We all are well aware of our basic human rights. There are laws and regulations in every country. Additionally, these rules and regulations are referred to as law. Now the question must have arisen in your mind that what actually is Labour law. Moreover, the History of Labour Laws in India dates back to the Pre-Independence British Era as these Labour and Industrial Laws were enacted by the British Administration to protect the interests of British Employers and Industrialists. So, in simple language, Labor law acts as a mediator between the employee and employer.

Furthermore, labour law primarily concerns the rights and responsibilities of unionized employees. Some groups of employees find unions beneficial since employees have a lot more power when they negotiate as a group rather than individually. Unions can negotiate for better pay, more convenient hours, and increased workplace safety. However, unions do not have limitless power. Leaders must treat all union members fairly and refrain from restricting union members’ rights to speech, assembly, and voting powers.

Additionally, employers also must follow specific rules when dealing with union members. For example, employers may only negotiate with designated union representatives and must carefully any agreement between the union and the employer.

What is Labour Law?

Now that you are well aware of the basic information about the labor law. Subsequently, the next step is to get to know it better, which, means getting in-depth knowledge about it. Labour law arose in parallel with the Industrial Revolution as the relationship between worker and employer changed from small-scale production studios to large-scale factories. Subsequently, workers sought better conditions and the right to join a labor union, while employers sought a more predictable, flexible, and less costly workforce. Additionally, the state of labor law at any one time is therefore both the product of and a component of struggles between various social forces.

List of major Labor law Acts in India

Additionally, there are numerous labour laws in India. But below are the few of them which are considered majorly:

- Firstly, Worker’s Compensation Act, 1923

- Secondly, The Trade Unions Act, 1926

- Thirdly, Payment of Wages Act, 1936

- Subsequently, Industrial Employment (Standing Orders) Act, 1946

- Furthermore, Indian Industrial Disputes Act, 1947

- Minimum Wages Act, 1948

- Next, Factories Act, 1948

- Furthermore, Maternity Benefits Act, 1961

- Payment of Bonus Act, 1965

- MRTU and PULP Act, 1971

- Last but not least, The Payments of Gratuity Act, 1972

One of the best way to learn and enhance your experience is by taking certification and training programmes that would not only help you prepare better but also examine your skills set.

Average Salary

The next important thing which pops in our mind when we are looking for any certification is how much will we earn after completing this certification. Subsequently, on average, the salary of an labor law analyst is $144,000. However, salaries can range anywhere from $65,000 to $175,000. Additionally, the highest-paid wages come from large national firms located in metropolitan areas. Furthermore, recent graduates, typically due to their minimal work experience, are the lowest paid.

How to become a Labour Law Analyst?

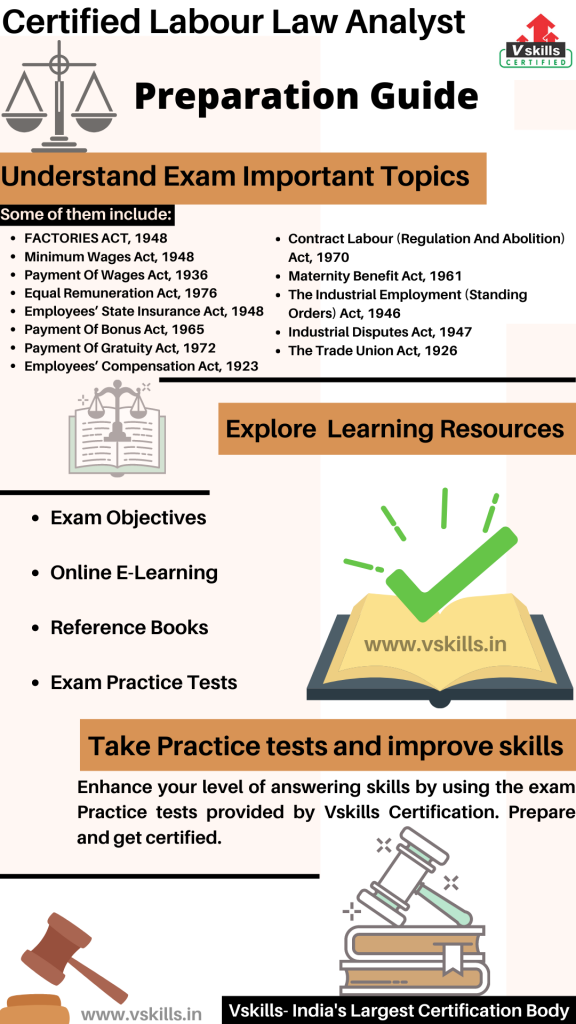

Firstly, to crack any examination you need to have a proper plan and study guide. Moreover, there is an endless list of resources that you can use for exam preparation. Subsequently, for acing the Certified Labour Law Analyst you need to prepare, practice, and work hard. To help you in your preparation, we have prepared a guide to which you can refer to. Furthermore, following this preparation guide will help you learn and understand every exam’s objectives. Here we are providing you with the best learning resources to qualify for the exam. Moreover, here we are going to illustrate a detailed description to help you prepare for the exam. Let’s get started:

