The anti-money laundering laws and rules in the United States, which have gotten much stricter since 2001, include SARs. SAR requirements were significantly increased by the Patriot Act in an effort to combat both domestic and foreign terrorism. Identification of customers who are involved in money laundering, fraud, or terrorist funding is the aim of the SAR and the investigation that follows. Let’s learn about reporting suspicious activity and its requirements.

Suspicious Activity Reports (SAR): What is that?

The Bank Secrecy Act (BSA) of 1970 established the suspicious activity report (SAR) as a tool for tracking suspicious activities that would not typically be noted in other reports (such as the currency transaction report). In 1996, the SAR was adopted as the standard form for reporting suspicious activity.

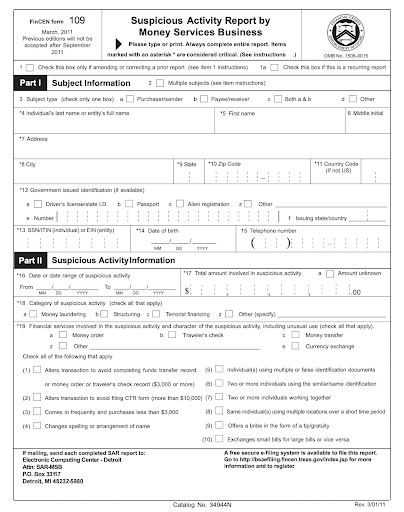

Almost any unusual activity can be covered by SARs. Activities that raise the possibility that the account holder is trying to conceal something or carry out an illegal transaction may be included in the SAR. The SAR form will look like this –

The organization with which a SAR is filed will determine its precise contents. But typically, it contains details like:

- the person’s or peoples’ full name, address, and passport number

- who frequently acts as a money mule and is a low-level criminal

- what kind of suspicious activity there is

- the time the suspicious activity occurred

- suspected class or classes

- involved financial services

- whether a previous SAR was filed in connection with this one, etc.

When Must a SAR Be Filed?

When a financial institution has knowledge or reasonable grounds to believe that a client is engaging in money laundering activity or otherwise violating the Bank Secrecy Act, it is necessary to file a Suspicious Activity Report (SAR). Transaction monitoring, which is also an AML requirement, typically identifies this. Due to the fact that money laundering is frequently an international issue, participating nations all share this fundamental legal foundation. They naturally differ slightly, though, to accommodate different financial systems.

Who May Submit SARs?

All businesses involved in financial activity, such as banks, investment companies, real estate brokers, etc., are required to submit SARs. In other words, whenever something suspicious is discovered, SARs must be filed by every organization required by law to conduct transaction monitoring.

Individually, any employee in the US who has reason to believe that money is being laundered is wrongdoing should be required to file a Suspicious Activity Report (SAR). The designation of an MLRO (Money Laundering Reporting Officer), who is responsible for submitting the SAR, is a notable difference in the parallel UK legislation.

SARs are primarily submitted digitally via the internet; in 2019, FinCEN received over 2 million of them. However, a hotline is recommended in the event of money laundering connected to terrorism to enable quicker triage and, if necessary, action.

When is it necessary to report suspicious activity?

To comply with SAR requirements, financial transactions must be closely monitored. Using sophisticated transaction monitoring software and trained staff, it is possible to identify potentially problematic transactions.

- Financial institutions and related companies in the US are required to submit a SAR in the following circumstances:

- Insider trading involves any kind of financial stake. No minimum exists.

- aggregated purchases of $5,000 or more when a suspect can be identified

- aggregate transactions with or without potential suspects totaling $25,000 or more.

- aggregate transactions that violate other BSA requirements or have a potential for money laundering totaling $5,000 or more.

If financial thresholds have not been met but financial institutions suspect money laundering or other criminal activity, they are typically expected to file a SAR. Since there is no clear threshold, this provision puts even more pressure on banks and other businesses. They must investigate these transactions more thoroughly.

The financial institution or related business has 30 calendar days from the time it becomes aware of the suspicious activity to submit a SAR. Governments may give an additional 30 days to file the SAR if no suspect is found. Financial institutions should submit an updated SAR every 90 days or less if suspicious activity is persistent. SARs must be kept for five years after they are filed in order to properly follow the compliance program. All financial institutions and businesses need to prioritize staying up to date with these regulations, but doing so requires a lot of staff time and other expenses.

Additional Cause:

Although potential money-laundering transactions, such as the excessive use of money orders, are the most common cause of SARs, other causes include:

- Secret trading

- Potential funding for terrorism

- Transactions that are unusual, like when a pawnshop pays a laundromat to provide catering

- Transactions made by people connected to criminal gangs

- Law enforcement’s requests for surveillance

- These questionable transactions might end up being legal, but they still need to be reported so the government can look into them if necessary.

What happens If Institutions Don’t Submit SARs?

There may be serious repercussions if the SAR regulations are broken. Penalties like hefty fines, regulatory restrictions, and losing the institution’s banking charter are among them. They also include civil and criminal penalties. Finally, bank and business administrators may be sent to prison in some extreme circumstances. In any case, the organization involved will suffer significant harm if SARs are not filed. Their reputation for moral behavior will at the very least suffer.

What Details Are Included in a Report?

The SAR requirements must be followed when preparing the reporting form, which calls for including names, addresses, social security numbers, birth dates, driver’s license numbers, and other contact and personal information about the potential offenders.

In-depth details about the incident or incidents as well as a written account of the financial activity are requested on the SAR forms. Filers must specify the type of suspicious activity as well as any additional supporting information they may have. Briefly, the reports must be thorough, which takes some time, especially if the business lacks all the tools necessary to maintain compliance.

What Signs Point to Money Laundering?

Financial institutions should be acutely aware of the warning signs of laundered money because they are frequently glaring. This is true despite the fact that money mules use a wide variety of techniques, tools, and strategies to layer and launder money in drop accounts.

It’s advised to pay attention to particularly shady clients and unusual transactions to spot the signs of money laundering. Checks for Customer Due Diligence (CDD) and Know Your Customer (KYC) are typically used to gauge things like secrecy. Software solutions assist in user authentication and use machine learning to identify which clients are suspicious and behaving atypically in order to keep businesses CDD compliant.

Beyond the onboarding stage, fraud prevention software can be used throughout the customer experience to identify customers who switch from normal to anomalous transactions—another possible indicator of money laundering. This way, security teams or MRLOs can stay informed if an account is compromised or if its location changes in a worrying way, as well as when their transaction patterns suddenly change.

Other actions that might raise a valid suspicion include:

- Cash deposits of $10,000 or more must be reported as unusual sources of funds, such as sudden infusions of cash or unusual sums from private accounts.

- unnecessary layers of ownership, shell companies, trusts, and other efforts to conceal the account’s beneficial owner’s

- abrupt changes in real estate transaction velocity, particularly for “super-prime” properties

Overall, a suite of proactive and reactive fraud prevention and AML tools should be used in tandem to enforce true and proactive compliance with AML legislation, which includes filing SARs. This will protect banks and fintech from penalties and criminals.

Final Words

The failure to file a SAR or disclose to the customer may result in very harsh penalties for both people and institutions. Law enforcement can identify patterns and trends in organized and individual financial crimes using SARs. In this manner, they are able to foresee criminal and fraudulent behavior and stop it before it gets out of hand. The Anti-Money Laundering Act of 2020, which went into effect on January 1, 2021, significantly increased the requirements under the anti-money laundering statutes once more.