“Explore the hurdles and risks in today’s insurance world. Uncover the challenges in underwriting – a landscape changing rapidly. Here, underwriters must adapt swiftly to stay ahead.”

What is Underwriting

Underwriting in insurance is like a careful checkup before giving someone an insurance policy. Imagine insurance companies as doctors. They examine different aspects to figure out how likely it is that someone might need to make a claim. This process helps set the rules for the insurance, like how much you need to pay (premium). Underwriters are like the insurance doctors – they play a crucial role in making sure the insurance company stays financially healthy by finding the right balance between taking risks and staying secure.

Importance of underwriting in the insurance industry

| Point | Description |

| Risk Management Backbone | Underwriting is the foundational element of effective risk management in the insurance industry. |

| Thorough Risk Assessment | It involves a meticulous evaluation of potential risks before extending insurance coverage. |

| Informed Decision-Making | Factors like individual health, property condition, or business operations are analyzed. |

| Balancing Act | Crucial for maintaining a delicate balance between comprehensive coverage and financial stability. |

| Fulfilling Commitments | Successful underwriting ensures that insurance firms fulfill commitments without excessive risks. |

| Contributing to Industry Sustainability | The overall sustainability and prosperity of the insurance sector depend on effective underwriting. |

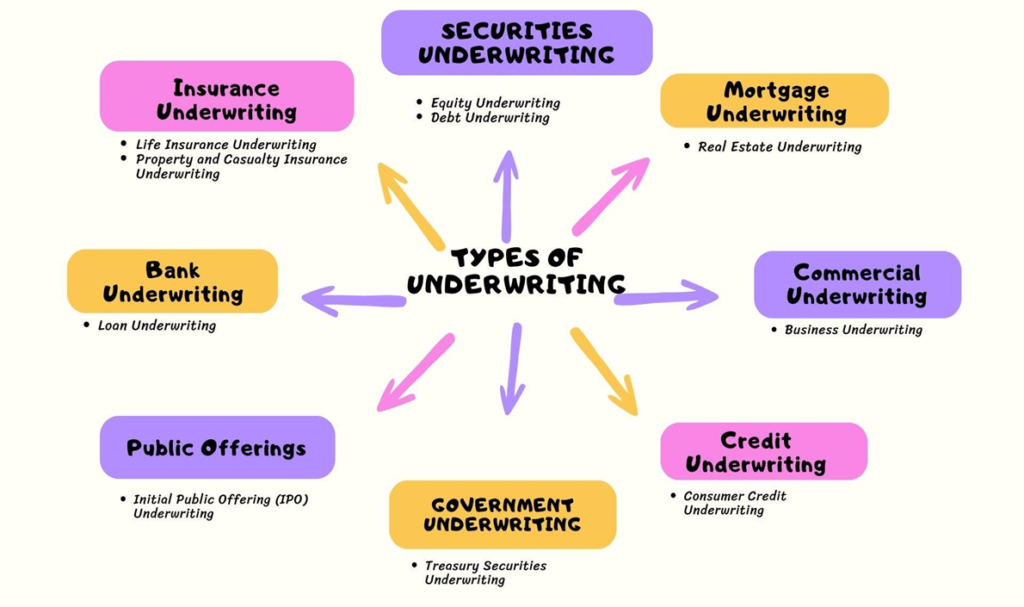

Types of underwriting with examples

Insurance Underwriting

- Life Insurance Underwriting: Evaluates an individual’s health and lifestyle to determine the risk and premium for life insurance. Example: Monika applies for a life insurance policy. The underwriter assesses her health, lifestyle, and medical history. Based on this evaluation, they determine the risk of a potential claim and set an appropriate premium for Monika’s life insurance coverage.

- Property and Casualty Insurance Underwriting: Assesses risks related to properties, vehicles, or liabilities to set appropriate coverage and premiums. Example: Arun purchases auto insurance for his car. The underwriter evaluates the risks associated with Arun’s vehicle, driving history, and potential liabilities. This assessment helps determine the coverage limits and premiums for Arun’s auto insurance policy.

