In today’s fast-paced world of finance and insurance, underwriters play a crucial role in making decisions that directly impact both businesses and individuals. Therefore, the need for skilled underwriters is expected to grow exponentially in the coming years. With new risks emerging, regulations evolving, and a greater focus on personalized solutions, the role of an underwriter has never been more important. Whether it’s assessing the risks of insuring a new business, evaluating a mortgage, or setting premiums for health insurance, underwriters are at the heart of balancing risk and reward. This career path not only offers a chance to make meaningful contributions but also provides diverse opportunities in a field that’s both challenging and rewarding. As we look to the future, there’s never been a better time to explore a career in underwriting.

Underwriting is a critical function in the financial and insurance industries, serving as the backbone of risk management. Underwriters play a pivotal role in evaluating the risks associated with insuring people and assets and deciding whether to accept or reject these risks. This comprehensive blog focuses into the role of underwriters and explores the different types of underwriting: life, health, and property underwriting.

Who are the underwriters?

Underwriters play a crucial role in the financial and insurance sectors, acting as the gatekeepers who assess and manage risk. Their primary responsibility is to evaluate and decide whether to accept or reject applications for insurance, loans, and securities, determining the terms and conditions under which these applications are approved. This role is essential for ensuring that companies take on a balanced amount of risk, which is critical for their long-term stability and profitability.

The Role of Underwriters

Underwriters operate across various industries, including insurance, banking, and securities. While their specific duties can vary depending on the industry, the core of their job remains consistent: evaluating risk and making informed decisions based on that evaluation.

- Insurance Underwriters: In the insurance industry, underwriters assess the risk associated with insuring a person, business, or asset. They analyze information provided by applicants, such as health records for life insurance or driving records for auto insurance. Based on this information, they determine whether to offer insurance, the premium rate, and the terms of coverage. Their decision-making process involves using sophisticated software, historical data, and industry knowledge to predict the likelihood of claims being made.

- Loan Underwriters: In banking and finance, underwriters evaluate loan applications. They assess the creditworthiness of individuals or businesses applying for loans by examining factors such as credit scores, income levels, employment history, and debt levels. The underwriter’s role is to ensure that the lender is protected from the risk of default while providing fair opportunities for borrowers to access credit. Loan underwriters are particularly important in mortgage lending, where the stakes are high for both the borrower and the lender.

- Securities Underwriters: In the securities industry, underwriters are typically investment banks or other financial institutions that help companies raise capital by issuing stocks or bonds. They assess the financial health of the issuing company and determine the appropriate price at which the securities should be offered to investors. Securities underwriters play a critical role in initial public offerings (IPOs), where they help set the price of the company’s shares, buy the shares from the company, and then sell them to the public.

Job Roles and Responsibilities of an Underwriter

Underwriters play a vital role in evaluating the risk presented in loan applications. As mentioned by Finance Strategists, underwriters determine the level of risk associated with different types of lending opportunities. They may work directly for companies that are in the business of making loans, or they may be employed by insurance companies that protect against specific types of financial loss.

For example, an underwriter at a life insurance company might determine which applicants will be approved for coverage, based on their age, family history, and state of health. The underwriter assesses your proposal and your eligibility for the cover to be provided.

There are two underwriting principles –

- Financial underwriting – assuming that you are opting for a life cover of 1 crore, a financial underwriting process would check your current income and professional status for 1 crore cover. The idea is that you should be able to pay off the premia on time and that you are not covered for a large sum disproportionate to your current income, you never know how an individual can misuse this.

- Medical underwriting– while providing you with a cover a medical underwriter would assess your medical conditions by subjecting you to medical scrutiny through a medical practitioner or lab tests. The idea is that at the time of accepting your proposal, the individual should be fit enough. After all no company wants to lay a claim 🙂

An underwriter’s job is to make sure that the life proposal accepted by them will have the least probability of turning into a claim.

Insurance underwriters are supposed to:

- accept or reject risks

- propose appropriate terms and conditions for the accepted risks

However, because of their human nature and personal interest (keeping the job) sometimes not being fully aligned with the company goal, when facing strong competition, they tend to vitiate both risk acceptance and terms & conditions, given the delayed nature of results in the insurance business.

The underwriter on an IPO (or indeed a secondary raising) will typically be a large investment bank, or often a syndicate of banks (called joint bookrunners). The capital raising will comprise a specified number of shares in the company representing a proportion of total ownership.