Refer to Exam Objectives

Firstly, it is important to know the topics beforehand. Significantly, this is the most important step in the preparation guide. Furthermore, exam objectives are very important when it comes to preparing the exam strategy. So, let’s take a quick look:

- Firstly, FACTORIES ACT, 1948

- Secondly, the Minimum Wages Act, 1948

- Thirdly, the Payment Of Wages Act, 1936

- Subsequently, the Equal Remuneration Act, 1976

- Furthermore, the Employees’ State Insurance Act, 1948

- To add on, Payment Of Bonus Act, 1965

- Additionally, the Payment Of Gratuity Act, 1972

- Employees’ Compensation Act, 1923

- Contract Labour (Regulation And Abolition) Act, 1970

- Maternity Benefit Act, 1961

- The Industrial Employment (Standing Orders) Act, 1946

- Industrial Disputes Act, 1947

- Last but not the least, The Trade Union Act, 1926

Join a Study Group

Secondly, it is very important to interact with people who have a common aim in life. Additionally, joining study groups is a good way to get yourself fully involved with the certification exam you applied for. Furthermore, these groups will help you get up to date with the latest changes or any update happening exam. Also, these groups contain both beginners as well as professionals. Furthermore, these groups will help you get up to date with the latest changes or any update happening exam. Also, these groups contain both beginners as well as professionals. Moreover, This is a nice way for the students to discuss their issues.

E-Learning and Study Materials

Firstly, learning for the exam can be fun if you have the right set of resources matching your way of studying. Vskills offers you its E-Learning Study Material to supplement your learning experience and exam preparation. This online learning material is available for a lifetime and is updated regularly. You can also get the hardcopy for this material, so, you can prefer either way in which you are comfortable. Furthermore, you can refer, Vskills online tutorials as well.

About Certified Labour Law Analyst

Vskills Labour Law Analyst certification will help candidates to learn about labor laws. Moreover, the certification validates the candidate’s skills and knowledge on various areas that include industrial relations, trade unions, employers’ federation, collective bargaining, employee grievances, discipline, industrial conflict, ILO, labor welfare and social security.

Furthermore, candidates earning this certification will get to explore various opportunities in companies specializing in legal-related services & human resource outsourcing constantly hire skilled Labour Law Analysts.

How will I benefit from this certification?

Firstly, companies specializing in legal-related services & human resource outsourcing constantly hire skilled Labour Law Analysts. Various public and private companies also need Labour Law Analysts for their legal or human resources departments. Furthermore, Vskills Certified Labour Law Candidates will find employment in Top MNC’s and organizations like Deloitte, Fox Mandal, DSK Legal, Samsung, KPMG, PwC, E&Y.

Course Outline

1. Factories Act, 1948

1.1. Firstly, Important Definitions

1.2. Secondly, Statutory Agencies And Their Powers For Enforcement Of The Ac

1.3. Thirdly, Approval, Licensing And Registration Of Factories

1.4. Furthermore, Notice By Occupier

1.5. Subsequently, General Duties Of The Occupier

1.6. General Duties Of Manufacturers Etc.

1.7. Measures To Be Taken By Factories For Health, Safety And Welfare Of Workers

1.8. Special Provisions Relating To Hazardous Processes

1.9. Working Hours Of Adults

1.10. Additional Provisions Regulating Employment Of Women In A Factory

1.11. Employment Of Young Persons And Children

1.12. Annual Leave With Wages

1.13. Penalties And Procedures

2. Minimum Wages Act, 1948

2.1. Firstly, Important Definitions

2.2. Secondly, Fixation Of Minimum Rates Of Wages [Section 3(1)(A)

2.3. Thirdly, Revision Of Minimum Wages

2.4. Subsequently, Manner Of Fixation/Revision Of Minimum Wages

2.5. Procedure For Fixing And Revising Minimum Wages (Section 5)

2.6. Advisory Board

2.7. Central Advisory Board

2.8. Minimum Wage – Whether To Be Paid In Cash Or Kind

2.9. Payment Of Minimum Wages Is Obligatory On Employer (Section 12)

2.10. Fixing Hours For A Normal Working Day (Section 13))

2.11. Payment Of Overtime (Section 14)

2.12. Next, Wages Of A Worker Who Works Less Than Normal Working Day (Section 15)

2.13. Minimum Time – Rate Wages For Piece Work (Section 17)

2.14. Maintenance Of Registers And Records (Section 18)

2.15. Authority And Claims (Section 20-21)

2.16. Last but not least, Offenses And Penalties

3. Payment Of Wages Act, 1936

4. Equal Remuneration Act, 1976

4.1. Firstly, Act to have overriding effect

4.2. Secondly, Duty of employer to pay equal remuneration to men and women workers for same work or work of a similar nature