Securities Underwriting

- Equity Underwriting: Involves the issuance of new stocks, with underwriters guaranteeing the purchase of shares not bought by the public. Example: Tech Innovators Inc. plans an Initial Public Offering (IPO) to issue new stocks. An investment bank acts as the underwriter, guaranteeing the purchase of shares not bought by the public. This ensures that Tech Innovators Inc. successfully raises capital through the sale of its shares.

- Debt Underwriting: Involves the issuance of bonds or debt instruments, where underwriters ensure the sale of these securities. Example: The city municipality decides to fund a new infrastructure project by issuing municipal bonds. Underwriters, often investment banks, ensure the successful sale of these bonds to investors, providing the municipality with the necessary funds.

Mortgage Underwriting

- Real Estate Underwriting: Assesses risks associated with lending for real estate purchases, considering factors like borrower’s credit, property value, and market conditions. Example: Mayank applies for a mortgage to buy a home. The mortgage underwriter assesses Mayank’s creditworthiness, the property’s value, and market conditions. Based on this evaluation, the underwriter determines the terms of the mortgage, including the interest rate.

Bank Underwriting

- Loan Underwriting: Assesses the creditworthiness of individuals or businesses applying for loans, deciding whether to approve, deny, or set conditions for the loan.Example: Jessica, a small business owner, applies for a business loan. The underwriter reviews Jessica’s credit history, business operations, and financial statements to determine the risk associated with the loan. The underwriter then decides whether to approve the loan and establishes the loan terms.

Commercial Underwriting

- Business Underwriting: Assesses risks related to insuring businesses, considering factors such as operations, revenue, and industry.Example: ABC Corporation seeks insurance coverage for its operations. The business underwriter assesses the risks related to ABC Corp’s industry, revenue, and business operations to determine appropriate coverage and premiums.

Public Offerings

- Initial Public Offering (IPO) Underwriting: Investment banks underwrite new shares offered by a company entering the stock market.Example: Biotech Solutions Inc. plans to go public. An investment bank underwrites the IPO, guaranteeing the purchase of shares not subscribed by the public. This ensures a successful launch of Biotech Solutions Inc. on the stock market.

Government Underwriting:

- Treasury Securities Underwriting: Involves governments issuing bonds, with underwriters ensuring the sale of these bonds for a stable source of funding treasury bonds to raise funds for infrastructure projects. Underwriters, often financial institutions, guarantee the sale of these bonds, ensuring a stable source of funding for the government.

Credit Underwriting:

- Consumer Credit Underwriting: Banks assess the creditworthiness of individuals applying for credit cards, personal loans, or other forms of consumer credit.Example: Chris applies for a credit card. The underwriter assesses Chris’s credit score, income, and debt history to determine the credit risk. Based on this evaluation, the underwriter decides on Chris’s credit limit and terms for the credit card.

Click here to learn about 5 Best Underwriter Certifications and Online Courses

The Basics of Underwriting

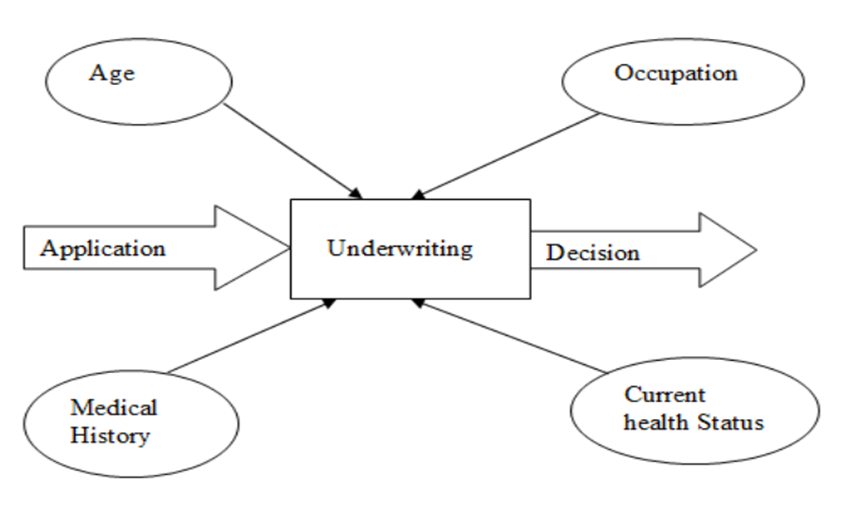

The fundamental concepts of underwriting

Underwriting stands at the heart of the insurance industry, encompassing essential concepts such as:

- Risk Evaluation: Underwriters analyze risks associated with insuring individuals, properties, or businesses, considering factors like health, past claims, and external risks.

