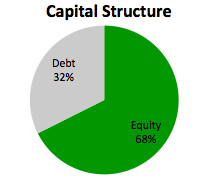

There are various capital structure theories from the available literature are as follows:-

Net income Theory (1952): Durand, David (1952) first time stated that the capital structure influences the value of the firm and the overall cost of capital. He further stated that firm value will be highest when overall cost of capital will be lowest.

Modigliani & Miller Theory (1958): This theory states that capital structure decision of the firm is irrelevant for the value of a firm under some restrictive assumption no corporate taxes, and bankruptcy cost, no agency cost, no information asymmetric.

Net Operating income Theory: This theory states overall cost of capital remains constant irrespective of the debt content. If the cost of debt is assumed to be constant, then the cost of equity increases with leverage.

Traditional Theory (1963): According to the traditional approach cost of equity constantly increases with leverage and cost of debt increases beyond a point with leverage when the cost of debt is less than the cost of equity. According to Solomon (1963) that the cost of capital is dependent on the capital structure and there is an optimal capital structure which minimizes the cost of capital.

The trade-off theory (1973): Kraus & Litzebnerger (1973) stated that the firms by trading off the costs against the benefits of the use of debt and equity after accounting for market imperfections such as taxes, bankruptcy costs and agency costs achieves optimal capital structures.

Agency Cost Theory (1976): Jensen & Meckling (1976) stated that the existence of agency cost happens due to the asymmetric information. More or less Agency problem exists but debt minimizes the rift between managers and shareholders.

The pecking order theory (1984): The pecking order theory (Myers, 1984, Myers and Majluf, 1984) states that firm first choose internal source which is cheaper and secondly firm goes for an external source, debt in the form of a debenture or long-term loan which comparatively cheaper than other sources.

Market timing theory (2002): Baker and Wurgler (2002) stated that companies time their equity issues in a way that they issue fresh stock when the stock prices are overvalued and buy back shares when they are undervalued. As a result, variations in stock prices influence a firm’s capital structures.

Click here for government certification in Accounting, Banking & Finance

8 Comments. Leave new

Good explanation..!

Well explained and informative.

nice one …wonderful post .liked it

Good article. Sir !

Good one.

Nice work!

Well researched 🙂

Very well researched content 😀

The content , presentation as well as the subtopic 😀

Really Awesome 😀 Good work 😀