Accruals are used to recognise revenues and costs booked in one period but relating

to another period

The main categories of accruals are:

1)Prepaid costs; i.e., charges relating to goods or services to be supplied later. For

instance, three-quarters of a rental charge payable in advance for a 12-month

period on 1 October each year will be recorded under prepaid costs on the asset

side of the balance sheet at 31 December

2)Prepaid income; i.e., income accounted for before the corresponding goods

or services have been delivered or carried out. For instance, a cable

company records three-quarters of the annual subscription payments it receives

on 1 October under prepaid income on the liabilities side of its balance sheet at

31 December

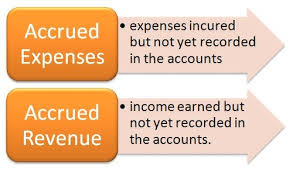

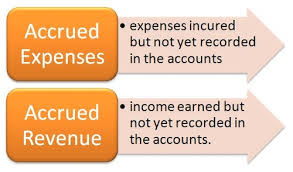

We should also cite accrued income and cost, which work in the same way as

prepaid income and cost, only in reverse.

Click here for government certification in Accounting, Banking & Finance

7 Comments. Leave new

This is a mandate topic to understand in finance.

nice work,wonderful post

Good one !

Good work!

Good one.. well written..

Very well wriiten 😀

Got to know something new 😀

As the content as well as the presentation was really good 😀

and as the topic say introduction 😀 basic and brief information served 😀

a live example should also be introduced that is lacking 🙁

rest all

good work 😀

😀

Commendable work 🙂