- Premium Determination: After assessing risks, underwriters set the premium— the amount policyholders pay for coverage, often reflecting the level of risk involved.

- Application Decision: Based on risk assessment, underwriters decide to approve or reject insurance applications, outlining specific terms and conditions for approved policies.

- Policy Specification: Underwriters establish policy details, including coverage limits, deductibles, and exclusions, ensuring clarity for insurers and policyholders alike.

- Regulatory Compliance: Underwriters ensure that insurance policies adhere to relevant laws and regulations, meeting legal requirements and industry standards.

Why underwriters play a crucial role in the insurance process.

| Key Responsibilities | Objectives/Purposes | |

| 1 | Oversight of Risks | Evaluate and manage risks associated with insurance coverage. |

| Offer insurers a comprehensive understanding of potential risks. | ||

| 2 | Ensuring Financial Stability | Effectively balance risk and profitability. |

| Contribute to the financial stability of insurance companies. | ||

| Guarantee companies can fulfill their commitments to policyholders. | ||

| 3 | Precision in Premium Determination | Calculate precise premiums based on thorough risk assessments. |

| Prevent underpricing or overpricing that could impact an insurer’s financial health. | ||

| 4 | Crafting Tailored Policies | Customize insurance policies to meet the specific needs of individual policyholders. |

| Provide personalized coverage options aligned with policyholders’ requirements. | ||

| 5 | Adaptability and Innovation | Stay informed about industry changes, emerging risks, and technological advancements. |

| Adjust insurance policies to address evolving circumstances and industry trends. | ||

| 6 | Oversight of Claims | Play a vital role in claims management. |

| Ensure adherence to policy terms |

Want to become certified Underwriter click here

Evolution of Underwriting

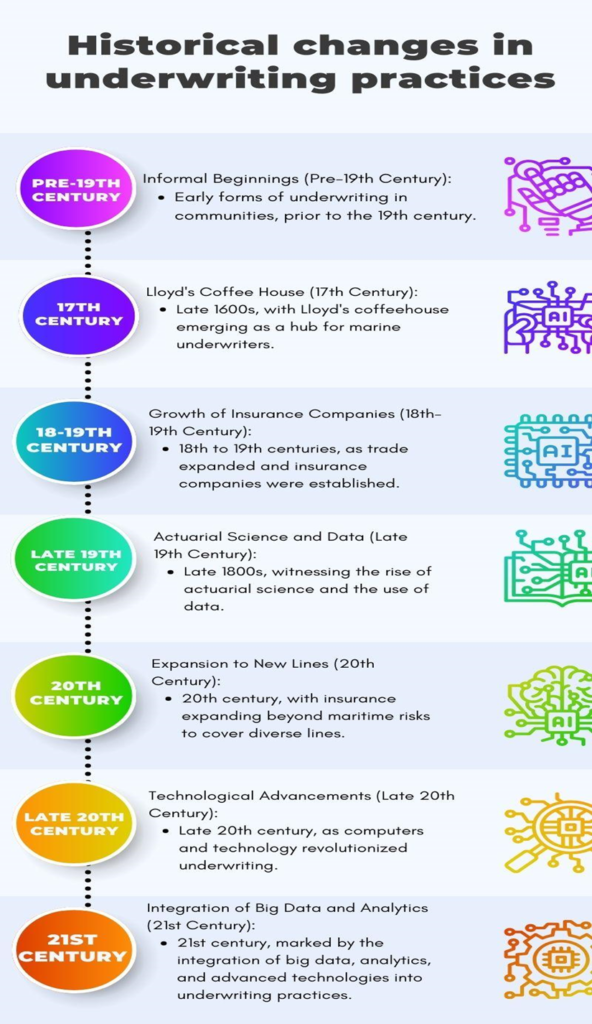

Historical changes in underwriting practices

How the traditional methods have evolved over time

Informal Beginnings:

- Traditional: Informal risk assessment in communities.

