Open Market Operations- Central bank tools to stabilize the economy

In order to deal with instabilities in the economy i.e., to deal with inflation and deflation, central bank take up monetary policies to control money supply in the economy. Open market Operations(OMO) is one such monetary policy which central bank uses to control money supply in the economy.

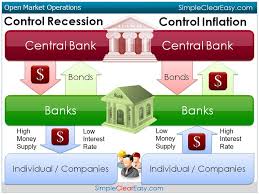

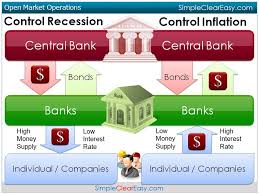

Open Market Operations or OMO refers to sale and purchase of government securities or other financial instruments (such as in India some of securities are National Saving Certificates, government bond etc. ) in the open market by the central bank . The objective of Open Market Operations is to indirectly control total money by expanding or contracting money supply in the economy. This is done by manipulating short-term interest rate and the supply of base money in the economy.

Depending on the prevailing economic scenario central bank sucks liquidity from the economy by selling the securities or the financial instruments or release liquidity in the economy by buying the securities.

In order to curb inflation central bank sells securities and cash reserves of commercial banks are squeezed which lowers their credit creation capacity. On the other hand, in order to curb deflation, central bank buy securities and release cash reserves in commercial bank and thereby increasing the credit creation capacity of the commercial banks.

Open Market operations in India

before the financial reforms of 1991, Cash Reserve Ratio and Statutory Liquid Ratio were sought to be major source of finance and control over credit and interest rates by the Reserve Bank of in India. Soon, after the reforms of 1991, the use of Cash Reserve Ratio and Statutory Liquid Ratio lost their importance and use of Open Market Operations rose tremendously to maintain a balance in the economy.

Types of Open Market Operations used by Reserve Bank of in India:

- Outright purchase (PEMO): Permanent buying and selling of government securities.

- Repurchase agreement ( REPO): It is repurchase of buying and selling of government securities on short term basis.

– Aayushi Prasad

aayuship1202@gmail.com

Click here for government certification in Accounting, Banking & Finance

13 Comments. Leave new

Nice!

Well explained

well written!

good one!

Very nice concept as controlling credit through open market operation is one of the crucial work that are government and central bank is doing so it’s always good to know about their hard work and their strategies so well done

Well codified!!

very simple and effective!it could have been better if u would have went into a little detail!anyway, good job!

good work!

Well explained

Well put, Aayushi!

Nicely Written 😀

You can release and suck funds through this medium it is indeed one of the important measures that can be enacted to control the money supply in the economy thus bringing stability in the economy, great jon

Nice work.