The bookrunner/s does not buy the shares from the issuer in advance of the IPO, but rather underwriting the transaction represents an agreement that the bank/s will purchase any shortfall (i.e. any proportion of the raising that is not covered) from the issuer at the issue price. Their role is to build the book i.e. to source out an appropriate mix of investors that will cover the shares to be issued. Key considerations in this process include trying to get the highest price possible as this a) raises a higher amount of capital for the issuer, but also b) increases the commission paid to the bookrunner/s. This needs to be balanced against trying to have the right mix of buyers to improve the quality of the secondary market.

Usually, as an institutional investor you have the opportunity to bid into the bookbuild, indicating that you are willing to buy X shares at one price, Y shares at a higher price (where Y<X) and so on. Some investors may be locked up as cornerstone investors, which carries an agreement that they won’t sell any shares for an agreed period.

As you have noted underwriting comprises a fair degree of risk for the bookrunner/s. To help manage this risk they will frequently engage in sub-underwriting agreements with their institutional clients – this is somewhat similar to reinsurance. Essentially the institution will agree to purchase a specified number of shares from the bookrunner at the issue price if there is a shortfall – this is rare for an IPO (as it would just be priced to clear!) but does happen from time to time with secondary raisings where the market remains active. Essentially the institution is short a put option on the stock with the issue price representing the strike.

In return for agreeing to sub-underwrite the deal the institution will be paid a premium upfront, as well as usually an additional premium on exercise should the stock not be cleared (referred to as getting hit).

Process of Underwriting

The Underwriting Process

The underwriting process varies depending on the industry but generally follows a similar pattern:

- Application Review: The process begins when an individual or business submits an application for insurance, a loan, or securities issuance. The underwriter reviews the application and gathers all necessary information, such as financial statements, health records, or property details.

- Risk Assessment: Next, the underwriter evaluates the risk associated with the application. In insurance, this might involve predicting the likelihood of an insured event occurring, such as a car accident or a house fire. In lending, it might involve assessing the likelihood that the borrower will repay the loan. This assessment often involves the use of statistical models and risk assessment tools.

- Decision-Making: Based on the risk assessment, the underwriter decides whether to approve the application. If the application is approved, the underwriter also determines the terms, including the premium or interest rate, coverage limits, or loan amount. In some cases, the underwriter might require additional conditions, such as a higher premium for insurance or a larger down payment for a loan.

- Policy or Contract Issuance: If the application is approved, the underwriter issues a policy, contract, or loan agreement that outlines the terms and conditions. The applicant can then accept or reject the offer.

- Ongoing Monitoring: In some cases, the underwriter’s role doesn’t end with the approval of the application. They may continue to monitor the situation to ensure that the terms of the contract are being met and that the risk remains acceptable. For example, an insurance underwriter might review a policyholder’s claims history over time, or a loan underwriter might monitor a borrower’s repayment behavior.

Skills and Qualifications of Underwriters

Underwriting is a complex and analytical job that requires a blend of technical skills and industry-specific knowledge. Key skills and qualifications include:

- Analytical Skills: Underwriters must be able to analyze large amounts of data and make sound decisions based on that data. This involves understanding statistical models, financial statements, and risk assessment tools.

- Attention to Detail: Given the high stakes involved, underwriters need to have a keen eye for detail. Missing a key piece of information or making a small mistake in the assessment process can lead to significant financial losses.

- Industry Knowledge: Underwriters need a deep understanding of the industry they work in, whether it’s insurance, banking, or securities. This includes knowledge of industry regulations, market trends, and risk factors.

- Communication Skills: Underwriters often need to explain their decisions to other stakeholders, such as clients, agents, or executives. This requires strong communication skills, both written and verbal.

- Decision-Making: Underwriters must be comfortable making decisions that can have significant financial implications. This requires confidence, sound judgment, and the ability to weigh multiple factors.

- Technical Proficiency: In today’s digital world, underwriters need to be proficient with various software tools, such as risk assessment models, underwriting software, and data analysis tools.

Underwriting can be broadly categorized into three main types: life underwriting, health underwriting, and property underwriting. Each type involves specific processes and criteria tailored to the nature of the insurance being provided.

Life Underwriting

Life underwriting involves assessing the risk of insuring an individual’s life. The primary objective is to determine the likelihood of the insured person’s death during the policy term and to set appropriate premium rates based on this risk.

