“Zambia Credit Rating cut by S&P on widening budget deficit”

“S&P cuts Bank of India’s credit profile rating”

“Weak monsoon to be credit negative for India: Moody’s”

Ever wondered what these statements refer to? What are these “credit ratings”? Who are the people or institutions which give these ratings? Who are they given to? How much reliable are they, and how are they calculated?

Just as we are given marks in college or grades in school, companies and sovereigns are given credit ratings. (This analogy clearly highlights the importance of Credit ratings.) Credit ratings are measures of the credit worthiness of a debtor. They are opinions about the relative ability and willingness of issuers of debt to meet their financial obligations. These are provided only to corporations and governments, and also to their debt instruments. Evaluations of individuals’ credit worthiness are known as credit reporting and are done by Credit Bureaus (maybe an article on that later!).

So why credit ratings? Imagine a situation where two of your friends come up to you and ask for some money. Let’s say Rs. 2000. One of the friends is trustworthy, and you know that he’ll return it in time. But the other one hasn’t even repaid the earlier amount which he had borrowed a few months back. To whom would you lend the money?

Similar situations, but in a more complex manner and involving huge amounts, happen in the business world. So a bank may use credit ratings to assess counterparty risk (the potential risk that a party to an agreement may not fulfill its financial obligations) in deciding whether to lend money to a particular organization or not.

Credit ratings are also used by retail investors to assess credit risk and to compare different issuers and debt issues when making investment decisions and managing their portfolios. Institutional investors often use credit ratings to supplement their own credit analysis of specific debt issues.

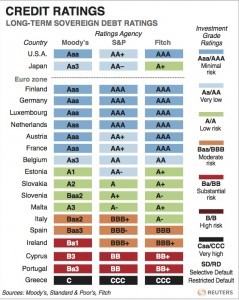

Credit Ratings are provided by Credit Rating Agencies. Apart from the Big Three agencies – Standard & Poor’s (S&P), Moody’s, and Fitch – having a combined market share of roughly 95% and issuing ratings across industry sectors and around the world, there are specific regional and niche rating agencies that tend to specialize in a geographical region or industry.

A broad range of financial and business attributes are reviewed. The specific risk factors that are analyzed depend in part on the type of issuer. For example, the credit analysis of a corporate issuer typically considers key performance indicators (like the financials of the company, key ratios etc.), economic, regulatory, and geopolitical influences, management and corporate governance attributes, and competitive position. In rating a sovereign or national government, the analysis may concentrate on fiscal and economic performance, monetary stability and the effectiveness of the government’s institutions.

So the next time you decide to invest in a particular company or a bond, don’t forget to check its credit rating!

Click here for government certification in Accounting, Banking & Finance

25 Comments. Leave new

informative..

Thanks

Very informative

Thanks!

nice article…and i think more strictness should be there in terms of giving ratings because sometimes big companies tend to buy these agencies and obtain high ratings…

Yes, absolutely correct!

very informative and interesting article….credit rating is very important

thanks

Very well explained and informative.

Thanks!

A very thorough and well composed piece.

Thanks a lot!

Informative 😀

Thanks 🙂

very informative one…

thanks..

Good article!

thanks

Very nicely explained!

Thanks!

Nice article!!

Thank you!!

Enlightening to the common man-cum-investor

Thanks! 🙂

Enlightening to the common man cum investor