- Evolution: Transition to more systematic evaluations with formal marketplaces like Lloyd’s coffeehouse.

Lloyd’s Coffee House (17th Century):

- Traditional: Marine underwriting with collective assessment.

- Evolution: Formalization, moving from informal to structured marketplace.

Growth of Insurance Companies (18th-19th Century):

- Traditional: Individual to corporate underwriters, pooling resources.

- Evolution: Specialization and diversification of criteria with the emergence of insurance companies.

Actuarial Science and Data (Late 19th Century):

- Traditional: Statistical methods introduced, reliance on historical data.

- Evolution: Integration of sophisticated data analysis for nuanced risk understanding.

Expansion to New Lines (20th Century):

- Traditional: Underwriting expansion with diverse criteria.

- Evolution: Increased specialization and tailored practices for different lines.

Technological Advancements (Late 20th Century):

- Traditional: Paper-based, manual processes.

- Evolution: Introduction of computers and automation for efficiency.

Integration of Big Data and Analytics (21st Century):

- Traditional: Reliance on historical data.

- Evolution: Big data, machine learning, and AI for real-time, accurate risk assessment.

Current Underwriting Landscape

Underwriting today is a smart blend of tradition and innovation. Insurance firms leverage advanced technologies and extensive data analysis to make swift and precise decisions. This approach aims to provide tailored coverage by combining age-old insights with contemporary tools.

Factors that currently influence underwriting decisions

Data Revolution:

- Insurance companies harness vast datasets and sophisticated algorithms to gain deeper insights into risks.

- For instance, predictive analytics might help them anticipate potential claims based on historical patterns.

Tech Integration:

- The adoption of cutting-edge technologies, such as artificial intelligence, streamlines underwriting processes.

- An example would be automated underwriting systems that expedite the evaluation of applications.

Personalization Through Data:

- Insurers prioritize customer information, tailoring policies to individual needs.

- An illustrative example is the use of behavioral analytics to understand customer preferences and customize offerings.

Regulatory Compliance:

- Insurance companies strictly adhere to evolving regulations to maintain compliance.

- For instance, compliance with data protection laws is crucial to safeguard customer information.

Environmental Risk Assessment:

- The underwriting process now includes considerations for environmental risks, such as climate change impacts.

- For example, insurers assess how rising sea levels might affect property values and associated risks.

Health and Wearables:

- In health insurance, underwriters incorporate health and wellness data from wearable devices.

- A practical application is adjusting premiums based on policyholders’ fitness data.

Cybersecurity Emphasis:

- Cybersecurity risks are evaluated more comprehensively in underwriting decisions.

- Insurers may assess a business’s digital security measures to determine cyber risk exposure.

Global Economic Trends:

- Economic shifts on a global scale are considered when underwriting various insurance lines.

- For instance, economic downturns may impact the likelihood of claims in certain industries.

Societal Dynamics:

- Changing societal norms and demographics influence underwriting strategies.

- An example could be adapting life insurance products to meet the evolving needs of diverse family structures.

Pandemic Preparedness:

- Recent experiences prompt insurers to factor pandemic risks into underwriting scenarios.

- Plans may include provisions for health crises to ensure better risk management.

In practice, the current underwriting landscape showcases a harmonious integration of traditional wisdom and technological advancements, illustrated by how insurers incorporate these factors in real-world examples.

Impact of Technology

Technological advancements have significantly reshaped the landscape of underwriting, introducing both Pros and cons of incorporating technology into underwriting processes.