Key Factors in Life Underwriting

- Age: Younger applicants typically pose a lower risk, resulting in lower premium rates.

- Health Status: Medical history, current health conditions, and lifestyle choices such as smoking and drinking habits are crucial factors in assessing risk.

- Occupation: High-risk occupations may lead to higher premium rates due to the increased likelihood of accidental death.

- Family History: A family history of certain diseases can indicate a higher risk for the applicant.

- Lifestyle: Hobbies and activities that involve significant risk can affect the underwriting decision.

Process of Life Underwriting

- Application Review: The underwriter reviews the application form, which includes personal information, medical history, and lifestyle details.

- Medical Examination: Depending on the policy amount and the applicant’s age and health, a medical examination may be required.

- Risk Classification: Based on the gathered information, the underwriter classifies the applicant into a risk category (preferred, standard, or substandard).

- Premium Calculation: The underwriter calculates the premium based on the risk classification and policy terms.

- Approval or Denial: The underwriter decides whether to approve or deny the application.

Health Underwriting

Health underwriting focuses on assessing the risk of providing health insurance to an individual or group. The goal is to evaluate the potential costs of providing medical coverage and to set premium rates accordingly.

Key Factors in Health Underwriting

- Medical History: Previous illnesses, surgeries, and ongoing medical conditions are critical in assessing risk.

- Current Health: Current health status, including weight, blood pressure, and other vital indicators, is evaluated.

- Lifestyle Choices: Smoking, alcohol consumption, and other lifestyle habits can significantly impact health underwriting decisions.

- Age and Gender: These factors can influence the likelihood of certain health conditions and the associated costs.

- Occupation: Some occupations may expose individuals to health risks that need to be considered.

Process of Health Underwriting

- Application Review: The underwriter examines the application, which includes detailed medical history and lifestyle information.

- Medical Examination: Depending on the insurer’s requirements, a medical examination may be conducted.

- Risk Assessment: The underwriter evaluates the potential health risks and estimates the cost of providing coverage.

- Premium Calculation: Premium rates are determined based on the assessed risk and the chosen policy.

- Approval or Denial: The underwriter decides whether to approve or deny the application based on the risk assessment.

Property Underwriting

Property underwriting involves assessing the risk of insuring physical assets, such as homes, commercial buildings, and vehicles. The primary objective is to evaluate the potential for damage or loss and to set appropriate premium rates and coverage terms.

Key Factors in Property Underwriting

- Location: The location of the property can significantly impact the risk of natural disasters, theft, and other hazards.

- Property Type and Age: The type, construction, and age of the property can influence the likelihood of damage or loss.

- Value of Property: The market value and replacement cost of the property are essential in determining coverage limits and premium rates.

- Security Measures: The presence of security systems, fire alarms, and other protective measures can reduce the risk of loss.

- Claims History: Previous claims made on the property can indicate higher risk and affect underwriting decisions.

Process of Property Underwriting

- Application Review: The underwriter reviews the application, which includes details about the property, its location, and its value.

- Inspection: Depending on the insurer’s requirements, a physical inspection of the property may be conducted.

- Risk Assessment: The underwriter evaluates the potential risks associated with the property and its location.

- Premium Calculation: Premium rates are determined based on the assessed risk and the chosen coverage limits.

- Approval or Denial: The underwriter decides whether to approve or deny the application based on the risk assessment.

Underwriting Job Role – Skills Required

Underwriting is a critical function in industries like insurance, banking, and securities, where professionals evaluate and manage risk. The role of an underwriter requires a blend of technical expertise, analytical prowess, and interpersonal skills. Here’s a breakdown of the key skills needed to excel in an underwriting role:

1. Analytical Skills

- Data Analysis: Underwriters analyze large volumes of data to assess risk. This involves interpreting financial statements, health records, credit reports, or market trends, depending on the industry.

- Risk Assessment: The ability to identify and evaluate risk factors is at the heart of underwriting. This skill involves understanding probability, risk modeling, and how different variables impact risk.

- Attention to Detail: Even small errors in risk assessment can lead to significant financial losses, so underwriters must have a meticulous approach to reviewing data and documents.

2. Industry Knowledge

- Regulatory Understanding: Underwriters need to be well-versed in industry-specific regulations, such as insurance laws, banking regulations, and securities guidelines. This knowledge ensures compliance and helps in making informed decisions.

