Inflation is defined as the a general and sustained rise in prices. Having covered its causes here: http://vskills.in/certification/blog/causes-of-inflation-part-1-demand-pull-inflation/ and here: http://vskills.in/certification/blog/causes-of-inflation-part-ii-cost-push-inflation/ , I will proceed to explain the Modern Theory of Inflation. Imagine that you are driving a car at a constant speed, and suddenly you step onto the accelerator because of some reason and speed up your car. What will happen to the people travelling with you? They will be thrown backwards in their seats. The jerk will be even stronger as your poor fellow travelers had been caught unawares by the sudden acceleration. Had they expected it, they would have held on to something in the car, wouldn’t they?

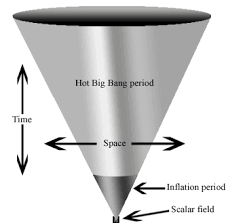

Similarly the economy may be moving at a constant speed, meaning the aggregate supply and aggregate demand (that is the sum total of the demand for goods and services and supply of goods and services respectively) may be moving at a constant rate. This implies that the economy is growing in a stable manner in real as well as nominal terms (which is the rate of inflation, the economy grows in real output and also in terms of of the value of that output-which is the rate of inflation) This rate of inflation being constant, can be predicted and absorbed into the economic decisions made by people. Households, firms and the government, who are the major economic agents, always take the current price level and anticipated price level in the future into account while taking economic decisions. The moment there is a shock in the pace of aggregate demand or aggregate supply; additional inflationary pressures are released into the economy.

When people make economic decisions, they also think of the future.

- Hence a firm, in case of a constant inflation rate, will expect it to continue further and will factor it in its wage contracts and its product pricing.

- A consumer, expecting that prices of his items of consumption will rise at the same rate as before, will not change his consumption pattern, other things being the same.

Thus people’s expectations have adapted to the ongoing inflation rate, which is built into contracts and economic arrangements. This is the inertial or the expected rate of inflation.

- Now if the aggregate demand rises suddenly, which in most cases is due to excessive money supply growth, it exceeds the economy’s productive potential, causing prices to rise more rapidly than before to bridge the gap between the aggregate demand and supply. People’s expectations of the inflation rate go haywire and they struggle to adapt to the new price scenario.

- In the example above, inflation rate, like the car passengers, will experience a shock, the car, because of the sudden acceleration and the inflation rate, because of the sudden rise in demand. This therefore is called a demand shock.

Now imagine that while driving, you suddenly see a person crossing the street in front of you. Pushed out of your stupor, you hastily press the brakes and bring the car to a halt. Again your fellow travelers will experience a jerk. Similarly if the aggregate supply moving steadily upwards experiences a shock and falls below its original level, prices will rise more rapidly than before to equal the demand with the supply.These ‘supply shocks’ may be caused by a plethora of reasons, the major among them being:

1. Sudden rise in global oil prices (called an oil shock)

2. Deficient food production

3. Sudden rise in wages

As seen above in cost-push inflation, the sudden scarcity of inputs in the production process drives prices higher. If the central bank implements a tight monetary policy (the policy of raising key policy interest rates, so as to restrict bank credit which fuels demand for output causing prices to rise), in response to the excess aggregate demand or deficient aggregate supply, the accelerated price rise is temporary and it comes down to growing at a steady rate as before, curbing the additional inflationary pressure in the process. But if the increase in aggregate demand or the decrease in aggregate supply is persistent, and no policy action is taken, the prices will go spiraling. People will now come to expect that prices will accelerate at this new rate, and hence will adjust their economic decisions accordingly. Consumers will spend more today, in fear of higher prices in the future. Their anticipation of higher prices is fuelled due to the current high rate of inflation.Wage-earners will demand raises as a safeguard for the higher cost of living in the future, raising further the cost of production. If a firm expects the current inflation rate to continue in the future, it will not bring down its prices, as it will expect that other firms will do the same.

The actual rate at which prices grow in the future is less than what is expected today, but as fear feeds onto itself, the expectations of a greater future price rise feed onto the already high prices, causing them to inflate further. This is known as inflationary expectations. According to Karl E Case and Race C Fair, “Expectations can lead to an inertia that makes it difficult to stop an inflationary spiral. If prices have been rising and if people’s expectations are adaptive, that is if they form their expectations on the basis of past pricing behaviour-that firm may continue raising prices even if demand is slowing.”

As long as aggregate demand and aggregate supply move steadily upward, the inflation rate is inertial, but the moment there are fluctuations in the inflation rate in response to demand and supply shocks, the entire equilibrium in the economy gets disturbed. The central bank of country is mandated with controlling the rate of inflation in an economy through monetary policy (which is predominantly aimed at controlling bank credit). In India, the Reserve Bank of India is entrusted with this responsibility.

Click here for government certification in Accounting, Banking & Finance

4 Comments. Leave new

Very relevant information and well explained this concept by using example.Good job!

Explained well…

I really liked your example in the beginning to illustrate inflation and it’s impact on the masses.

Very well illustrated.. Nice