Pros of Technology in Underwriting

| Aspect | Advantages | Example |

| Efficiency and Speed | Automation streamlines processes. | – Automated data processing accelerates risk evaluation. |

| Enhanced Accuracy | Advanced analytics improves risk prediction. | – Predictive modeling enables precise premium calculations. |

| Data-Driven Decision Making | Informed decisions using vast datasets. | – Big data analytics provides insights into complex risks. |

| Cost Reduction | Automation reduces manual labor, saving costs. | – Automated underwriting systems cut operational expenses. |

| Customization and Personalization | Tailored approaches based on individual data. | – Behavioral analytics for personalized policy offerings. |

Cons of Technology in Underwriting

| Aspect | Challenges | Example |

| Data Privacy and Security Concerns | Increased risks due to data reliance. | – Risks of data breaches compromising customer info. |

| Over Reliance on Models | Blind reliance may overlook unique factors. | – Failure to account for exceptional events in data. |

| Complexity and Learning Curve | Adoption challenges for traditional underwriters. | – Navigating and utilizing advanced analytics. |

| Bias in Algorithmic Decision-Making | Algorithms may perpetuate biases. | – Discriminatory outcomes based on biased data. |

| Dependency on External Data Sources | Risks from inaccurate or outdated data. | – Inaccuracies in third-party data affecting assessments. |

| Job Displacement Concerns | Automation may lead to job displacement. | – Reduced demand for manual data entry roles. |

| Regulatory Compliance Challenges | Evolving tech may outpace regulations. | – Ensuring adherence to data protection amid tech changes. |

| Lack of Human Judgment | Overreliance may overlook human insights. | – Inability to assess complex situations intuitively. |

Technology brings efficiency and customization but raises challenges related to privacy, bias, and adapting to change. Striking a balance is crucial.

Read the details of Underwriting digitization: past, present, and future insights click here

Challenges Faced by Underwriters

The challenges faced by underwriters are:

Data Quality and Availability:

- Reliance on data quality and accessibility for accurate risk assessments.

Data Overload:

- Difficulty in processing and analyzing large volumes of information.

Cybersecurity Concerns:

- Risks associated with the digital transformation, including data breaches.

Technological Integration:

- Challenges in integrating AI and machine learning into existing processes.

Regulatory Compliance:

- Navigating complex and evolving regulatory requirements.

Industry Trends and Market Dynamics:

- Adapting to rapid changes, emerging risks, and market trends.

Customer Expectations:

- Balancing quick turnaround times with thorough risk assessments.

Environmental and Social Considerations:

- Incorporating sustainability and social responsibility into underwriting.

Globalization:

- Assessing risks in diverse markets with unique challenges.

Talent Shortages and Skill Gaps:

- Recruiting and retaining talent to match evolving industry needs.

Regulatory Changes

How regulatory changes influence underwriting practices

Regulatory shifts significantly impact underwriting by shaping rules and standards, influencing risk assessment criteria, policy terms, and the overall approach to specific coverage.

Importance of compliance and its challenges

Compliance with regulations is vital for upholding legal and ethical underwriting standards, safeguarding both insurers and policyholders. It ensures operations within legal boundaries.

Risk Mitigation: Regulatory guidelines aim to mitigate systemic risks in the insurance industry. Compliance helps underwriters identify and manage risks, contributing to overall financial stability.

Consumer Protection: Regulations safeguard consumers by ensuring fair and transparent underwriting practices, preventing unfair discrimination and unethical behaviors.

Market Stability: Regulatory oversight enhances market stability by setting standards that prevent excessive risk-taking and ensure the financial health of insurers.

Challenges of Compliance

- Keeping Pace: Continuous monitoring and adaptation to evolving regulatory landscapes require ongoing training and awareness.

- Complexity: Navigating complex regulatory frameworks poses challenges, particularly for global insurers dealing with diverse jurisdictions.

Balancing Innovation and Compliance

The push for innovation may conflict with compliance requirements. Underwriters must strike a balance, allowing technological advancements while adhering to regulatory boundaries.

Resource Allocation: Ensuring compliance demands significant resources in terms of time, manpower, and technology, posing challenges for insurers, especially smaller ones.

Legal Consequences: Non-compliance may lead to legal repercussions, fines, and reputational damage. Staying vigilant is crucial for underwriters to avoid such consequences.

Global Regulatory Variations: Global insurers encounter challenges in navigating diverse regulatory landscapes, requiring an understanding and compliance with different rules in various regions.

Regulatory changes are pivotal in shaping underwriting practices. Compliance is essential for ethical standards, consumer protection, and overall market stability. Challenges include staying updated on regulations, managing complexities, and balancing compliance with innovation.