- Market Awareness: Staying updated with industry trends, economic conditions, and emerging risks is crucial for making accurate assessments. This might include keeping an eye on changes in health trends for health insurance underwriters or market conditions for loan underwriters.

3. Technical Proficiency

- Software Proficiency: Underwriters use various software tools for data analysis, risk modeling, and decision-making. Familiarity with underwriting software, statistical analysis tools, and financial modeling software is often required.

- Automation and AI: As technology plays a larger role in underwriting, understanding automation tools and AI-driven analytics is increasingly important. These tools can streamline processes but require underwriters to adapt and leverage them effectively.

4. Communication Skills

- Written Communication: Underwriters must clearly document their findings, decisions, and the rationale behind those decisions. This includes writing reports, risk assessments, and policy recommendations.

- Verbal Communication: The ability to explain complex concepts in a clear and concise manner is crucial, whether discussing terms with clients, collaborating with agents, or presenting findings to management.

- Negotiation Skills: In some cases, underwriters need to negotiate terms with clients or intermediaries, requiring both tact and a deep understanding of the underwriting process.

5. Decision-Making Skills

- Judgment and Problem-Solving: Underwriters often deal with complex cases that require sound judgment and the ability to solve problems creatively. This involves weighing the potential risks against the benefits and making decisions that align with the company’s risk appetite.

- Ethical Decision-Making: Maintaining ethical standards is crucial in underwriting, especially when faced with borderline cases where the risk is not clear-cut. This involves making decisions that are not only financially sound but also ethical.

6. Interpersonal Skills

- Client Interaction: Underwriters often interact with clients, brokers, or agents. Building and maintaining positive relationships is essential, especially when discussing sensitive topics like risk and coverage terms.

- Team Collaboration: Underwriters frequently work as part of a team, particularly in large organizations. Collaborating effectively with colleagues in risk management, claims, sales, and other departments is important for cohesive decision-making.

7. Organizational Skills

- Time Management: Underwriters must manage multiple cases simultaneously, often under tight deadlines. Strong time management skills help ensure that all applications are reviewed thoroughly and decisions are made in a timely manner.

- Prioritization: The ability to prioritize tasks based on the complexity of the case, the amount of information available, and the potential impact on the organization is key to being effective in this role.

8. Adaptability

- Learning Agility: The financial landscape is constantly evolving, with new risks and regulations emerging regularly. Underwriters need to be quick learners, able to adapt to changes and continuously update their knowledge base.

- Flexibility: Being open to change and adaptable in the face of shifting market conditions, regulatory updates, or new company policies is essential for long-term success in underwriting.

9. Ethical Standards

- Integrity: Underwriters must uphold the highest ethical standards, as their decisions have significant financial implications for both clients and their own companies. Integrity ensures that they act in the best interest of all parties involved.

The role of an underwriter is multifaceted, requiring a diverse skill set that blends analytical expertise with strong communication and decision-making abilities. As the financial and insurance sectors continue to evolve, underwriters who cultivate these skills will find themselves well-equipped to navigate the complexities of risk assessment and management. Whether you’re considering a career in underwriting or looking to advance in the field, focusing on these key skills will help you succeed in this dynamic and critical profession.

How to Become an Underwriter?

Step 1: Earn a Bachelor’s Degree

Some students choose to pursue a degree in financing or business administration or another related program, such as a Bachelor of Science in Insurance. Other students acquire an education in business law or accounting.

Students aspiring to work as life insurance underwriters should volunteer or work part-time in an insurance company. Students can learn about the insurance industry, as well as develop their skills while working on their undergraduate degrees. The acquired knowledge can be an asset when applying for a permanent position. Students should also consider work or co-op programs for college students offered by some insurance companies.

Step 2: Get Work Experience

Recent college graduates may want to consider entry-level jobs to gain more work experience before applying for more complex positions. By starting in entry-level jobs, such as insurance policy processing clerks and procurement clerks, candidates can learn about the insurance industry, acquire skills in using computers and develop their analytical and reasoning abilities for more complex work.

Step 3: Complete Training

Job training is typically a requirement of all trainees or assistants starting in the underwriting business. Candidates who have acquired insurance experience or received a degree can work as a trainee under the supervision of an experienced worker, helping them to perform routine research and applications. During this time, a life insurance underwriter also studies more complex claim files.

