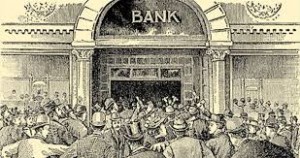

A shout of “fire” in a panicked voice by somebody in a crowded strikes the same fear into most of us. We immediately get up and progressively walk, jog, and finally run in panic to the nearest exit even before finding out whether it is a false alarm or how bad the fire may be.After all, it is better to be safe than sorry..A bank run situation is lethal to the economy and it usually occurs when a large number of bank or other financial institution’s customers demand their cash and they cant supply the cash being demanded as they have invested the money in other fields.In other words when customers withdraw their deposits simultaneously due to concerns about the bank’s solvency it is quite similar to a person running for fire as they have no idea if the panic is reasonable or not but people just want their money with them.

A bank run is typically the result of panic and not due to true insolvency on the part of the bank and when everyone starts taking out money from the bank havoc spreads when everyone wants to have their cash in hand. As more and more people withdraw their funds the probability of default increases more and more. In extreme cases, the bank’s reserves may not be sufficient to cover all the withdrawals that everyone wants to make. The bank does risk default as more and more individuals withdraw funds .If the demand for withdrawal cant be controlled a simple panic can turn into a default situation.

The generalization among people that if a particular bank is in trouble then maybe all are in trouble. Thus, a run on one bank could cause a chain reaction and cause failure of large number of failure of banks nationwide and destabilize the financial system and possibly the economy.In other words people cause the bank run and it is usually due to the irrational behavior of human beings.

Banks usually keep only a small percentage of deposits as cash on hand which might be at the statuary rate ( the rate decided by the central bank of the nation).The Banks now have to increase the cash on hand they must increase cash to meet depositors’ withdrawal demands which may not be possible over-night. The sudden increase on demand has caused a asset-liability mismatch on the part of the bank as they had expected the demand to arise at a future date and had plans to invest accordingly. One method a bank uses to quickly increase cash on hand is to sell off its assets usually at significantly lower rates than the prices at which they actually could have sold. Losses on selling the assets at lower prices can cause a bank to become insolvent. A “bank panic” occurs when multiple banks endure runs at the same time.

There are several techniques to prevent or mitigate the effects of bank runs. The techniques include supervision and regulation of commercial banks, after a run has started a temporary suspension of withdrawals,bailing out the banks and central bank acting as lender at the last resort .The techniques may or may not work depending upon the trust of individuals upon the Government,bank and Central Bank.

The next time there is a bank run situation remember to be calm understand the situation of the bank and then only react rather than going for a wild goose chase.If everyone is calm when a bank runs into small trouble then its likely that it wont turn into a total disaster.

Click here for government certification in Accounting, Banking & Finance

12 Comments. Leave new

Extremely interesting post. The Bank Runs can be harmful for the economy and might turn it upside down. Then only a force from outside can pull the economy back into situation.

Very informative!

I hope you guys liked the post.Yes indeed, a bank run could turn the economy upside down and it would be a long time before faith was restored in banks.

Informative article

Informative article..!

Very informative..well described!

Interesting article, unique concept.

Interesting article!

good one

Very informative one 😀

Simply awesome

GOod work 😀

nice

good one …