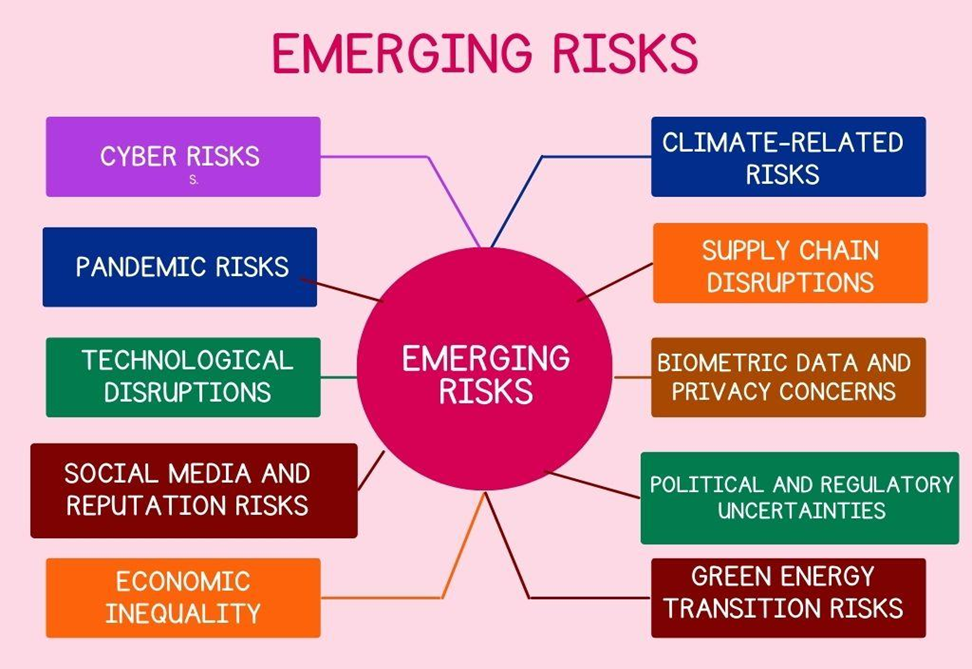

Emerging Risks In Underwriting

In recent times, new challenges have surfaced, reshaping the risk landscape for insurers. Notable examples include:

| Risk Category | Examples |

| Cyber Risks | Ransomware attacks, data breaches |

| Climate-Related Risks | Increased risk from extreme weather events |

| Pandemic Risks | Business interruptions, health-related claims |

| Supply Chain Disruptions | Business interruptions from global supply chain issues |

| Technological Disruptions | Liability concerns with advancements like autonomous vehicles |

| Biometric Data and Privacy Concerns | Risks related to the use of biometric information |

| Social Media and Reputation Risks | Reputational risks from negative social media campaigns |

| Political and Regulatory Uncertainties | Risks tied to unpredictable political environments |

| Economic Inequality | Risks stemming from growing economic disparities |

| Green Energy Transition Risks | Assessing risks associated with the shift to renewable energy |

Real-world Examples

Roadmap to uncover real-world examples

- Industry Journals and Magazines: Explore reputable publications for case studies and insights.

- Company Case Studies: Visit innovative insurance companies’ websites for success stories and strategies.

- Insurance Conferences: Harvest best practices from event materials, presentations, and summaries.

- Online Platforms: Engage with professionals on LinkedIn, forums, and discussion groups for firsthand experiences.

Strategies for Mitigating Risks

Strategies for underwriters to mitigate emerging risks

- Diversification of Risk Pools: Spread risks across categories to reduce vulnerability.

- Leveraging Advanced Analytics and Technology: Use tech for precise risk assessment and early risk identification.

- Dynamic Risk Monitoring: Shift to real-time monitoring for swift policy adjustments.

- Scenario Planning: Envision scenarios and establish pre-planned strategies.

Role of Continuous Learning and Adaptation

- Staying Informed: Continuous learning keeps underwriters updated on trends and changes.

- Adapting to Tech: Condensed: Learning enables adaptation to evolving technologies.

- Enhancing Decision-Making: Ongoing education sharpens decision-making skills.

- Remaining Agile: Adaptability through continuous learning ensures agility.