Step 4: Obtain Certification

Most employers expect insurance underwriters to obtain certification. Through the coursework required for Vskills Underwriter certification, new employees stay up-to-date on changes within insurance industry policies and standards, especially as they may apply to federal and state regulatory requirements. Introductory certification is offered through organizations that include The Institutes and the American College.

These organizations also offer continuing education courses for underwriters participate in continuing education. Because of various changes that regularly impact the insurance industry, it can be beneficial to continue training.

Step 5: Gain Experience

Insurance underwriters learn and obtain new skills on the job. With enough experience, promotion to a senior position or management position, which may involve mentoring, training, or managing the performance of newer employees, is possible for underwriters who demonstrate leadership ability.

Life insurance underwriters use specific criteria to assess the risks of providing insurance coverage to individuals seeking a policy. A bachelor’s degree in a relevant field is preferred by employers, though experience may be enough for employment. As of 2015, insurance underwriters earned a median wage of just over $65,000 annually.

Expected Salary

The average salary for an Underwriter in India is approximately ₹5,97,604 per year, with the highest salary being around ₹9,34,713 per year and the lowest around ₹4,22,478 per year. Salaries can vary based on experience, location, and the employing company’s policies. Entry-level positions typically range from ₹3 to ₹5 lakhs per annum.

The average base salary for an insurance underwriter trainee is ₹3,05,840 per year, while the average base salary for a licentiate underwriter is ₹8,31,125 per year.

These figures indicate that underwriters in India have the potential to earn competitive salaries, with variations based on different factors.

Some of the top companies hiring underwriters in India include:

MPOWER Financing- Average Salary: ₹8,20,243 per year

ICICI Lombard- Average Salary: ₹7,47,979 per year

These companies are known for offering competitive salaries to underwriters in India. The average salary for an underwriter in India is approximately ₹5,97,604 per year, with the highest salary being around ₹9,34,713 per year and the lowest around ₹4,22,478 per year.

Salaries can vary based on experience, location, and the employing company’s policies.

How to make a Career as an Underwriter?

A career as an underwriter is both challenging and rewarding, offering a unique blend of analytical work, decision-making, and the opportunity to impact businesses and individuals significantly. Underwriters play a crucial role in the insurance, banking, and financial services industries by assessing risks and determining the terms of coverage, loans, or investments. As the financial landscape evolves, the demand for skilled underwriters remains strong, making this a viable and promising career path.

What Does an Underwriter Do?

Underwriters are responsible for evaluating and analyzing the risks involved in insuring a person, asset, or business. Their primary goal is to determine whether it is profitable for the company to take on the risk and, if so, under what terms. Depending on the industry, underwriters may work with:

- Insurance Policies: Assessing risks related to life, health, property, or liability insurance.

- Loans and Mortgages: Evaluating the creditworthiness of individuals or businesses applying for loans.

- Securities: In investment banking, underwriters help companies raise capital by assessing and pricing new stocks or bonds before they are offered to the public.

Key Responsibilities

The day-to-day responsibilities of an underwriter can vary based on their specific role and the industry they work in, but generally include:

- Risk Assessment: Reviewing applications, financial statements, medical records, and other relevant data to assess the level of risk involved.

- Decision-Making: Deciding whether to approve or deny applications, and determining the appropriate terms, such as coverage limits or interest rates.

- Communication: Collaborating with agents, brokers, and clients to explain decisions, discuss terms, and negotiate conditions.

- Documentation: Preparing detailed reports that outline the rationale behind decisions, the risks involved, and the terms offered.

- Compliance: Ensuring that all decisions comply with industry regulations and company policies.

Career Path and Progression

The underwriting profession offers various paths for advancement, with opportunities to specialize in different types of underwriting or move into management roles. Here’s an overview of a typical career progression:

- Junior Underwriter/Underwriting Assistant: Entry-level positions where individuals learn the basics of underwriting and support senior underwriters with their tasks.

- Underwriter: After gaining experience, individuals take on full underwriting responsibilities, handling cases independently and making risk assessments.

- Senior Underwriter: Experienced professionals who handle more complex and high-value cases. They may also mentor junior underwriters and contribute to policy development.

- Underwriting Manager: In this role, individuals oversee a team of underwriters, ensuring that the department meets its targets and adheres to best practices.

- Chief Underwriter: The top position in the underwriting department, where one is responsible for the overall risk strategy and management within the organization.

