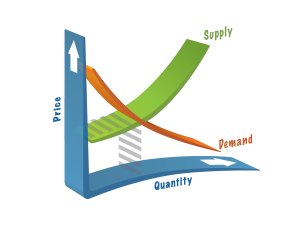

It is natural to say that the demand for a particular commodity is determined by the supply and demand for that commodity. So the weaker demand for oil and over-supply situation might be some of the reasons for a constant fall in oil prices. The price of crude oil has reached a 6 year low in the international market. This situation seems to be favorable for the Indian market as the oil imports in India accounts for the 30% of its total imports. The two-third of the requirement of the oil in India has to come from oil imports.

India being a major importer of oil has to be benefited from such a situation. There has been a subsequent reduction in the value of imports by 28.6%, noticed in the month of December, since the last year due to falling oil prices and so an improvement in the trade account. The trade account deficit has showed a reduction to $9.43 billion. A low deficit indicates that the government is holding more money comparatively which has helped in the improvement of domestic currency and a boost in GDP. The fall in imports has also helped government to reduce the burden of subsidy and also has expectation that this situation will help the current account deficit to improve largely by the end of 2014/15 fiscal year.

The negative effects are also there to affect the economy in several ways. Fall in imports from the oil producing countries could also make the demand for exports lower in the domestic country as the oil producing countries may face a slump in their economic growth. Infact, the investment from the institutions of such oil producing countries may also go down and the Indian market may face a pinch.

There are many issues that are linked with the fall in oil prices and may impact the economy in both positive and negative ways.

Click here for government certification in Accounting, Banking & Finance

4 Comments. Leave new

Good effort!

Good work..!

Nice work..!!

great one