In essence, effective risk mitigation involves strategic planning, technology use, and a commitment to continuous learning, empowering underwriters to navigate emerging risks successfully.

Looking Ahead: Future Trends

As the underwriting landscape undergoes transformation, being ahead of the curve becomes paramount. Here, we explore potential upcoming trends in underwriting, urging professionals to anticipate and proactively prepare for the changes on the horizon.

Potential future trends in underwriting

1. Integration of Artificial Intelligence (AI):

AI is set to revolutionize underwriting with its predictive analytics prowess. Expect the incorporation of AI-driven tools for more precise risk assessments and decision-making.

2. Advanced Data Analytics on the Rise:

The future of underwriting will witness an upsurge in sophisticated data analytics. Prepare to harness advanced analytics tools, extracting actionable insights from expansive datasets to refine risk evaluation processes.

3. Tailored Risk Solutions:

The horizon sees a shift towards tailoring risk solutions for individual clients. Anticipate a move towards personalized underwriting, requiring a deep understanding of client-specific needs and risk profiles.

4. Embracing Blockchain Technology:

Blockchain technology adoption is gaining momentum. Stay ahead by acquainting yourself with blockchain applications in underwriting, ensuring secure and transparent transactions.

Embracing change in a proactive manner

In the dynamic world of underwriting, foresight defines success. By anticipating future trends and actively preparing for changes, underwriters position themselves as industry leaders. Embrace innovation, stay informed, and foster an adaptable mindset to navigate the exciting path that lies ahead.

Commit to Lifelong Learning:

- Foster a mindset of continuous learning. Stay abreast of emerging technologies, industry regulations, and market dynamics to adapt with agility.

Navigate Technological Shifts with Ease:

- Embrace technological advancements willingly. Equip yourself with the skills necessary to navigate new tools and platforms emerging in the underwriting landscape.

Cultivate Agility as a Skill:

- Develop adaptability to change. Being agile in adjusting strategies and approaches will be a pivotal asset in navigating the dynamic future of underwriting.

Forge Collaborative Networks:

- Establish industry networks. Collaborate with peers, engage in conferences, and participate in discussions to gain diverse perspectives on emerging trends.

In summary, mastering the art of underwriting involves strategic risk management. Diversifying risks, integrating technology, and adopting real-time monitoring are pivotal. Scenario planning, continuous learning, and tech adaptation ensure resilience. Agility in facing uncertainties and building collaborative networks amplify success.

Looking ahead, anticipating trends like AI, advanced analytics, and blockchain is key. The call to action is clear: stay informed, be adaptable, and proactively shape the future of underwriting. The journey forward requires not just participation but leadership in navigating the evolving landscape. Embrace change, foresee trends, and lead with an informed and visionary mindset for unparalleled success!

Frequently Asked Questions

Q: What are the main risks currently emerging in the field of underwriting?

- A: The article covers various emerging risks, including technological advancements, geopolitical factors, and shifts in regulatory landscapes.

Q: How are underwriting processes influenced by recent technological advances?

- A: The article explores the impact of technologies like artificial intelligence and big data on underwriting, from automation to improved risk assessment.

Q: What obstacles do underwriters encounter when adapting to new technologies?

- A: The article outlines challenges such as skill gaps, concerns about data security, and the necessity for ongoing training to keep pace with rapidly evolving technologies.

Q: In what ways are geopolitical factors taken into account in underwriting decisions?

- A: The article delves into the influence of geopolitical events on underwriting, including economic uncertainties, trade tensions, and global political developments.

Q: Are there changes in regulatory environments impacting underwriting practices?

- A: Yes, the article highlights how evolving regulations can affect underwriting, exploring challenges in compliance and the need for adaptability.

Q: How does climate change factor into underwriting risks?

- A: The article discusses the increasing relevance of climate-related risks in underwriting considerations, including their impact on property and casualty insurance.

Q: What strategies can underwriters employ to stay informed about emerging risks and challenges?

- A: The article may suggest approaches such as continuous education, networking, and leveraging industry resources for underwriters to stay updated.

Q: Can the article provide practical examples or case studies illustrating the influence of emerging risks on underwriting?

- A: The article may offer real-world examples or case studies demonstrating how emerging risks have affected specific underwriting scenarios.