Skills and Qualifications

To succeed as an underwriter, certain skills and qualifications are essential:

- Educational Background: A bachelor’s degree in finance, economics, business administration, or a related field is often required. Some roles may require additional certifications, such as the Chartered Property Casualty Underwriter (CPCU) designation for insurance underwriters.

- Analytical Skills: The ability to analyze data, assess risks, and make informed decisions is crucial.

- Attention to Detail: Underwriters must be meticulous in reviewing applications and documents to avoid costly errors.

- Communication Skills: Strong written and verbal communication skills are necessary to explain complex decisions and negotiate terms.

- Technical Proficiency: Familiarity with underwriting software, financial modeling tools, and industry-specific platforms is often required.

- Ethical Judgment: Underwriters must adhere to ethical standards, ensuring that their decisions are fair and comply with regulations.

Challenges and Rewards

A career in underwriting comes with its own set of challenges and rewards:

- High-Pressure Environment: Underwriters often work under tight deadlines and handle multiple cases simultaneously.

- Complex Decision-Making: Making decisions that balance risk and profitability can be challenging, especially in uncertain or volatile markets.

- Regulatory Compliance: Keeping up with ever-changing regulations and ensuring compliance can be demanding.

Rewards and Opportunities

- Impactful Work: Underwriters play a crucial role in helping individuals and businesses manage risk, providing a sense of purpose and accomplishment.

- Career Stability: Given the ongoing need for risk assessment in various industries, underwriting offers long-term career stability.

- Professional Growth: Opportunities for specialization and advancement are plentiful, allowing underwriters to continuously grow in their careers.

Industry Sectors

Underwriters can work in various sectors, each with its own focus and requirements:

- Insurance: The most common industry for underwriters, where they assess risks related to life, health, auto, property, and liability insurance.

- Banking and Finance: Underwriters in this sector evaluate the creditworthiness of loan and mortgage applicants, ensuring that banks minimize their risk of default.

- Investment Banking: Securities underwriters work with companies to assess and price new stocks and bonds, playing a key role in capital markets.

- Real Estate: Underwriters assess risks associated with real estate transactions, including mortgage underwriting and property insurance.

How to Get Started?

For those interested in pursuing a career as an underwriter, here are some steps to consider:

- Education: Start with a relevant bachelor’s degree. Consider taking courses in risk management, finance, or economics.

- Internships: Gain practical experience through internships or entry-level positions in insurance companies, banks, or financial institutions.

- Certifications: Obtain industry-recognized certifications like the CPCU, Associate in Commercial Underwriting (AU), or Certified Financial Underwriter (CFU) to enhance your qualifications.

- Networking: Join professional organizations, attend industry conferences, and connect with experienced underwriters to learn about job opportunities and industry trends.

- Continuous Learning: Stay updated on industry developments, new regulations, and emerging risks through ongoing education and professional development.

A career as an underwriter offers a unique blend of analytical challenges, decision-making responsibilities, and the opportunity to make a significant impact on businesses and individuals. With the right combination of education, skills, and experience, underwriters can build a rewarding and stable career in a variety of industries. Whether you’re just starting out or looking to advance in the field, the underwriting profession offers numerous opportunities for growth and specialization.

Challenges Faced by Underwriters

Underwriting is a complex and dynamic process that involves several challenges:

- 1. Data Accuracy: Accurate and complete data is essential for effective underwriting. Incomplete or inaccurate information can lead to incorrect risk assessments and potentially significant financial losses for the insurer.

- 2. Regulatory Compliance: Underwriters must navigate a complex web of regulations and compliance requirements. Staying updated with changing laws and regulations is crucial to ensure that underwriting practices remain compliant.

- 3. Technological Advancements: The rapid pace of technological advancements presents both opportunities and challenges for underwriters. Leveraging advanced data analytics and artificial intelligence can enhance risk assessment, but it also requires continuous learning and adaptation.

- 4. Market Competition: The insurance industry is highly competitive, with companies vying for market share by offering attractive policies and premiums. Underwriters must balance the need for competitive pricing with the need for profitability.

- 5. Emerging Risks: New and emerging risks, such as cyber threats and climate change, require underwriters to continuously update their risk assessment models and develop innovative coverage solutions.

The Future of Underwriting

The future of underwriting is likely to be shaped by technological advancements and evolving market dynamics. Here are some key trends to watch:

- 1. Artificial Intelligence and Machine Learning: AI and machine learning technologies have the potential to revolutionize underwriting by enabling more accurate and efficient risk assessments. These technologies can analyze vast amounts of data to identify patterns and predict risks more effectively than traditional methods.

