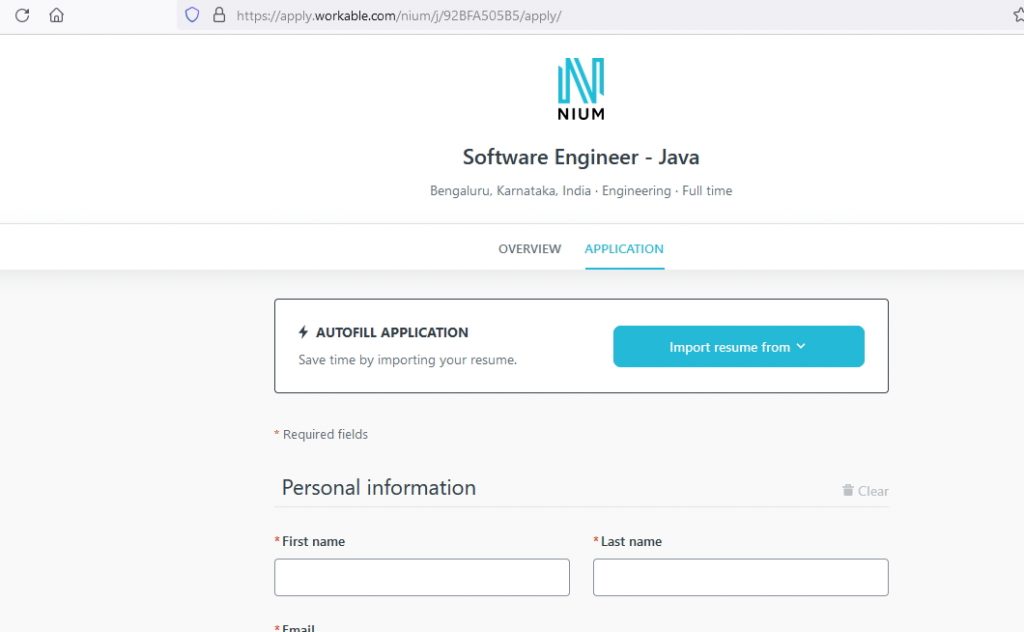

The steps to directly apply for AML-KYC jobs at Nium are –

Step 01 – Search jobs at the link – Nium Job center

Step 02 – Complete your details and Apply for the job

AML-KYC professionals are responsible for following activities in their compliance role at Nium

- Working on transaction monitoring, both live and retrospective

- Identifying and detecting suspicious and unusual activities across geographies

- Managing escalations raised by clients over email

- Preparation of Suspicious Activity Report (SAR) to MLRO / Country Financial Investigation Unit (FIU).