4.3. Thirdly, Discrimination not to be made while recruiting men and women

4.4. Subsequently, Authorities for hearing and deciding claims and complaints

4.5. Last but not least, Maintenance of Registers

5. Employees’ State Insurance Act, 1948

5.1. Firstly, Introduction

5.2. Secondly, Important Definitions

5.3. Thirdly, Registration Of Factories And Establishments Under This Act

5.4. Next, Employees’ State Insurance

5.5. Subsequently, Administration Of Employees’ State Insurance Scheme

5.6. Employees’ State Insurance Corporation

5.7. wings of the corporation

5.8. Employees’ State Insurance Fund

5.9. Employees’ Insurance Court (E.I. Court)

6. Employees’ Provident Funds And Miscellaneous Provisions Act, 1952

6.1. Firstly, Introduction

6.2. Secondly, Application Of The Act

6.3. Thirdly, Important Definitions

6.4. Subsequently, Schemes Under The Act

6.5. Furthermore, Determination Of Moneys Due From Employers

6.6. Additionally, Employer Not To Reduce Wages

6.7. Transfer Of Accounts

6.8. Protection Against Attachment

6.9. Power To Exempt

7. Payment Of Bonus Act, 1965

7.1. Firstly, Object And Scope Of The Act

7.2. Secondly, Application Of The Act

7.3. Thirdly, Act Not To Apply To Certain Classes Of Employees

7.4. Furthermore, Calculation Of Amount Payable As Bonus

7.5. Subsequently, Eligibility For Bonus And Its Payment

7.6. Bonus Linked With Production Or Productivity

7.7. Power Of Exemption

7.8. Penalties

7.9. Offences By Companies

7.10. Compliances Under The Act

8. Payment Of Gratuity Act, 1972

8.1. Firstly, Introduction

8.2. Secondly, Application Of The Act

8.3. Thirdly, Who Is An Employee?

8.4. Other Important Definitions

8.5. When Is Gratuity Payable?

8.6. To Whom Is Gratuity Payable?

8.7. The Controlling Authority and the Appellate Authority

8.8. Rights And Obligations Of Employees

8.9. Rights And Obligations Of The Employer

9. Employees’ Compensation Act, 1923

9.1. Object And Scope

9.2. Definitions

9.3. DISABLEMENT

9.4. EMPLOYER’S LIABILITY FOR COMPENSATION

9.5. Employer’s Liability When Contractor Is Engaged

9.6. Compensation

9.7. Obligations And Responsibility Of An Employer

9.8. Notice And Claim

9.9. Medical Examination

9.10. Procedure In The Proceedings Before The Commissioner

9.11. Appeals

9.12. Penalties

9.13. Special Provisions Relating To Masters And Seamen

9.14. Special Provisions Relating To Captains And Other Members Of Crew Of Aircrafts

9.15. Special Provisions Relating To Employees Aboard Of Companies And Motor Vehicles

10. Contract Labour (Regulation And Abolition) Act, 1970

10.1. Scope And Application

10.2. Act Not To apply To Certain Establishments

10.3. Important Definitions

10.4. The Advisory Boards

10.5. Registration Of Establishments Employing Contract Labour

10.6. Effect Of Non-Registration

10.7. Appointment Of Licensing Officer And Licensing Of Contractors

10.8. Welfare And Health Of Contact Labour

10.9. Rules Framed Under The Act By The Central Government On The Question Of Wages

10.10. Penalties And Procedure

10.11. Inspectors

10.12. Maintenance Of Records & Registers

11. Maternity Benefit Act, 1961

11.1. Introduction

11.2. Employment of or work by women prohibited during certain period

11.3. Right to payment of maternity benefits

11.4. Notice of claim for maternity benefit

11.5. Nursing breaks

11.6. Abstract of Act and rules there under to be exhibited

11.7. Registers

11.8. Penalty for contravention of Act by employer

12. THE CHILD LABOUR (PROHIBITION AND REGULATION) ACT, 1986

12.1. Additonally, Prohibition of employment of children in certain occupations and processes

13. The Industrial Employment (Standing Orders) Act, 1946

13.1. Firstly, Important Definitions

13.2. Certification Of Draft Standing Orders

13.3. Date Of Operation Of Standing Orders

13.4. Posting Of Standing Orders

13.5. Duration And Modification Of Standing Orders

13.6. Payment Of Subsistence Allowance

13.7. Interpretation Of Standing Orders

13.8. Last but not least, Temporary application Of Model Standing Orders

14. Industrial Disputes Act, 1947

14.1. Firstly, Introduction

14.2. Secondly, Object And Significance Of The Ac