- 2. Big Data Analytics: Big data analytics can provide underwriters with deeper insights into risk factors and trends. By leveraging data from various sources, underwriters can make more informed decisions and develop more personalized policies.

- 3. Automation: Automation of routine underwriting tasks can streamline processes and reduce administrative burdens. This allows underwriters to focus on more complex risk assessments and decision-making.

- 4. Predictive Modeling: Predictive modeling techniques can enhance the accuracy of risk assessments by using historical data to predict future outcomes. This can help underwriters develop more precise pricing models and identify emerging risks.

- 5. Personalized Insurance: Advancements in technology and data analytics enable the development of personalized insurance products tailored to individual needs and risk profiles. This can lead to more accurate pricing and better customer satisfaction

Expert Corner

In conclusion, a career as an underwriter is more than just a job; it’s a vital responsibility that contributes to financial stability, protects individuals and businesses, and offers personal and professional growth. If you enjoy analytical work, possess sound judgment, and thrive in a dynamic environment, then underwriting could be your ideal path to a fulfilling and impactful career.

Underwriting plays a crucial role in various financial sectors, serving as the gatekeeper of risk and stability. As an underwriter, you are not just analyzing numbers and documents; you are making informed decisions that impact individuals, businesses, and the overall financial landscape.

Here are some key takeaways to remember:

- Your expertise ensures responsible allocation of resources: Your risk assessments help ensure loans, insurance, and investments are distributed to suitable applicants, minimizing financial losses and protecting both the institutions and the beneficiaries.

- Your decisions contribute to market stability: By carefully evaluating risks, you promote a healthy financial ecosystem where responsible investments thrive and reckless ventures are contained.

- Your skills are valuable and in demand: The increasing complexity of financial instruments and growing awareness of risk management solidify the need for skilled underwriters.

- Your career offers growth potential: With experience and expertise, you can advance to managerial roles, specialize in different areas of underwriting, or even transition to related fields like finance or risk management.

Underwriters play a critical role in determining the level of risk for individuals or institutions and assisting in making profitable investment decisions. They work for various financial organizations, including mortgage, insurance, loan, or investment companies, and their primary task is to assume the risk of another party for a fee. Successful underwriters must possess strong analytical thinking, problem-solving, and communication skills, as well as a high level of attention to detail.