- Identifying red flag issues, and escalate for further investigation

Revolut,Mumbai

AML-KYC JOBS in Mumbai at Revolut

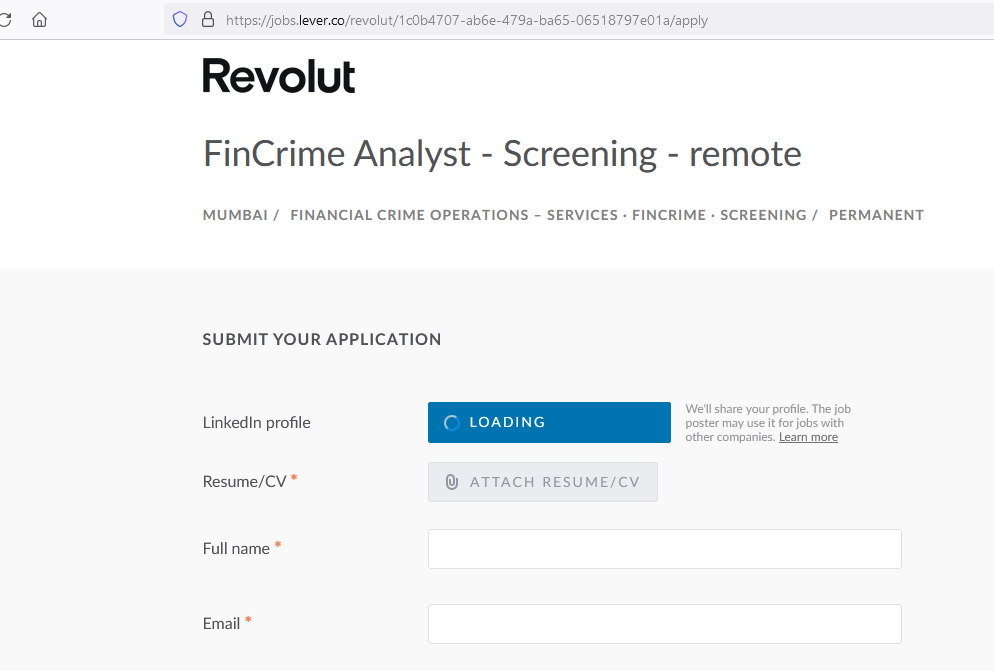

Revolut is a fintech founded in 2015 as digital alternative to traditional big banks. Revolut has a screening team in Mumbai for preventing any individuals or entities involved in financial crime, as well as sanctioned or terrorism-related entities, from using our product.

AML-KYC professionals having following skills can apply directly to financial crime screening profile at Revolut

- Excellent communication skills

- Ability to work under the pressure of time and with a high degree of accuracy

- Ability to multitask and prioritise

- Flexibility to work on shifts

- Prior experience in banking, risk, compliance or AML/KYC function

- Ability to identify potential significant elements in seemingly small things

- Ability to make difficult decisions in a short period of time

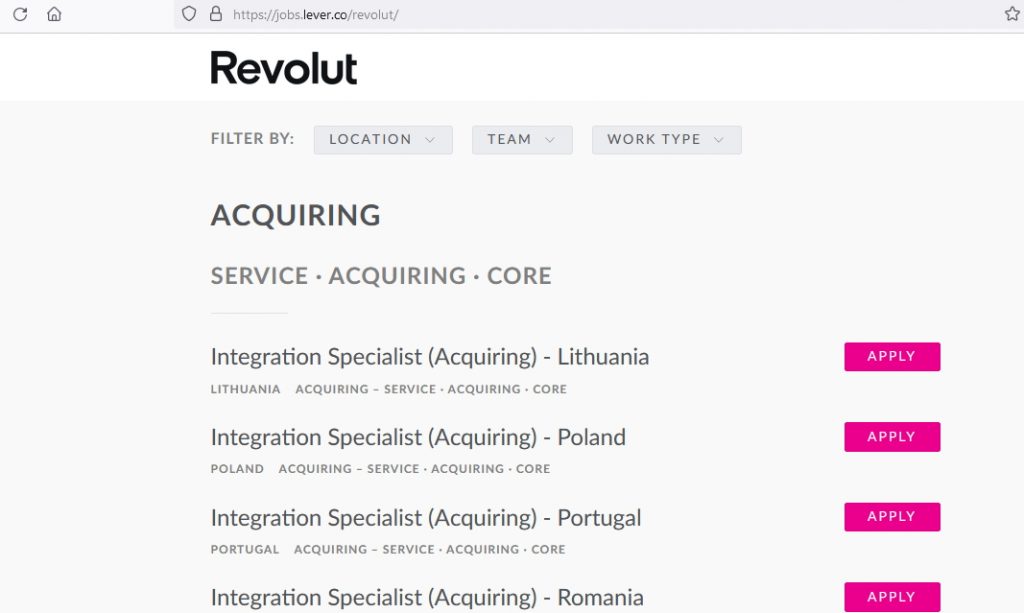

Apply directly to AML-KYC jobs at Revolut

The steps to directly apply for AML-KYC jobs at Revolut are –

Step 01 – Search for jobs at the link – Revolut Job Site

Step 02 – Provide details and apply for the job

AML-KYC professionals are responsible for following activities in their financial crime screening role at Revolut

- Conduct reviews of sanctions watchlist

- Escalate potential sanctions issues or suspicious activity

- Review and investigate PEP screening alerts

- Assist with the validation of the Sanctions and PEP alert systems

- Comply with rules and regulations, including without limitation, AML and OFAC/Sanctions requirements all internal policies, procedures and guidelines.

- Daily basis monitoring and reviewing of transfers, companies, business and individual profiles

- Handle sensitive or confidential information.