Some countries are financially better off than other countries, ever wondered why?

Well, the answer to this question was given 240 years ago by a famous economist called Adam Smith in his book ‘An Inquiry into the Nature and Causes of the Wealth of Nations’, an answer that still holds today.

In determining the financial prowess of a country, factor endowments possessed by it play a huge role. Factor endowments are the factors available for production within a country and include entrepreneurship, land, labor and capital. Profits, rents, wages and capital gains respectively are the returns to these four factors of production

The demand for factors is a derived demand, this means that it is derived from the demand for commodities. Thus greater is the elasticity or responsiveness of the quantity demanded of a commodity to a change in its price, greater will be the demand for factors of production, everything else remaining constant.

Factor endowments depend on a country’s geographical features as well as on its social, historical and political developments and thus ceteris paribus, countries with larger endowments and countries who can efficiently use these factors for producing output tend to be more prosperous than countries with smaller endowments and those with inefficient usage of the factors of production.

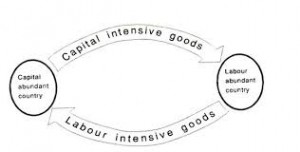

Factor endowments affect trade, industrial output and policies taken up by a country. It can be seen that every country has a comparative advantage over one or the other factor of production and according to the ‘Heckscher-Ohlin Theory of Factor Endowment’, commodities that require more of abundant factors of production and lesser of scarce factors of production will be exported in exchange of commodities with factor in the opposite direction and thus indirectly factors in abundant supply will be exported while the scarce factors of production will be imported. This means capital abundant countries will tend to export capital intensive commodities while labor abundant country will tend to export labor intensive commodities.

Efficient management of these factors of endowment is very important for a country and most successful economies seem to have realized that and this realization is something that is evident from their patterns of investment. China, with a population of 1.3 billion, is rich in labor and thus has been developing its industrial research institutes while Britain is largely trading on knowledge ideas and technology related products. Thus while, countries like Switzerland with abundant capital should specialize in producing capital intensive goods, a labor rich country like India, should concentrate more on producing labor-intensive goods to be economically prosperous.

Click here for government certifications

19 Comments. Leave new

Informative and Nicely presented! good work 🙂

It is every important for country to understand what its factor endowment is and to invest accordingly, any wrong decision can lead to a damage in the economic system. For ex- Bangladesh ha a factor endowment for jute and it is utilizing it to the fullest to sustain its economy, the climatic and soil conditions support the production of jute and hence it is there factor endowment

NYC article

Good Work 😀

very nice topic chosen.!

Good effort!

well explained 🙂

Thanks 🙂

Well explained..

Nice topic selection. Well articulated

nice 🙂

Informative!

good work!

good

Really nice article

nicely presented article..

Thanks everyone and a good point raised by you Rima!

very well written article.

nice article