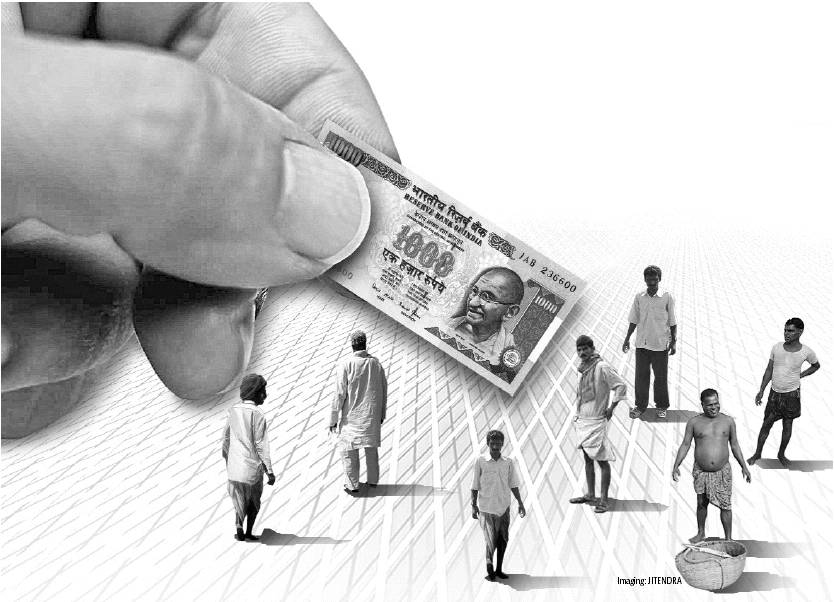

NBFC or Non-Banking Financial Companies are those that undertake activities similar to banks but with some differences. These Companies are registered in India under the Companies Act, 1956. These companies undertake activities like giving of loans and advances, provide investment facilities, wealth management, sale or purchase of shares, insurance business, etc.

However, the most important difference between a Bank and an NBFC is that NBFC’s are debarred from collecting demand deposits from the public, they are not a part of the payment and settlement system, cannot avail the support of the Deposit Insurance and Credit Guarantee Corporation and not issue cheques in their name. They don’t hold banking licenses and therefore provide specific banking services. They are primarily designed to support the banking structure in an economy and complement it. Therefore to support their activities they have to find other sources like issuing debt instruments, getting listed on the stock exchange.

Many Micro Finance Institutions incorporate themselves as NBFC’s like its an easier route to get registered with the RBI and it also provides them with much more flexible options to enhance their business capabilities and not have a rigorous structure like a Bank.

The NBFC in India are regulated by the RBI. Recently the RBI has bought out more guidelines which have to be implemented by the NBFC’s like maintaining higher Tier-I capital and revised Non-Performing Asset norms.

Click here for government certification in Accounting, Banking & Finance

8 Comments. Leave new

Good work!

terse article!

Good effort

Great efforts!!

Nice!

Great efforts 😀

keep it up 😀

good job writing this.. new post!

great…