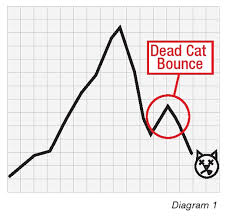

A dead cat bounce implies a short lived period of recovery in a continuous downward trend. Frequently, declining trends maybe interrupted by short term intervals which rally back towards the gap. This pattern is quite significant as well as frequent to bearish and volatile market.

For example, a $100 share falling low and currently trading at $60 which then rises to 72$ for a short period and then starts falling again. The dead cat bounce in this situation is the upward rally from $60 to $72. However it is not market recovery. It is just a dead cat (stock) falling from great height and bouncing a little just to fall back again.

A dead cat bounce may occur because of the investors who may think that the market has hit its bottom and start investing. Other reasons for dead cat bounce to occur maybe of short selling or because of other speculative reasons. As such, it presents quite lucrative opportunities for short term investors to get some profits on their deals.

Such trends and pattern can be predicted by using some technical and fundamental analysis. However, it is difficult to accurately predict them and requires a thorough understanding of investor psychology as well as market trends and reversals.

Click here for government certification in Accounting, Banking & Finance

14 Comments. Leave new

Good effort but more explanation is required.

Nicely written!

Nice work!

Interesting article

Unique…

nice one

Good effort!

Good work

well written

Catchy title

what i loved was the title of the article… and the article being really good and descriptive.

great…

Something new to read

interesting