Economy is affected by many things .Lets look out the effect of increase in saving rate in economy.

The economy is assumed to begin in a steady state with saving rate (s) and capital stock (k).When the savin g rate increases from s to s1 .At the initial saving rate S and the initial capital K ,the amount of investment just offsets the amount of depreciation .Immediately after the saving rate rises,investment is higher,but the capital stock and depreciation are unchanged.Therefore ,investment exceeds depreciation .The capital stock will gradually rise until the economy reaches the new steady state which has a capital stock and a higher level of output than the old steady state.

The saving rate is a key determinant of the steady state capital stock. If saving rate is high ,the economy will have a large capital stock and high level of output in the steady state .If the saving rate is low ,the economy will have a small capital stock and low level of output in the steady state.

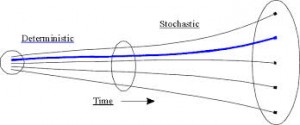

Higher saving leads to faster growth but only temporarily. An increase in the rate of saving raises growth only until the economy reaches the new steady state.If the economy maintains a high saving rate,it will maintain a high rate of faster growth forever.Policies that alter the steady -state growth rate of income per person are said to have a growth effect.By contrast higher saving is said to have level effect,because only the level of income per – not its growth rate.

7 Comments. Leave new

Nicely written.

informative article

Appropriate article!!

saving has a clear cut impact on capital stock whether it increases or decreases !

the article is to the point !

very well written !

Worth reading 🙂

really nice article

well done…