14.3. Furthermore, Important Definitions

14.4. Additionally, Types Of Strike And Their Legality

14.5. Legality Of Strike

14.6. Dismissal Etc. Of An Individual Workman To Be Deemed To Be An Industrial Dispute

14.7. Authorities Under The Act And Their Duties

14.8. Reference Of Disputes

14.9. Voluntary Reference Of Disputes To arbitration

14.10. Strikes And Lock-Outs

14.11. Justified And Unjustified Strikes

14.12. Wages For Strike Period

14.13. Dismissal Of Workmen And Illegal Strike

14.14. Justification Of Lock-Out And Wages For Lock-Out Period

14.15. Change In Conditions Of Service

14.16. Subsequently, Unfair Labour Practices

14.17. Last but not least, Penalties

15. The Trade Union Act, 1926

15.1. Firstly, Introduction

15.2. Secondly, Mode of registration

15.3. Thirdly, Application for registration

15.4. Additionally, Provisions contained in the rules of a Trade Union

15.5. Furthermore, Certificate of Registration

15.6. Incorporation of registered Trade Union

15.7. Last but not least, Cancellation of registration

16. THE LABOUR LAWS (EXEMPTION FROM FURNISHING RETURNS AND MAINTAINING REGISTER BY CERTAIN ESTABLISHMENTS) ACT, 1988

16.1. Firstly, DEFINITIONS

16.2. Secondly, Exemption from returns and registers required under certain labour law

16.3. Last but not least, Penalty

17. EMPLOYMENT EXCHANGES (COMPULSORY NOTIFICATION OF VACANCIES) ACT, 1959

17.1. Firstly, DEFINITION

17.2. Secondly, Act not to apply in relation to certain vacancies

17.3. Thirdly, Notification of vacancies to employment exchanges

17.4. Employers to furnish information and returns in prescribed form

18. Apprentices Act, 1961

18.1. Firstly, Definitions

18.2. Secondly, Qualification For Being Engaged As An Apprentice

18.3. Thirdly, Contract of apprenticeship

18.4. Obligations of employers

18.5. Subsequently, Obligations of apprentices

18.6. Apprentices are trainees and not workers

18.7. Records and Returns

18.8. Payment to apprentices

18.9. Hours of work, overtime, leave and holidays

18.10. Conduct and discipline

18.11. Additionally, Settlement of disputes

18.12. Furthermore, Authorities under the Act

18.13. Subsequently, Offences and penalties

18.14. Last but not least, Offences by companies

19. Audit Under Labour Legislations

19.1. Firstly, Introduction

19.2. Secondly, Scope Of Labour Audit

19.3. Thirdly, Methodology Of Conduct Of Labour Audit

19.4. Subsequently, Benefits Of Labour Audit

20. Employees Provident Fund

20.1. Firstly, Employees Provident Fund (EPF) Basics

20.2. Secondly, EPF Features

20.3. Thirdly, EPF Forms

20.4. Subsequently, UAN

20.5. Furthermore, EPF Calculation and example

20.6. Online EPF Submission

20.7. Last but not least, EPFO Claim Status

21. ESI

21.1. Firstly, ESI Basics

21.2. Secondly, ESI Registration for Organization

21.3. Thirdly, ESI and Wages

21.4. Subsequently, ESI Contribution

21.5. Last but not the least, Online ESI Contribution Submission

Prepare with free Practice Test

We all know the step to success is to practice what you have learned. Moreover, taking a practice test is a great way to diversify your study strategy and ensure the best possible results for the real thing. Furthermore, analyzing the practice test is very important so as to ensure complete preparation. We provide you with free sample papers to help you excel in the examination.

Furthermore, it is very important to practice what you have learned so that you are in a position to analyze your practice. Furthermore, by practicing you will be able to improve your answering skills that will result in saving a lot of time. Moreover, the best way to start doing practice tests is after completing one full topic. It will work as a revision part for you. Furthermore, practicing you will be able to improve your answering skills that will result in saving a lot of time. Moreover, the best way to start doing practice tests is after completing one full topic as this will work as a revision part for you. Moreover, the best way to start doing practice tests is after completing one full topic. Furthermore, it will work as a revision part for you. Therefore, start practicing now!