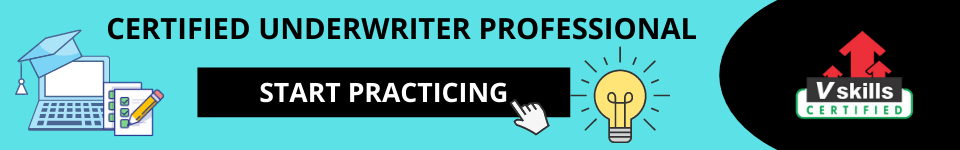

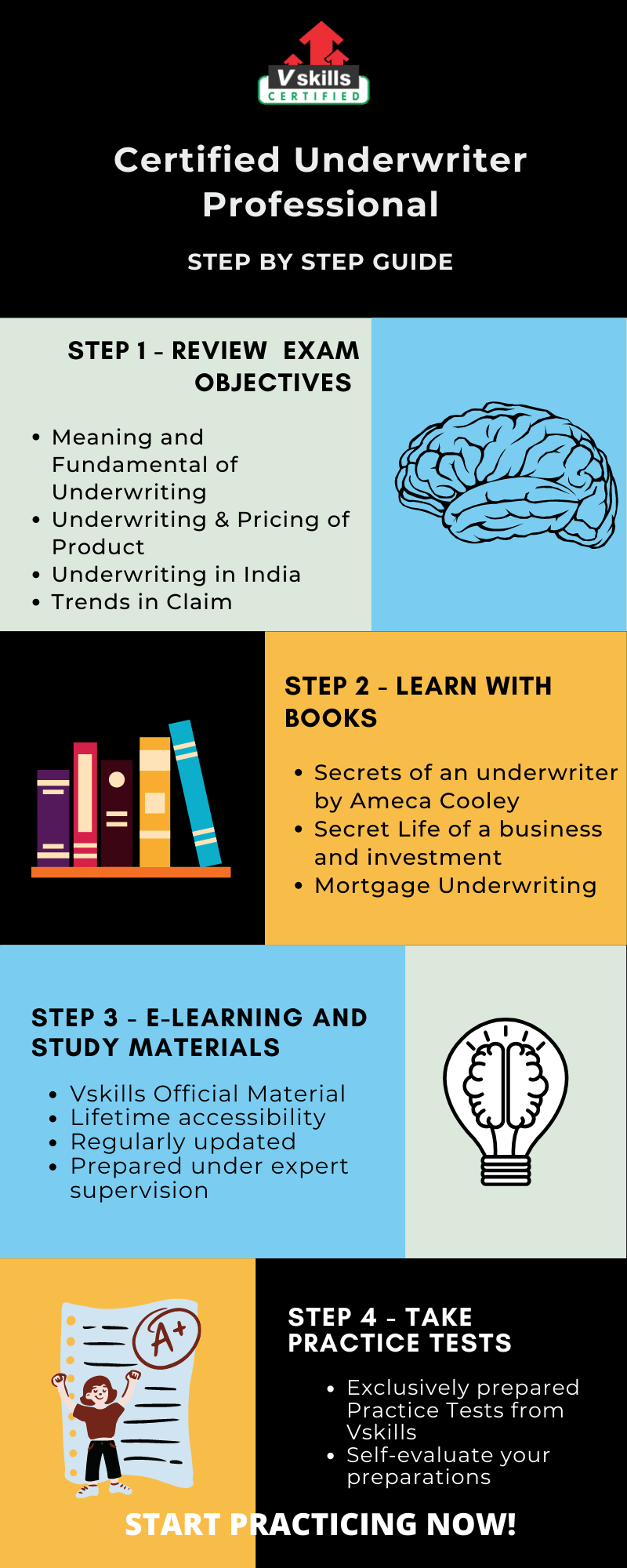

Preparation Guide for Certified Underwriter Exam

One of the best methods to prepare for the Underwriter job roles is by developing a comprehensive strategy that should be implemented before beginning your journey. We have curated a preparation guide consisting of all the necessary study resources and the essential steps for your plan of action before taking the exam.

Step 1 – Review the Exam Objectives

Reviewing each and every exam objective becomes the most important part of your preparation. Devote enough time to each topic and have in-depth knowledge of the subject. Moreover, this will also result in strengthening your preparation. This certification exam covers the following topics:

- Meaning and Fundamental of Underwriting

- Underwriting & Pricing of Product

- Underwriting in India

- Trends in Claim

Refer: Certified Underwriter Brochure

Step 2 – Learning with Books

Books are meant to improvise our memory, therefore it is a traditional source of learning. Although many of us feel that it is a tedious process and a waste of time sometimes but the fact is contrary to such a mindset. Books are beneficial in the terms of making you aware of the topics in detail, hence gain command of the required skills.

The books mentioned below are the best books for the Underwriter certification exam.

- Secrets of an underwriter by Ameca Cooley. The book essentially explores topics like how to approve a loan, how it evaluates, and what are the factors in underwriting.

- Secret Life of a business and investment. The book consists of all the secrets of the underwriter experience. How to create more business and investment. It has highlighted the major topics in the book

- Mortgage Underwriting. The book explains the domain of the underwriter. It reveals all the principal of the topic and what the outcome of it.

Step 3 – E-Learning and Study Materials

E-learning resources are accessible anytime and anywhere, along with accommodating all the educational needs as well. Through E-learning, the lectures can be repeated as per your convenience. Vskills offers E-Learning Study Material for the Certified Underwriter exam. One very special advantage of Vskills learning material is its timely updates and lifetime access. In addition to supporting your e-learning, Vskills also provides study materials in hard copy for the candidates preferring offline study methods.

Refer: Certified Underwriter Sample Chapter

Step 4 – Check your Progress with Practice Tests

There is a quote which states that “the more you are accustomed to sitting for a period of time, answering test questions and pacing yourself, the more comfortable you will feel when you actually sit down to take the test”. Practice tests can help us ensure our preparation and familiarize ourselves with the concepts better. So Start practicing with free Practice Tests Now!

Job Interview Questions

Prepare for your next job Interview with Vskills Latest online Interview questions, these questions are created by experts to help you to overcome the interview fear.

![Role of Underwriter - Jobs and Career Opportunities [2024]](https://www.vskills.in/certification/blog/wp-content/uploads/2024/09/Role-of-Underwriter-Jobs-and-Career-Opportunities-2024.jpg)